Ethereum approaches ‘Danger Zone,’ yet on-chain metrics shine

Ethereum is trading just 2% below its all-time high of $4,878, but Santiment’s latest analysis warns that on-chain metrics are flashing warning signals about potential price corrections.

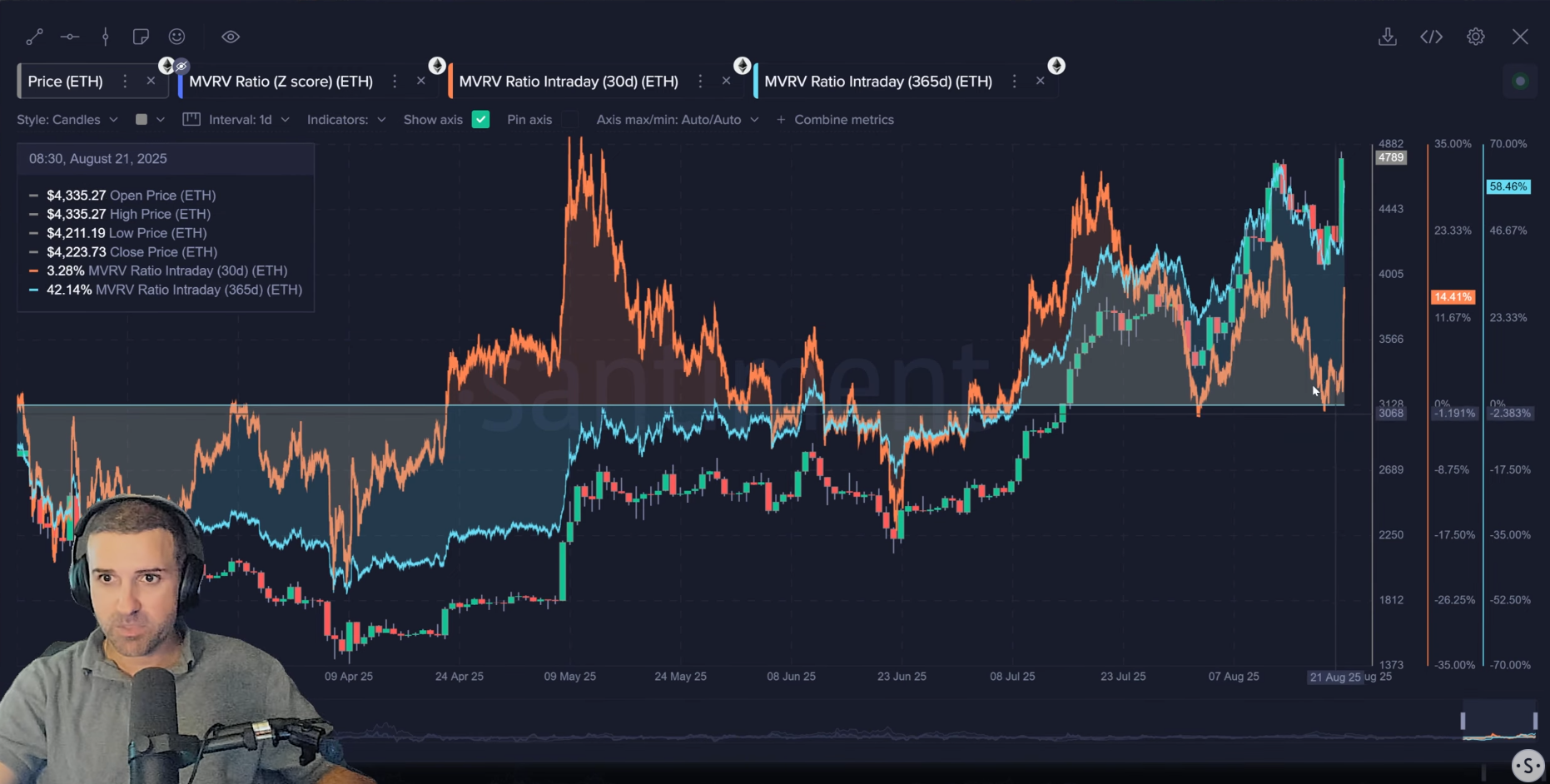

- Ethereum trades 2.2% below ATH with Santiment warning via high MVRV ratios

- 30-day MVRV at 15% and long-term at 58.5% signal profit-taking risk

- Bullish signs include falling exchange supply and rising network activity

The second-largest cryptocurrency has gained 32% over the past 30 days and climbed over 5% in the last week. Ethereum (ETH) reached $4,834 during recent trading sessions.

Blockchain analytics firm Santiment cautions that valuation metrics are entering risky territory that could cause profit-taking activity.

Why Ethereum price hits new all-time high

Ethereum has surged more than 40% in 2025, outperforming Bitcoin, after reclaiming $4,000 in early August and surpassing $4,500 a few days later.

The rally is driven by strong inflows into spot Ethereum ETFs—approved by the U.S. Securities and Exchange Commission (SEC) in July 2024 and now holding over $20 billion, led by BlackRock’s ETHA—as well as the rise of digital asset treasuries (DATs) centered on ether.

Ethereum ETFs also saw renewed inflows, adding $287 million on Thursday and more on Friday, bringing total ETF assets to $30.54 billion. Meanwhile, the Ethereum ecosystem shows strong activity, with stablecoin supply up 10% to $147 billion and total transactions rising to $880 billion, boosting project revenues.

Ethereum’s price is also rising due to growing expectations that the Federal Reserve may cut interest rates in September, following weaker-than-expected July jobs data and a higher unemployment rate.

A dovish Fed would likely shift investment from low-risk bonds to riskier assets like crypto.

Ethereum hits ‘danger zone’— On-chain signals keep bulls hopping

Santiment’s analysis points to concerning signals in Ethereum’s Market Value to Realized Value (MVRV) ratio. The short-term 30-day MVRV is approaching 15%, a level the analytics firm identifies as a “danger zone” where altcoins frequently face pullbacks.

The long-term MVRV currently stands at 58.5%. This elevated reading suggests current holders are sitting on substantial unrealized profits. This raises the likelihood of selling pressure if ETH breaks through resistance levels.

MVRV ratios measure the difference between market cap and realized cap. When these ratios reach extreme levels, they often precede price corrections as investors take profits.

The 15% threshold has historically marked turning points for Ethereum, with past instances coinciding with price declines that ranges from 10% to 25%.

Bullish on-chain signals counter the valuation warning

Other on-chain metrics paint a more optimistic picture for Ethereum’s long-term prospects. The mean dollar invested age is dropping sharply. This shows that previously dormant coins are moving back into active circulation.

Network realized profits are also spiking, which shows increased trading activity across the network. This measures the total profit realized by all coins moved on-chain, providing insight into market sentiment.

Most bullishly, the supply of ETH held on exchanges continues to decline. This trend suggests investors prefer self-custody storage over keeping tokens on trading platforms.

The exchange supply metric has been trending downward for months, with investors moving holdings to cold storage wallets. This behavior often correlates with price appreciation as it reduces readily available supply for trading.