Donald Trump to meet Armstrong amid Bakkt buy talks

Donald Trump’s bid to keep crypto promises appears to include discussions with the leader of America’s largest crypto exchange and a potential takeover of the digital asset trading venue Bakkt.

President-elect Donald Trump and Coinbase CEO Brian Armstrong reportedly scheduled a private meeting to discuss Trump’s appointments within his administration as crypto excitement surged following the Nov. 5 general election.

Reshuffles across federal agencies to align with new policy views were already underway weeks before Trump’s inauguration in January 2025. Trump appointed former Securities and Exchange Commission chair Jay Clayton to the U.S. Attorney’s Office for the Southern District of New York. The office subsequently announced plans to scale back crypto litigation days after the news.

Current SEC chair Gary Gensler thanked staff and fellow commissioners, hinting at his resignation amid mounting pressure and scrutiny over his tenure. Members of the digital asset industry and policymakers criticized Gensler’s SEC for taking an anti-crypto approach rather than providing clear rules for the nascent sector.

Candidates like former Binance U.S. CEO Briand Brooks and Robinhood Markets CLO Dan Gallagher were named top contenders for Gensler’s successor per prediction platform data.

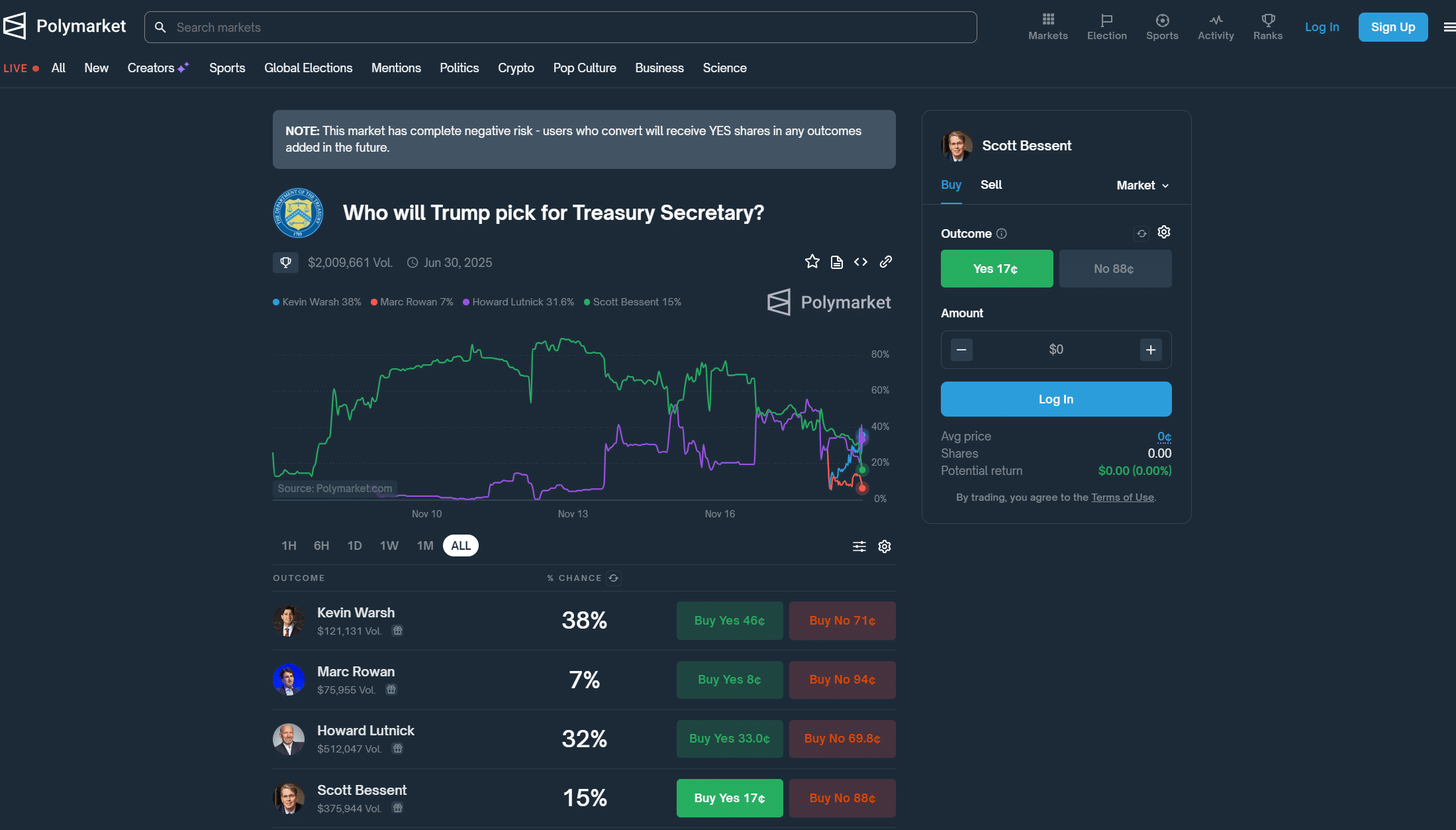

Much attention has turned to Trump’s choice for U.S. Treasury Secretary. Industry leaders like Nic Carter believe this position will be pivotal in reversing the crypto crackdown and reopening banking access to blockchain businesses.

Polymarket users have identified former Federal Reserve Board of Governors member Kevin Warsh, Cantor Fitzgerald CEO Howard Lutnick, and Key Square Group founder Scott Bessent as the top three choices. Lutnick’s crypto custodian collaborates with stablecoin issuer Tether, while Bessent shares Trump’s pro-Bitcoin stance.

Trump media eyes Bakkt

Donald Trump’s Media & Technology Group is reportedly in “advanced talks” to acquire Bakkt, a crypto trading platform owned by Intercontinental Exchange, through an all-stock transaction, according to a Financial Times report.

If finalized, the deal would broaden Trump’s influence in the crypto market as Bitcoin (BTC) and other crypto prices continue to surge after his election.

The Financial Times reports that TMTG, the parent company of social media platform Truth Social, plans to use its stock as currency for the acquisition. Despite TMTG’s $6 billion equity valuation, its revenue is only $2.6 million this year.

Bakkt, originally founded by Kelly Loeffler, a former Republican senator and wife of Intercontinental Exchange CEO Jeff Sprecher, operates under ICE’s majority ownership of 55%. Loeffler, who serves as co-chair of Trump’s inauguration committee, has ties to the platform’s development.

Key components of Bakkt’s operations, such as its crypto custody business licensed in New York, are expected to be excluded from the deal, according to the Financial Times.

This acquisition follows Trump’s recent promotion of World Liberty Financial, another crypto venture, signaling his administration’s potential alignment with the industry.

For TMTG, the deal represents an opportunity to diversify its assets and leverage rising crypto adoption. However, details of the transaction, including ICE’s continued involvement, were unclear and under negotiation at press time.