Deribit sees significant interest in $50k Bitcoin call options

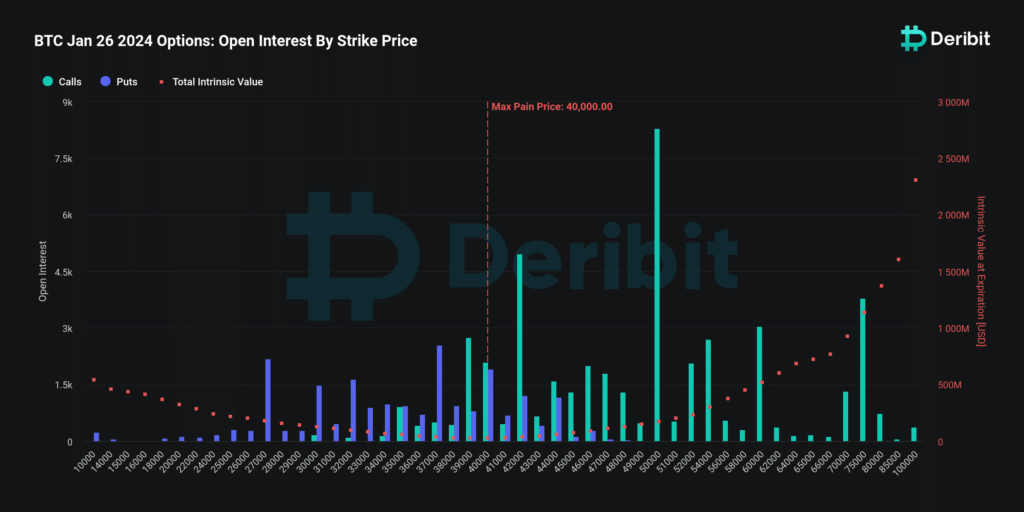

In response to Bitcoin’s recent price fluctuations, the options market is showing heightened activity, particularly with a focus on call options at a $50,000 strike price set to expire on Jan. 26.

According to Deribit data, over 8,300 contracts, valued at $376 million, are outstanding at this strike price, suggesting a notable anticipation of a potential rise in Bitcoin’s value.

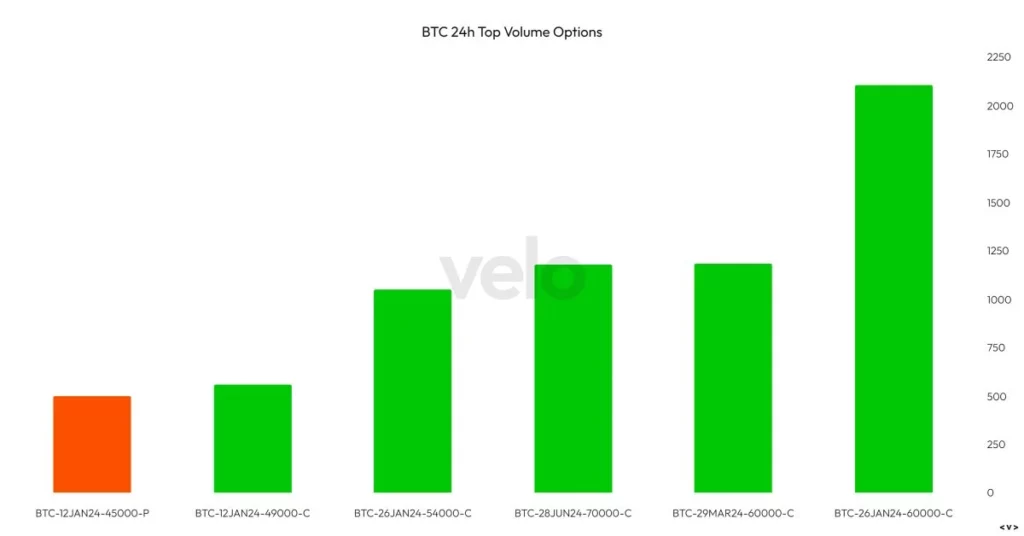

Across all expiry dates on Deribit, there are more than 21,800 contracts for calls at $50,000, totaling a notional value of $926 million. Additionally, Velo Data highlights a skew towards higher strike prices, particularly at $60,000 for the Jan. 26 expiry.

High-leverage trading allows traders to control positions with less capital and can amplify profits and intensify losses. Recent market volatility led to the liquidation of over $147 million in Bitcoin (BTC) positions, mainly affecting longs.

In the last 24 hours, the crypto market experienced a total of $642 million in liquidations across centralized exchanges, emphasizing the importance of risk management in such conditions. Bitcoin’s price retraced over 6% to below $43,000 after reaching a year-to-date high of $45,800.