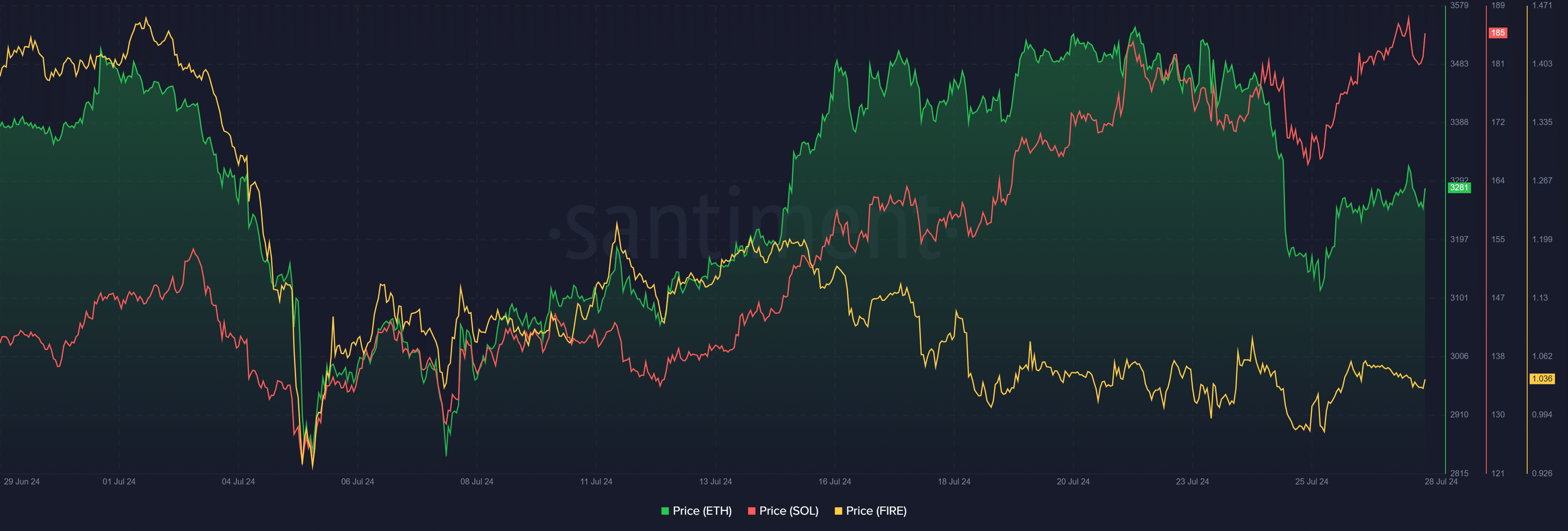

ETH, SOL, FIRE: Top cryptocurrencies to watch this week

Following a bullish performance two weeks ago, the cryptocurrency market recorded a bearish consolidation last week. The mild increase in Bitcoin’s price was not sufficient to drive a positive reaction from the rest of the market.

As a result, the global crypto market cap lost $70 billion, dropping from $2.47 trillion to $2.4 trillion by the week’s end. This decline occurred amid a mix of bullish and bearish performances from various altcoins.

Below are our picks for the top cryptocurrencies to watch this week, following their notable performances last week.

ETH drops 7.76% despite ETF launch

Ethereum (ETH) experienced a downward trend this past week. The asset witnessed a mild 1.21% increase on July 23, as spot Ethereum ETFs began trading, debuting with $106 million in net inflows and over $1 billion in trading volumes.

However, the July 23 gains were relinquished in the following days as Grayscale’s Ethereum Trust ETF (ETHE) led in outflows. ETH eventually closed the week at $3,247 per coin, marking a 7.76% decline.

