Elon Musk tells investors to be careful in crypto investments, still likes DOGE

Elon Musk recently said DOGE is his favorite cryptocurrency but warned investors to exercise caution when dealing with investments in the crypto space.

Elon Musk warns against heavy investments in crypto

Despite liking dogecoin, multi-billionaire Elon Musk recently noted that he would not advise anyone to bet huge on crypto. Elon Musk was speaking at an interview with the Wall Street Journal.

Musk was asked whether he still has enthusiasm for the cryptocurrency space. The billionaire noted that he still likes cryptocurrencies, mentioning that DOGE is his favorite owing to the use of memes, humor, and dogs.

However, as part of his response, Musk said, “I’m not advising anyone to buy crypto or bet the farm on dogecoin.”

In recent years, Musk has been seen by crypto investors as a key opinion leader. Starting his relationship with bitcoin and investing heavily in the coin, Musk seemingly found a new gem in dogecoin.

Elon Musk has in the past self-proclaimed himself as the Dogefather. The community has therefore been looking to him and watching his every statement about crypto.

The billionaire’s words have always been proven to have an impact within the dogecoin community, even impacting other meme coins.

Last month, Elon Musk went a step further, using DOGE as the Twitter logo for a day. The move was considered great for dogecoin, contributing to massive increases in the coin’s prices.

DOGE price action

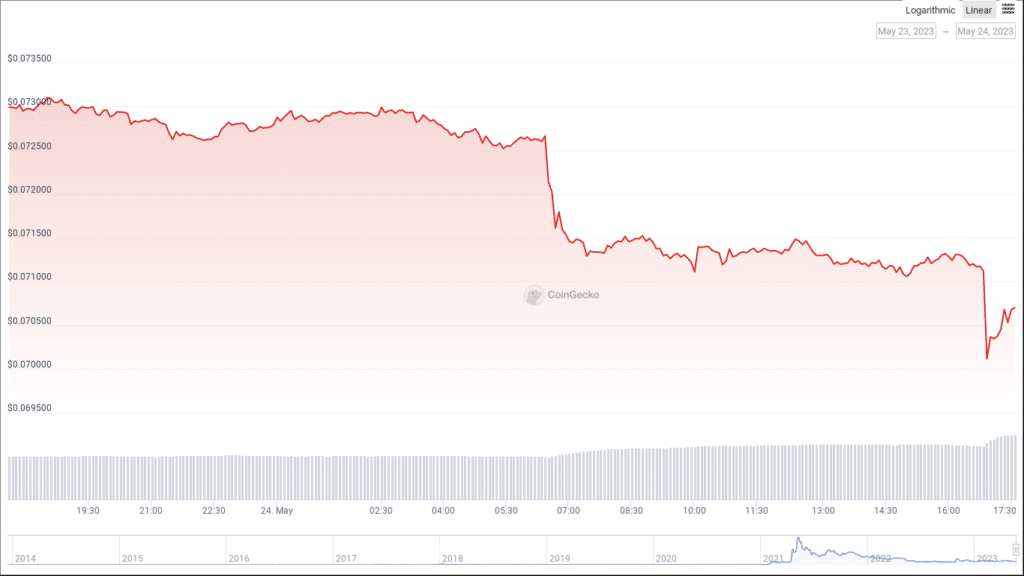

The recent comments from the entrepreneur triggered some negative price action for DOGE. Before the words, DOGE was trading at just about $0.074. However, since the announcements, the coin has been trading in the red, trending downwards.

At press time, DOGE was trading around $0.07. The data indicates that DOGE has plunged by over 5.4% in value since the announcement.

Looking at the weekly charts, DOGE has been trending downward for most of the past week. The coin seemed to make a recovery on May 22, but on 23, after Musk’s words, the coin took a sharp downturn.