Crypto venture capital fuding hits $16.5B in 2025, on track to break all-time records

CEX.io researchers believe that 2025 could be a record year for venture capital investment in crypto.

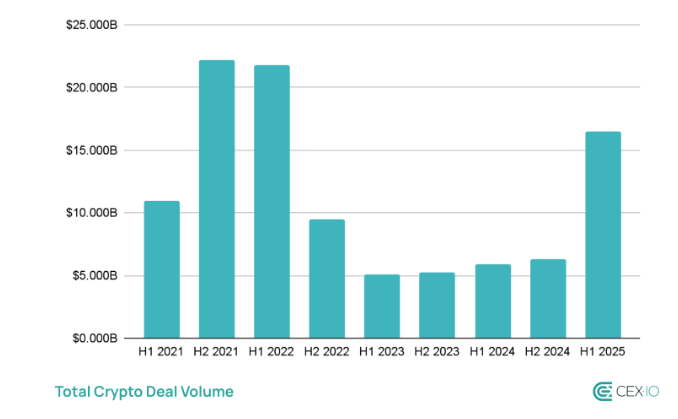

After several years of relative stagnation, venture capital is once again interested in crypto. According to a report by CEX.io, published on Thursday, July 17, venture deals in the first half of 2025 reached $16.5 billion. This suggests that 2025 could be on track to become the record year in venture deals.

This volume already surpasses the $12.2 billion recorded in all of 2024. It also exceeds the $10.9 billion in 2021, which was previously the highest year on record. For this reason, CEX.io suggests that 2025 may become the top year ever for crypto startup funding.

Additionally, the crypto industry accounted for 5.3% of global venture funding—its highest share in three years. This figure has steadily grown since the 2024 U.S. elections, indicating that a shift in policy may be a key driver of renewed investor confidence.

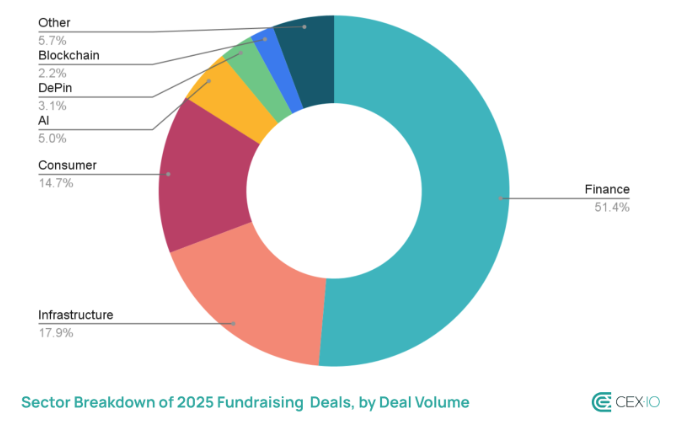

Finance leads in Venture capital funding

The industry segment attracting the most funding remains finance, which captured 51% of deal volume. This includes both centralized and decentralized finance projects, which continue to dominate. Infrastructure, encompassing hardware, security, bridges, and oracles, also saw a notable increase, driven by large deals involving Bitmain and TWL Miner.

Blockchain L1 and L2 network deals saw a significant contraction, and now accounts for just 2% of deal volume. At the same time, the AI-focused crypto project share is steadily increasing, now reaching 5% of total deal volume.

While the total size of funding has grown in recent years, the number of funding rounds has declined. Notably, the average size of funding rounds hit a record $20 million in the first half of 2025, marking a sharp rebound from the downturn following the 2022 market crash.