Dogecoin price forecast: key support lost, death cross likely

Dogecoin price continued its downward trend on Tuesday as most cryptocurrencies plunged. DOGE moved to a low of $0.1140, its lowest swing since March 1st, 2024. It has slipped by almost 50% from its highest point this year.

Crypto sell-off accelerates

Dogecoin has come under pressure since March as focus among most meme traders turned to newer tokens like Pepe, Dogwifhat, and Brett. In this period, most traditional meme tokens like DOGE, Shiba Inu, and Baby Doge underperformed their newer peers.

Dogecoin has also dropped because of Bitcoin’s performance. Bitcoin, the biggest cryptocurrency in the world, has remained in a tight range and attempts to move above the resistance at $72,000 have failed recently.

Bitcoin has struggled as it lacked another positive catalyst after the SEC approved spot ETFs and the recent halving event. In most cases, altcoins like Dogecoin rally when Bitcoin is doing well.

Further, there are lingering concerns about the Federal Reserve, which has signalled to just one rate cut. In its December meeting, it pointed to at least four cuts this year. Dogecoin and other risky assets thrive when the Fed is dovish.

Dogecoin price forecast

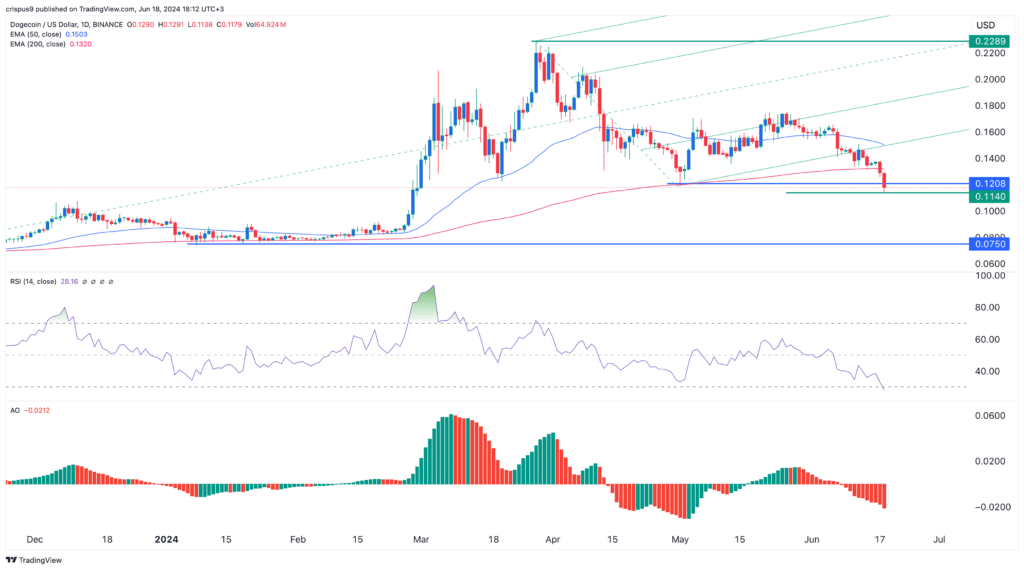

DOGE daily chart

Turning to the daily chart, we see that DOGE price peaked at $0.2290 in March as Bitcoin soared to a record high. It has now lost momentum and crashed to its lowest swing since March 1st.

Dogecoin has crashed below the lower side of the Andrew’s Pitchfork tool. Most importantly, it has moved below the key support at $0.1208, its lowest swing on May 1st.

It has also crashed below the 200-day moving average, opening the door for the formation of a death cross, one of the riskiest patterns in technical analysis.

Meanwhile, the Relative Strength Index (RSI) has continued falling and has moved to the oversold level of 30 for the first time this year. The Awesome Oscillator has moved been below the neutral level since June 8th.

Therefore, the price of Dogecoin will likely continue falling as sellers target the psychological level of $0.10. A break below that level will raise the possibility of it moving to $0.0750, its lowest swing in January.