DeFi share in crypto market increases by 18% in November

In November, the decentralized finance (DeFi) sector’s share of the cryptocurrency market increased by 18% compared to last month.

November also turned green for non-fungible tokens (NFTs). Trading volumes recently jumped 200%, according to the latest report from Binance Research.

Analysts noted that the rate remained from 3.8% to 4.1% throughout the year. However, in November, it began to overgrow. Over the month, the share of the DeFi sector increased by 18% and ended at 4.44%. The main drivers of significant growth were THORChain, PancakeSwap, Uniswap, and Synthetix.

Additionally, since the start of 2023, the value locked (TVL) in DeFi protocols has increased by 25%, with a 14% increase in November alone. Throughout the year, the figure was at $45-50 billion. Considering the latest dynamics, we can expect a breakthrough of the $50 billion mark.

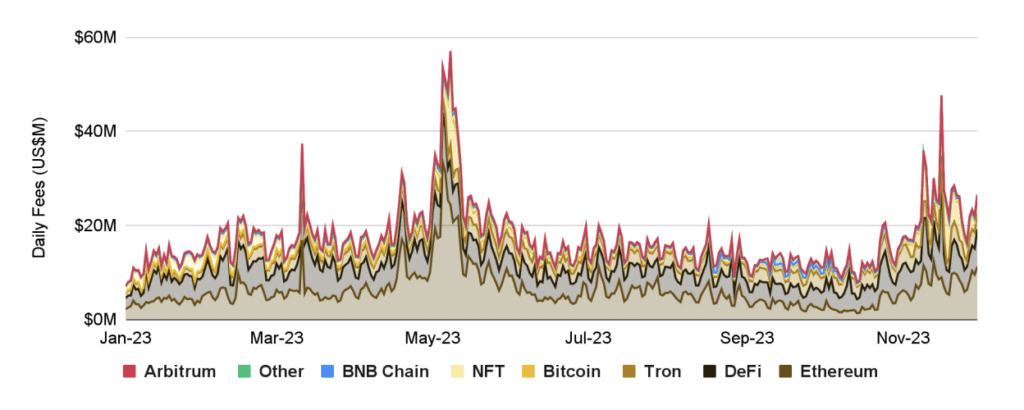

The dominant blockchain in the DeFi space remains Ethereum (ETH), accounting for over 56% of the total TVL. In second place is Tron (TRX), with a share of 16%, and in third place is BNB Chain (BNB) with a share of 6%.

This year’s largest category was liquid staking, which amounted to $27 billion. Almost the entire declared amount came from the Lido Finance protocol – $20 billion. Analysts noted that the Shanghai update facilitated the growth.

Along with the sharp rise in the BTC price in recent weeks, there has also been a sharp rise in the entire cryptocurrency market. So, if at the beginning of November the market capitalization of the crypto market was only $1.28 trillion, then at the end of last month this figure was already $1.43 trillion. Moreover, in December, the market capitalization of the cryptocurrency sector exceeded $1.6 trillion.