Ethereum Name Service jumps 7% on day spot Ethereum ETFs launch

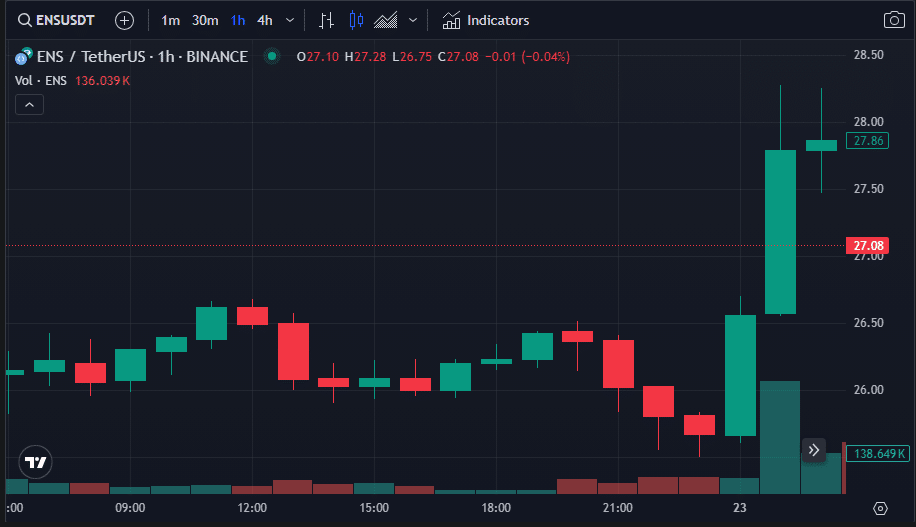

Ethereum Name Service has surged 7.6% over the past day, making it the top gainer among the largest 100 crypto assets amid a general downturn in the global crypto market.

At the time of writing, Ethereum Name Service (ENS) was trading at $27.32, marking a 4.4% increase in the last 24 hours, according to data from crypto.news. With a circulating supply of 32.8 million ENS, the project’s market cap stands at $896 million.

Despite this recent price increase, ENS remains down 68% from its all-time high of $85.69, achieved on November 11, 2021. Meanwhile, the daily trading volume for ENS has risen by 86%, reaching approximately $234 million.

Over the past year, ENS has surged over 185%, while Ethereum and Bitcoin have recorded gains of 84% and 122%, respectively.

Ethereum Name Service operates as a decentralized system on the Ethereum blockchain, enabling users to assign easy-to-remember names like “jake.eth” to various digital identifiers, including addresses and metadata.

This system, which is governed by smart contracts and a decentralized autonomous organization (DAO), represents a shift from traditional, centralized domain name systems.

Ethereum co-founder Vitalik Buterin has recently highlighted the importance of integrating ENS domains with layer-2 blockchains.

He advocates for the adoption of trustless, Merkle-proof-based CCIP resolvers to facilitate the registration and readability of ENS subdomains directly on layer-2 solutions, thereby reducing costs and emphasizing their role in the developing crypto landscape.

The recent surge in ENS coincides with the SEC’s approval of the first-ever spot Ethereum ETFs in the U.S., which are set to begin trading today, July 23.

ENS’s price jump also comes despite a drop in Ethereum, which has declined 1.13% in the last 24 hours, trading at $3,444 at press time.

ENS is fundamentally different from Ethereum, but many retail investors view them as cheaper alternatives. As ETH gains popularity among institutions, individual investors might shift their focus to lower-cap ‘Ethereum’ coins like ENS.

The global crypto market has also seen a 1.7% drop in the last 24 hours, currently standing at $2.41 trillion.