Ethereum leads Solana, Arbitrum: DEX volume falls in August

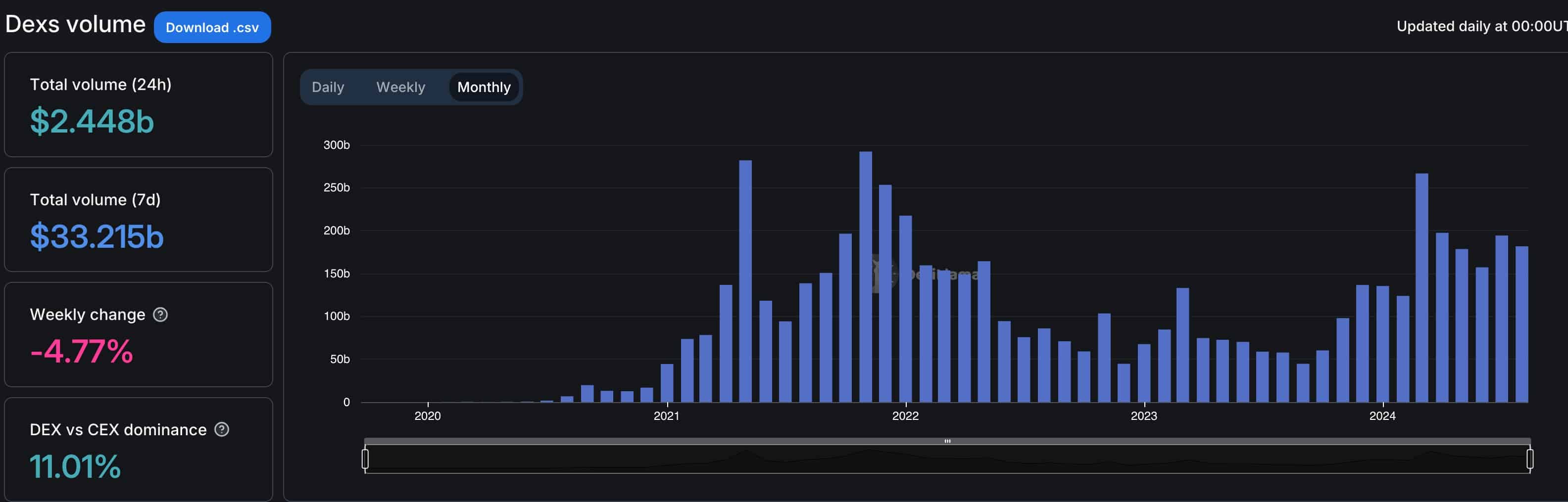

The volume of cryptocurrencies traded in decentralized exchanges dropped in August.

According to DeFi Llama, DEX platforms handled cryptocurrency worth over $181 billion in August, down from $198 billion in July.

The monthly volume of activity on DEX platforms peaked in March when they handled over $260 billion as most cryptocurrencies jumped.

Ethereum (ETH) was the most active chain for DEX platforms in August, handling over $52.5 billion. Solana (SOL) and Arbitrum (ARB) followed, with DEX platforms processing tokens worth $42.5 billion and $22.3 billion, respectively.

Tron (TRX) was the most improved chain in the DEX platforms, helped by the recently launched SunPump meme coin generator. SUN, the biggest DEX platform in its ecosystem, handled $3.2 billion worth of coins.

Uniswap was the most active DEX platform in August followed by Solana’s Raydium and BNB Chain’s PancakeSwap.

Solana’s DEX volume dropped because of the performance of meme coins in the ecosystem like Bonk, Book of Meme, and Dogwifhat. Bonk has dropped by over 64% from its highest point this year while Dogwifhat and Book of Meme have slipped by more than 70% from the year-to-date high.

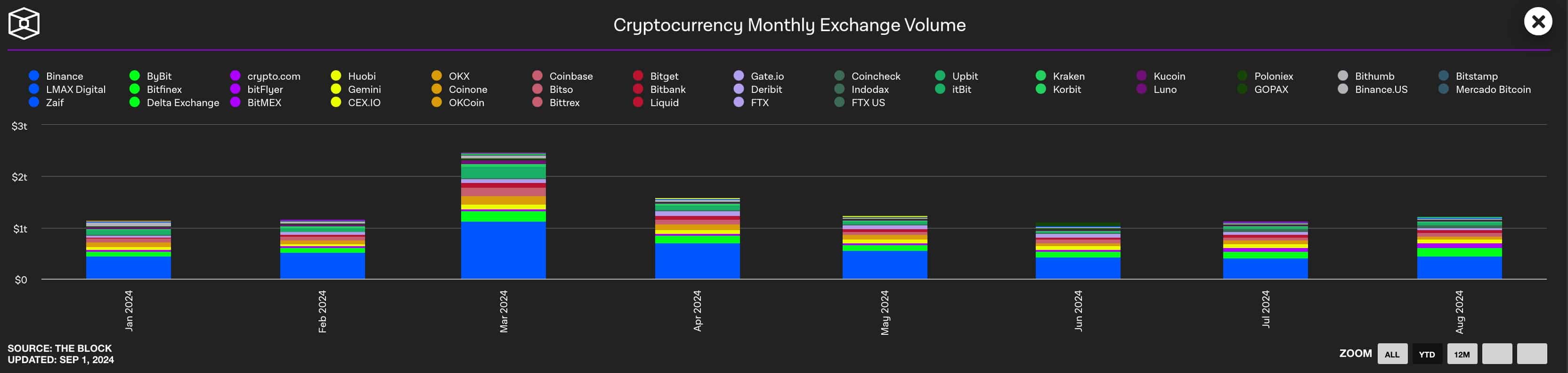

Binance maintained its lead among CEX exchanges

Meanwhile, Centralized Exchanges had a better performance in August. Data shows that these exchanges handled $1.2 trillion during the month, higher than the $1.1 trillion they processed in the previous month. Like DEX platforms, CEX exchanges’ volume peaked at $2.48 trillion in March as Bitcoin and other altcoins soared.

Binance maintained its lead, handling over $448 billion followed by Bybit, Crypto.com, Huobi, and Coinbase.

Additional data shows that the open interest of cryptocurrencies in the futures market fell during the month. Bitcoin’s futures interest stood at $30 billion on Aug. 31, down from the monthly high of $37 billion.

Cryptocurrencies had another difficult month in August. Most of them initially dropped on Aug. 5 as the fear of the unwinding of the Japanese yen carry trade pushed most assets downwards.

While most coins bounced back from their monthly lows, they remained significantly below their highest levels this year.

Bitcoin remains 18% below the year-to-date high while Ethereum has dropped by almost 40% below its March highs.

As we wrote on Friday, some analysts cite the underperformance to the falling liquidity in the crypto market and the rising fear that some governments will start selling their coins.