DeFi TVL recovers after high-profile US banks crumpled

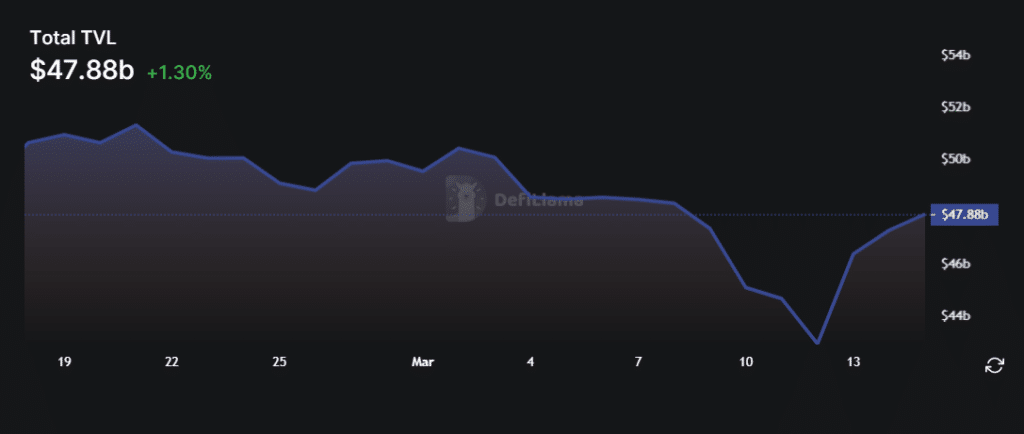

The total value locked (TVL) in decentralized finance (DeFi) protocols dropped to a two-month low after three banks in the US collapsed earlier this month. However, the TVL has been showing signs of recovery.

Data by DeFi Llama shows that the total DeFi TVL is up by 1.3%, reaching $47.88 billion at the time of writing. On March 12, the number dropped to a two-month low of $42.9 billion, last seen in mid-January.

DeFi’s bullish momentum started with the green crypto market at the start of this year, reaching a three-month high of $51.29 billion on Feb. 21, per DeFi Llama.

Moreover, Lido Finance has been leading the TVL list with a $10.08 billion value. The protocol’s TVL has risen by almost 25% over the last 30 days, according to DeFi Llama. Lido Finance currently has a 21% dominance over the total DeFi value.

What caused the drop in DeFi TVL?

The collapse of the US banks — Silvergate, Signature and Silicon Valley — could be a significant reason behind the recent drop in the total DeFi TVL. Last month, decentralized protocols witnessed notable hacks, losing over $21 million to hackers per crypto.news report.

While March still has two more weeks to go, hackers have already stolen almost $200 million worth of assets from DeFi protocols, including a $197 million Euler Finance hack on March 13.