Elastos eyes $700b Bitcoin staking market with Layer 2 network

Elastos announced the launch of BeL2, a Layer 2 network built on Bitcoin, to introduce sophisticated BTC transactions on its blockchain.

The blockchain network looks to introduce a key defi solution on Bitcoin (BTC) as innovations like inscriptions and spot ETF chatter fuel BTC’s narrative. The new L2 network will bring staking to Bitcoin and aim to unlock a potential multi-billion dollar market through its platform.

The arrival of BeL2 means that Bitcoin is now ‘smart’, highlighting the potential for Bitcoin holders to stake their assets directly and earn interest on their holdings. It’s always been an anomaly that Bitcoin reserves remained effectively ‘dormant’ between transactions.

Sasha Mitchel, head of Strategy and operations, BeL2

In addition to BTC staking and providing direct yield via the BeL2 network, Elastos also plans to offer cheap transactions on native decentralized applications. However, the company’s statement did not clarify if this product would integrate the Lighting network, another purpose-built L2 network focused on facilitating swift and affordable BTC-denominated transactions,

Furthermore, Elastos plans to chart the defi course on BTC by enabling smart contract deployment and irreversible digital agreement between participants.

Now Bitcoin owners can put the world’s most popular, liquid, and secure digital currency to work, potentially unlocking over $700 billion in value.

Sasha Mitchel, head of Strategy and operations, BeL2

Elastos unveiled their plan to essentially bootstrap decentralized finance on Bitcoin during a period of increased interest in crypto’s largest blockchain and token. Not only is BTC up over 150 percent since the start of 2023 and eying a continued rally following a brief correction, users have also developed a technology called inscriptions.

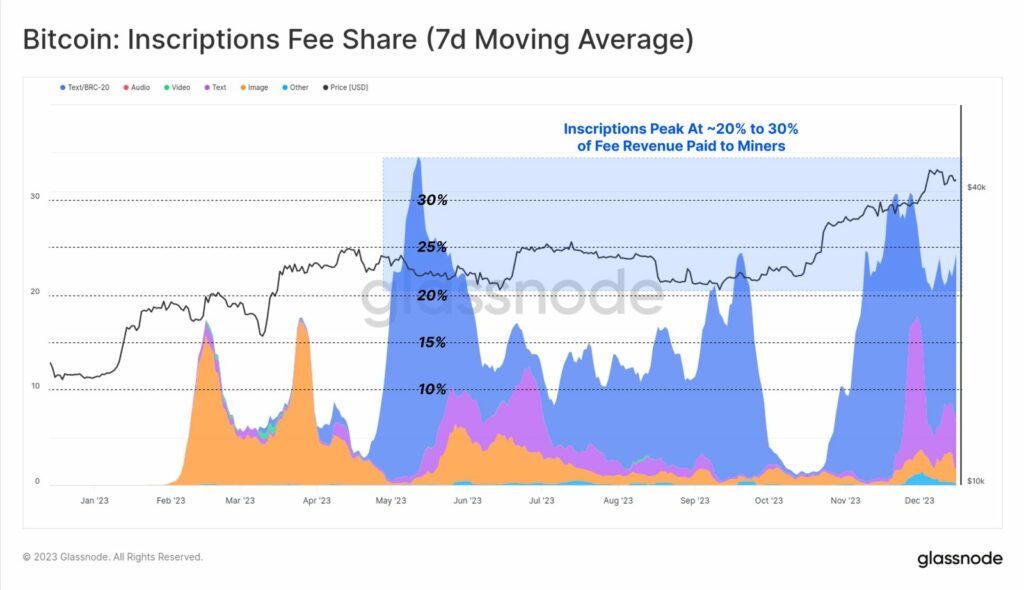

This involves adding digital data to transactions in a method akin to NFTs on blockchain like Ethereum and Solana. Inscriptions account for between 20 percent and 30 percent of total transaction fee revenue generated by BTC miners this year. At the same time, inscriptions also consumed a minority share of block space according to Glassnode.