Ethereum price crosses milestone to bring weekly gains to 13%

Ethereum price crossed the $2,500 milestone on Feb. 9, but rising number of ETH coins deposited in staking contracts could propel it even further.

Ethereum price made another giant stride on Feb. 9 as it crossed the elusive $2,500 territory to bring its weekly gains to 13%. Rising staking deposits, positive market sentiment surrounding the Dencun upgrade and the potential spot ETF approval have emerged as dominant bullish catalysts for ETH price in recent weeks.

Can the bulls build on this momentum to reclaim the $3,000 for the first time in the Ethereum 2.0 Proof of Stake (PoS) era?

Ethereum staking deposits hit 25% milestone

Ethereum’s developers launched the Dencun upgrade on the Sepolia testnet at the end of January, to a positive reaction from market participants.

With a promise of improving transaction processing capacity and reducing costs, Dencun upgrade may attract more developers and users to the Ethereum DeFi ecosystem. This increased utility and adoption could drive demand for ETH, ultimately driving up its price.

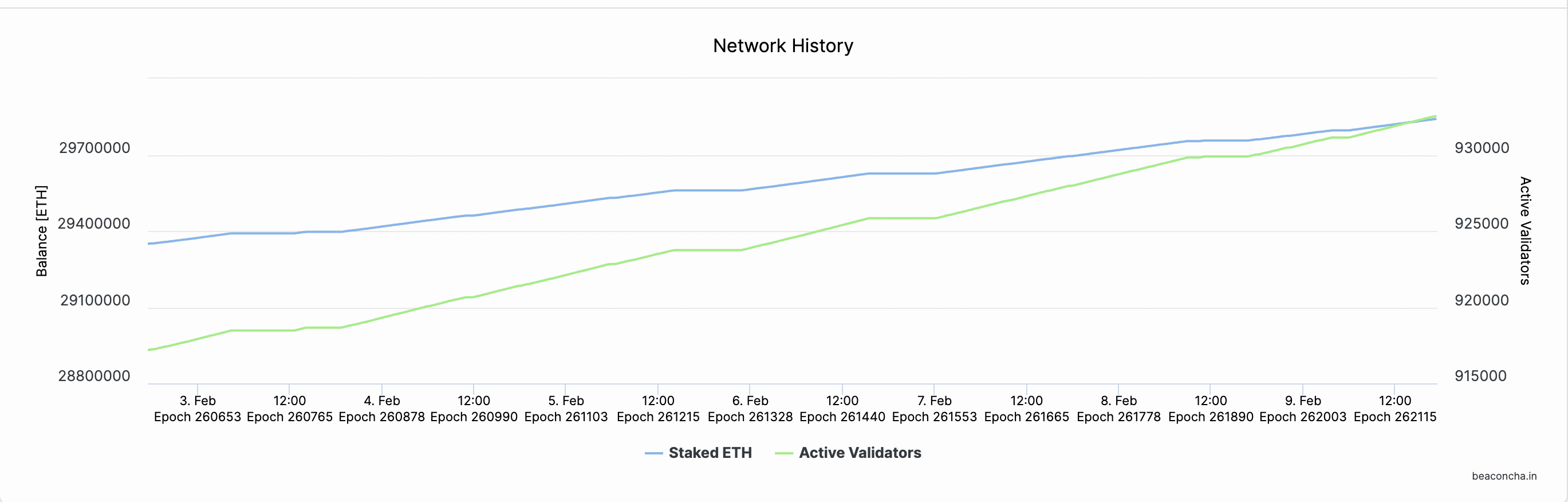

Notably, investors have increased the spate of staking on the ETH2.0 beacon chain, possibly in a bid to front-run the expected gains from the recent network improvement and potential spot ETF approval.

Ethereum staking deposits have been on the rise since the Shappela upgrade enabled withdrawals in April, and the recent successful Dencun upgrade appears to have further buoyed stakeholders’ conviction.

Investors have deposited another 588,866 ETH into Ethereum 2.0 staking contracts, since the Dencun testnet launch was announced on Jan 31.

As per official data from the Beacon chain, 29.8 million ETH are now locked up in Ethereum beacon chain staking contracts. Notably, this works out to 24.7% of total Ethereum circulating supply.

In simple terms, a quarter of the total ETH coins in circulation are now deposited in ETH2.0 staking contracts on the beacon chain by network validators. This milestone is bullish for two main reasons.

Firstly, increased staking is crucial for any PoS blockchain as it improves the network’s security architecture. More importantly, it reduces the number of coins readily available to be traded on exchange spot markets.

Currently, ETH stakers get an annualized rewards rate of 4%. This passive income incentive structure, positive market sentiment could further encourage more staking deposits in the coming days.

Given the prevailing bullish sentiment surrounding the crypto markets, all of these factors could combine to drive ETH price toward the $3,000 mark in the coming weeks.

ETH price prediction: Potential roadblock at $2,600?

Drawing inferences from the on-chain metrics analyzed above, the induced market scarcity from the rising staking deposits has put ETH prices on an upward trend. But in terms of short-term price targets, the bullish traders face a major roadblock at the $2,600 area.

IntoTheBlock’ global in/out of the money (GIOM) data groups all existing ETH holders according to their historical buy-in prices. Currently, it depicts 1.3 million addresses that acquired 193,130 ETH at the maximum price of $2,555.

This cluster of holders could pose initial resistance if they opt to book some profits as Etherum prices exceed their break-even point.

However, if the bulls can stage decisive breakout above that initial resistance level, an upswing toward $3,000 could be on the cards.

On the flip side, the bears could negate this optimistic prediction if the Ethereum price dips below $2,000. However, as seen above, the 3.2 million addresses acquired 3.4 million ETH at a minimum price of $2,259.

To avoid slipping into loss positions, those investors could make frantic covering purchases, which could inadvertently trigger a rebound.