Dogecoin price déjà vu? Analyst predicts a 112% surge

Dogecoin price remained in a consolidation phase this week as the recent parabolic rally paused.

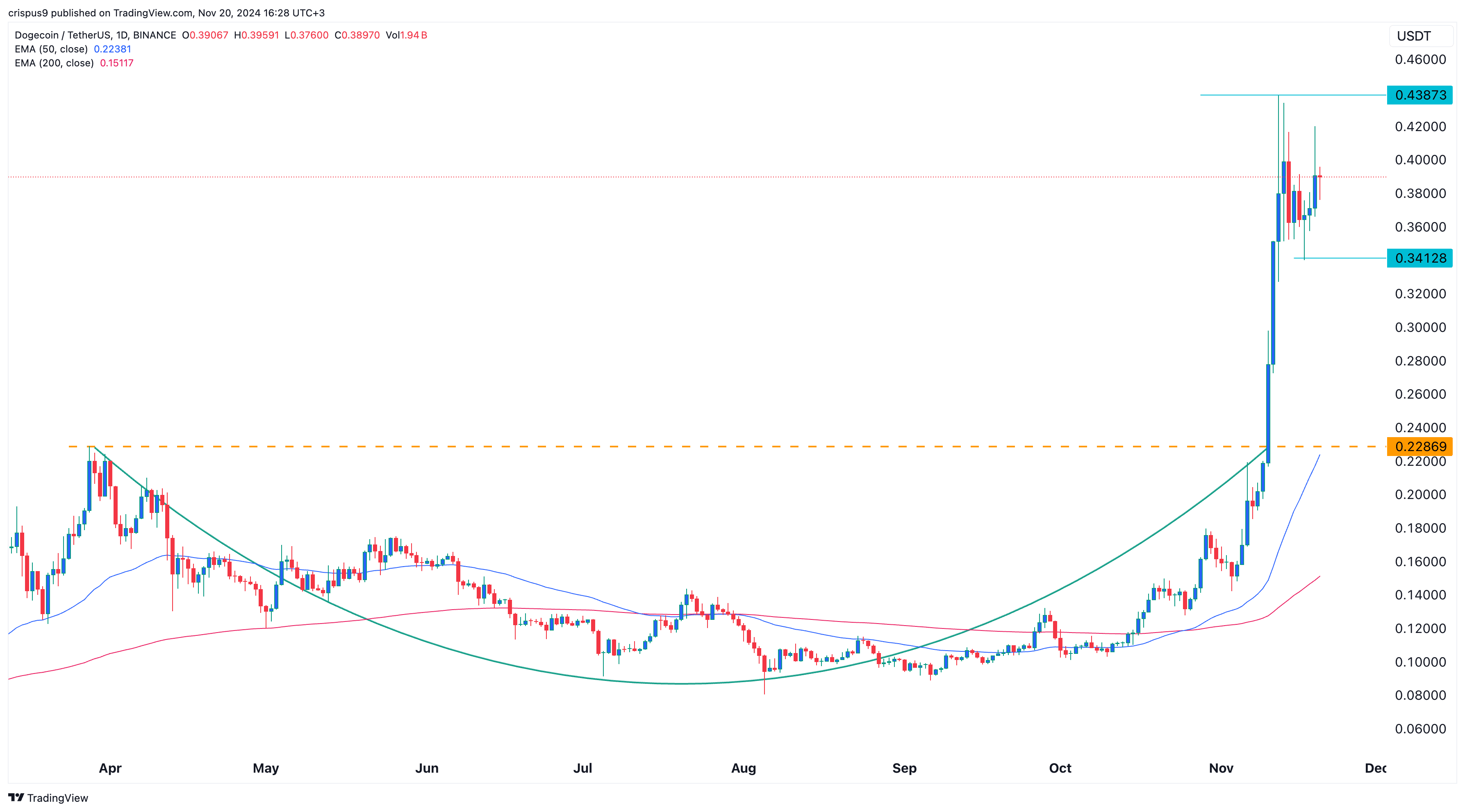

Dogecoin (DOGE) was trading at $0.3850 on Wednesday, Nov. 20, slightly below its year-to-date high of $0.4387.

This consolidation mirrors that of Bitcoin(BTC), which has been fluctuating between $90,000 and $94,000.

However, there is potential for Dogecoin to rebound in the coming weeks as investors monitor developments in the Trump administration. On Tuesday, Trump nominated Howard Lutnick, the head of Cantor Fitzgerald, as Commerce Secretary. Lutnick has previously supported cryptocurrencies, and his firm serves as a custodian for Tether.

Additionally, Trump has appointed Elon Musk and Vivek Ramaswamy to lead the new Department of Government Efficiency. There are also rumors that Trump Media may acquire Bakkt, a cryptocurrency company.

A combination of crypto-friendly regulations, Fear of Missing Out, and low interest rates could drive Dogecoin significantly higher in the near term.

Dogecoin is also seeing strong demand, as evidenced by its daily trading volume, which rose to over $14 billion. This figure exceeds the combined volume of Shiba Inu, Pepe, and Bonk. Similarly, futures open interest has surged to $3.8 billion.

Crypto analyst expects Dogecoin price to surge

According to Ali Charts, a well-known crypto analyst, Dogecoin has significant upside potential. He predicts the price could jump by 120%, reaching $0.82.

On the daily chart, Dogecoin remains above a key resistance level at $0.2286, which marked the upper side of the cup and handle pattern.

DOGE is trading well above the 50-day and 200-day moving averages, which formed a golden cross a few weeks ago. Additionally, it has developed a bullish pennant pattern, characterized by a vertical rise followed by a triangle formation. In technical analysis, this pattern often signals further gains.

Dogecoin is likely to see more upward momentum if it breaks above the upper side of the pennant at $0.4387. However, this bullish outlook would be invalidated if the price drops below the support level at $0.3412, its lowest point on Nov. 17.