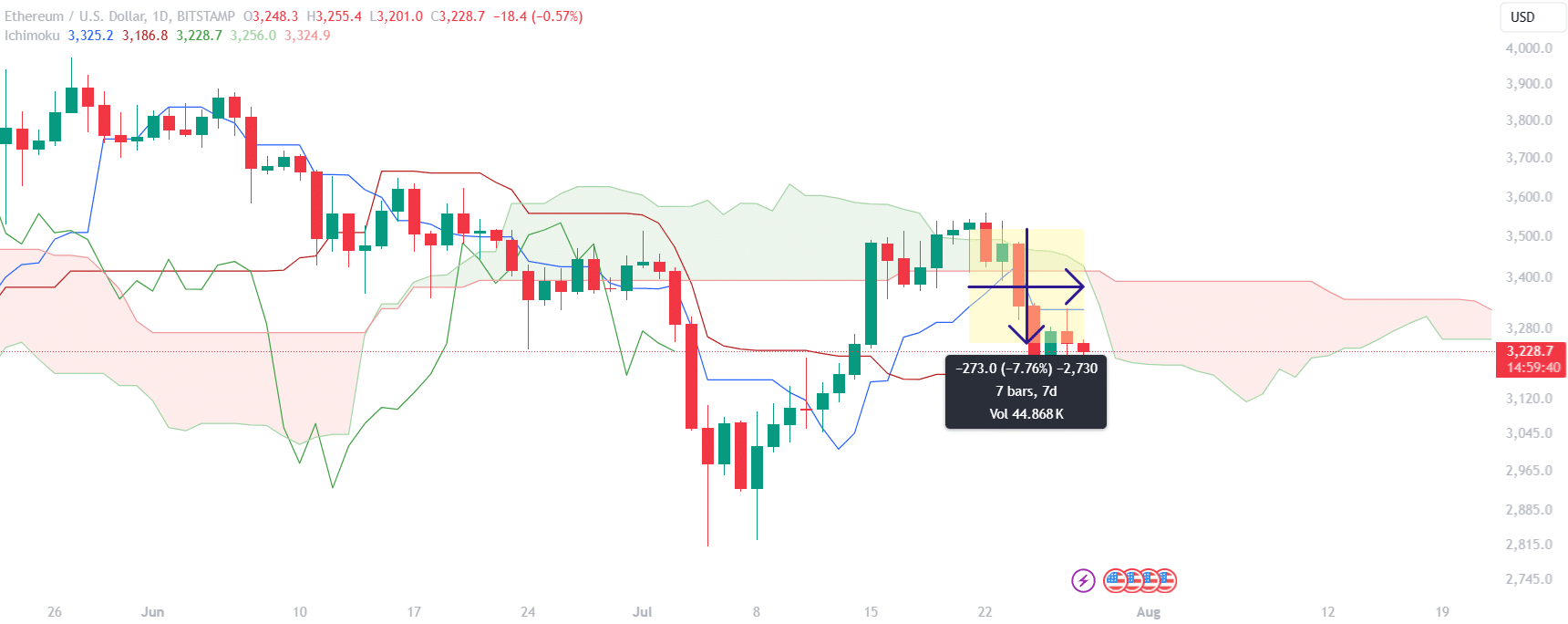

The Ichimoku Cloud confirms Ethereum’s bearish situation. ETH price is below the Tenkan-sen and Kijun-sen lines, which are both positioned under the cloud. This alignment suggests a bearish sentiment, with a likelihood of continued downward pressure.

For the upcoming week, ETH’s ability to recover depends on whether it can reclaim levels above the Kijun-sen and move back into the cloud, which would signal a potential trend reversal. However, if the downward trend continues, ETH may face further declines.

