DOW Jones down 1000 points amid uncertainty over tariffs, Fed’s future

U.S. stocks are taking a beating as ongoing fears over trade relations and attacks on the Fed are weighing on the markets.

The ongoing uncertainties over President Donald Trump’s trade war and attacks on the Federal Reserve see investors ditch the U.S. dollar and stocks. The DOW Jones was down 976.23 points or 2.49% by late afternoon since early afternoon, while the S&P 500 fell 2.63% in the same period. The tech-focused Nasdaq index fell even more, down 2.97%.

At the same time, the U.S. dollar index was as low as 97.92, dropping to its lowest level since 2022. Trump’s escalating attacks against the Fed Chair Jerome Powell are prompting some investors to question whether the Fed can remain independent.

At the same time, Bitcoin (BTC) reached a daily high of $88,460, suggesting that some traders may see it as a safe haven compared to a weakening dollar. Gold has also seen a strong performance, up 2.95% to $3,413 per ounce.

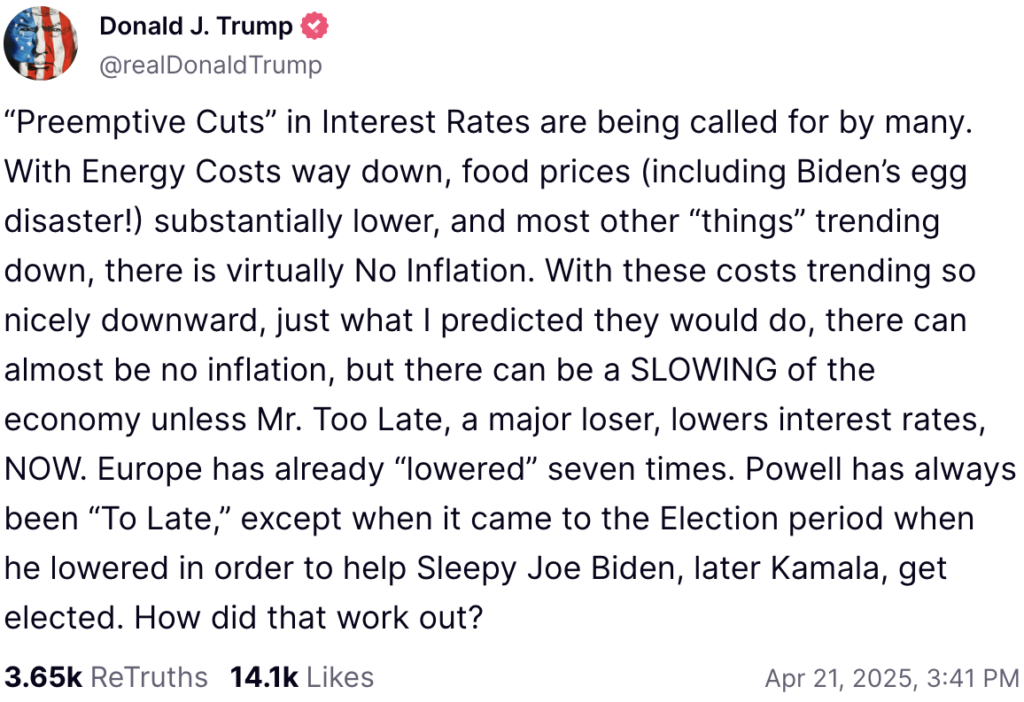

Trump pressures Fed Chair to cut rates

In a Monday, April 21, post on Truth Social, Trump called Powell a “major loser” and “Mr. Too Late,” pressuring him to cut interestest rates to help the struggling stock market. Trump claimed that lower energy prices, which are partially due to recession fears, would help buffer any inflation that might result from a rate cut.

Unlike Trump, Powell has repeatedly shown skepticism over the potential effects of easing monetary policy. In a speech in March, the Fed Chair explained that the U.S. economy is doing well, despite wild fluctuations in the stock market. Notably, Powell cited strong employment figures that suggest that the Fed has time to react.

Since its inception, the Federal Reserve has set monetary policy independently of Washington’s directives, just like central banks in all developed countries. This independence is seen as vital to ensure the strength of the domestic currency, as it helps against political pressures in favor of devaluation.