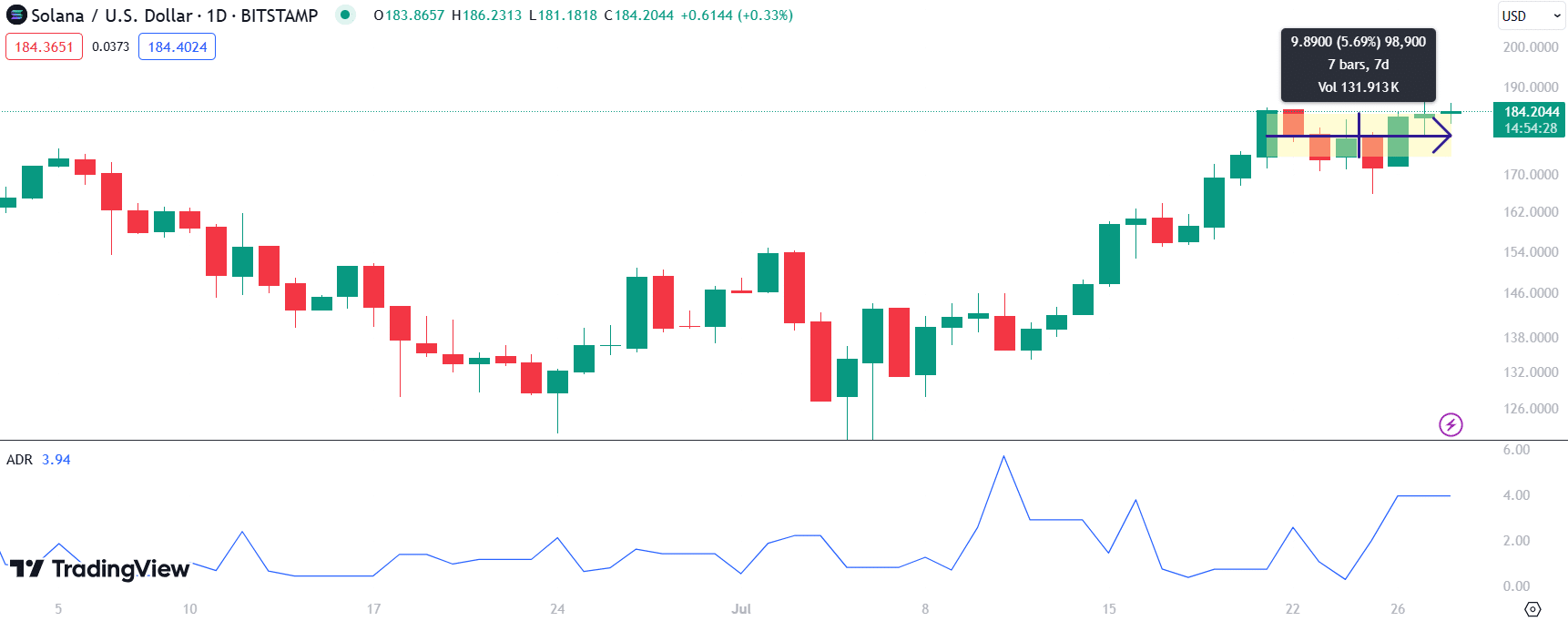

SOL finds support at $184

Solana (SOL) saw a relatively stable price movement with an overall upward trajectory. The price oscillated within a defined range amid reports of a possible from ETF finance giant Franklin Templeton. This period of consolidation suggests that the market was experiencing a phase of accumulation.

Overall, SOL experienced a growth rate of 5.69% last week. The price stayed above a key support level near $184, which served as a psychological and technical anchor. The closing price indicates bullish sentiment, as it remained near the upper boundary of the consolidation range.

The Advance Decline Ratio stands at 3.94 and indicates a bullish trend. This suggests that the number of advancing days outnumbered the declining days.

Looking ahead, if SOL manages to break above the resistance level around $186 with strong momentum, it could initiate a new bullish run. Conversely, if it fails to breach this level, it may retest the support around $184.

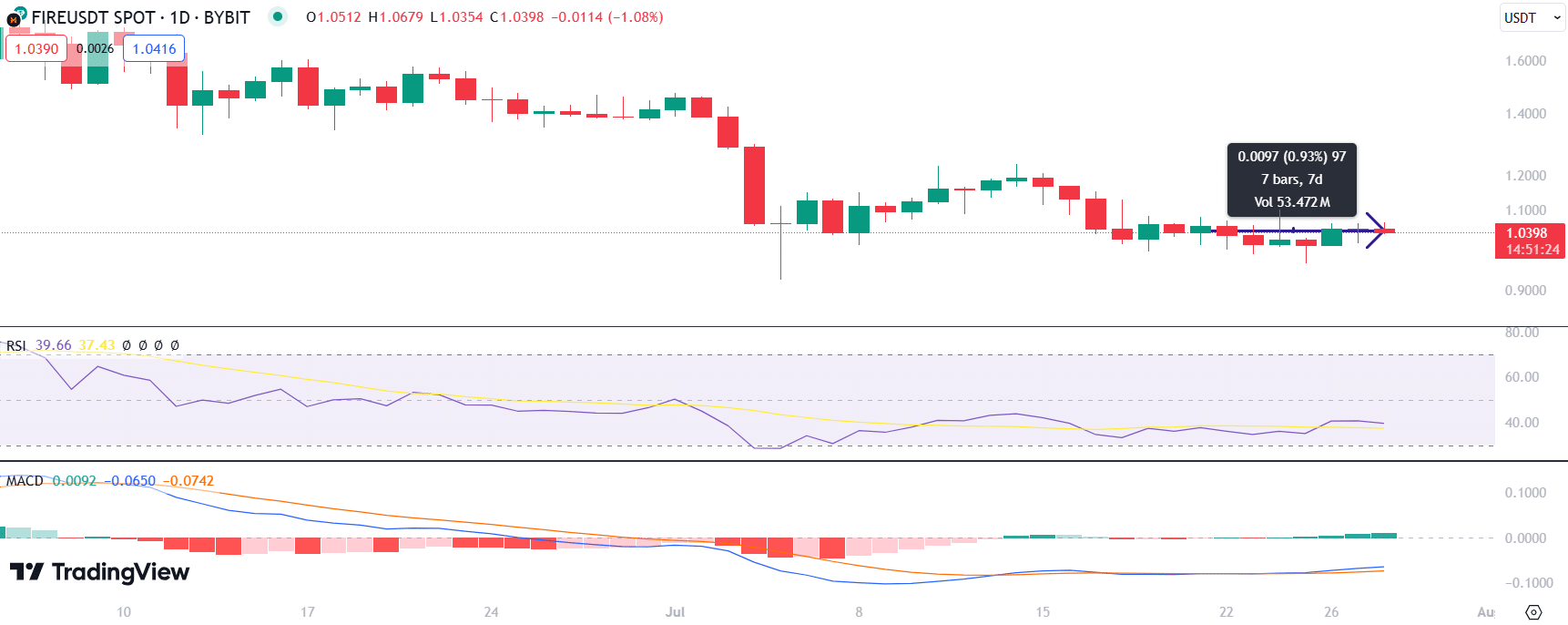

FIRE maintains stability

Last week, Matr1x Fire (FIRE) exhibited a relatively stable performance, with its price moving within a tight range and closing around $1.0512. The market showed a modest growth rate of 0.93%, indicating a period of consolidation rather than significant directional movement.

Technically, the RSI remained in the lower end of the range, around 37.43, suggesting that the asset is approaching oversold territory. This could imply that selling pressure might be easing, potentially setting up for a rebound if buying interest increases.

The MACD indicator continues to show a bearish trend, with the MACD line below the signal line, although the gap between them is narrowing. This could indicate a potential trend reversal or at least a relief from the consolidation.

For the upcoming week, monitoring whether the price can break above the immediate resistance level at Fibonacci 0.236 ($1.1309) or fall below the crucial support at $0.9222 will be pivotal in determining the next direction for FIRE.