Is Ethereum’s price headed to $5k after Dencun upgrade?

Ethereum’s price is down 5% from last week’s peak, raising the question of whether the asset is heading to $5,000.

The much-anticipated Ethereum Dencun upgrade went live on the mainnet on March 13. Despite this, the ETH price has struggled to maintain an upward momentum since the deployment, putting a question mark on the chances of a near-term rally toward $5,000.

Ethereum traders are selling into the Dencun upgrade hype

When Ethereum developers announced the successful Sepoli test run of the Dencun upgrade on Jan. 30, it sparked bullish expectations among ETH traders.

Over the next 40 trading days, Ethereum’s price delivered a blistering 70% rally, peaking at $4,092 on March 12 as strategic bull traders bought in on the promise of lower transactions and enhanced scalability.

But, as the update went live on the mainnet this week, ETH decoupled from the broader crypto market trend as traders entered a selling spree.

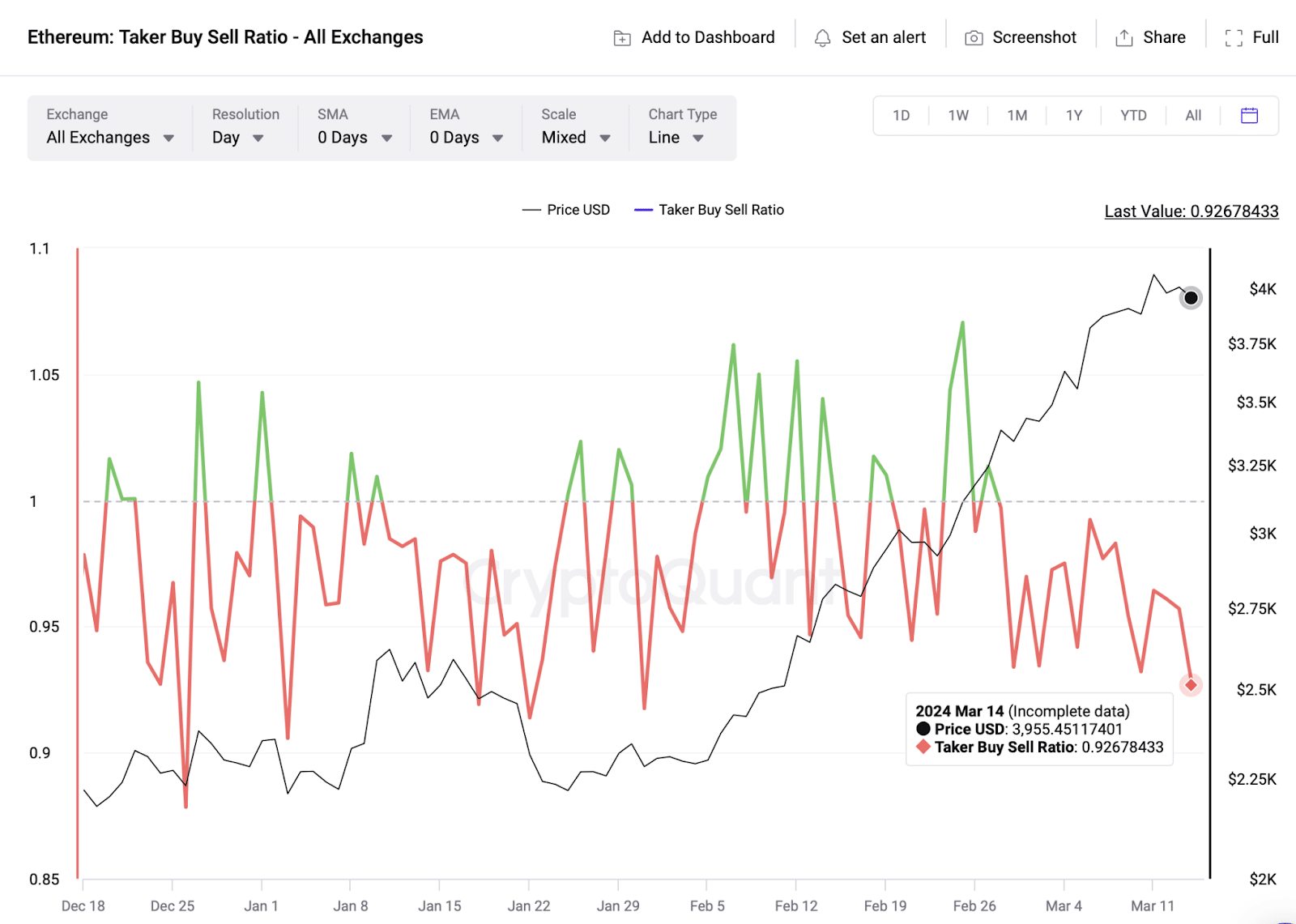

CryptoQuant’s taker buy/sell ratio is a metric used to analyze trading activity on crypto exchanges. It compares the volume of market orders executed by buyers against those executed by sellers.

The metric provides real-time insights into the imbalance between buying and selling pressure and the markets for a specific cryptocurrency.

ETH taker buy/sell ratio swung negative as prices raced above $4,000 in early March. It dipped to a 40-day low of 0.93% on March 14, barely 24 hours after the Dencun upgrade went live.

Negative taker buy/sell ratio values indicate more selling activity than buying activity across ETH perpetual swaps markets.

When this trend appears during a price downtrend, it signals that with sellers outnumbering buyers, they could potentially push prices even lower.

Investors have flooded the markets with another 74,000 ETH

The selling pressure witnessed in Ethereum markets after the Dencun upgrade signals a classic buy-the-rumor, sell-the-news cycle.

In further affirmation of this stance, the inflow of new ETH coins into exchange wallets this week highlights that more investors are seeking short-term trading opportunities.

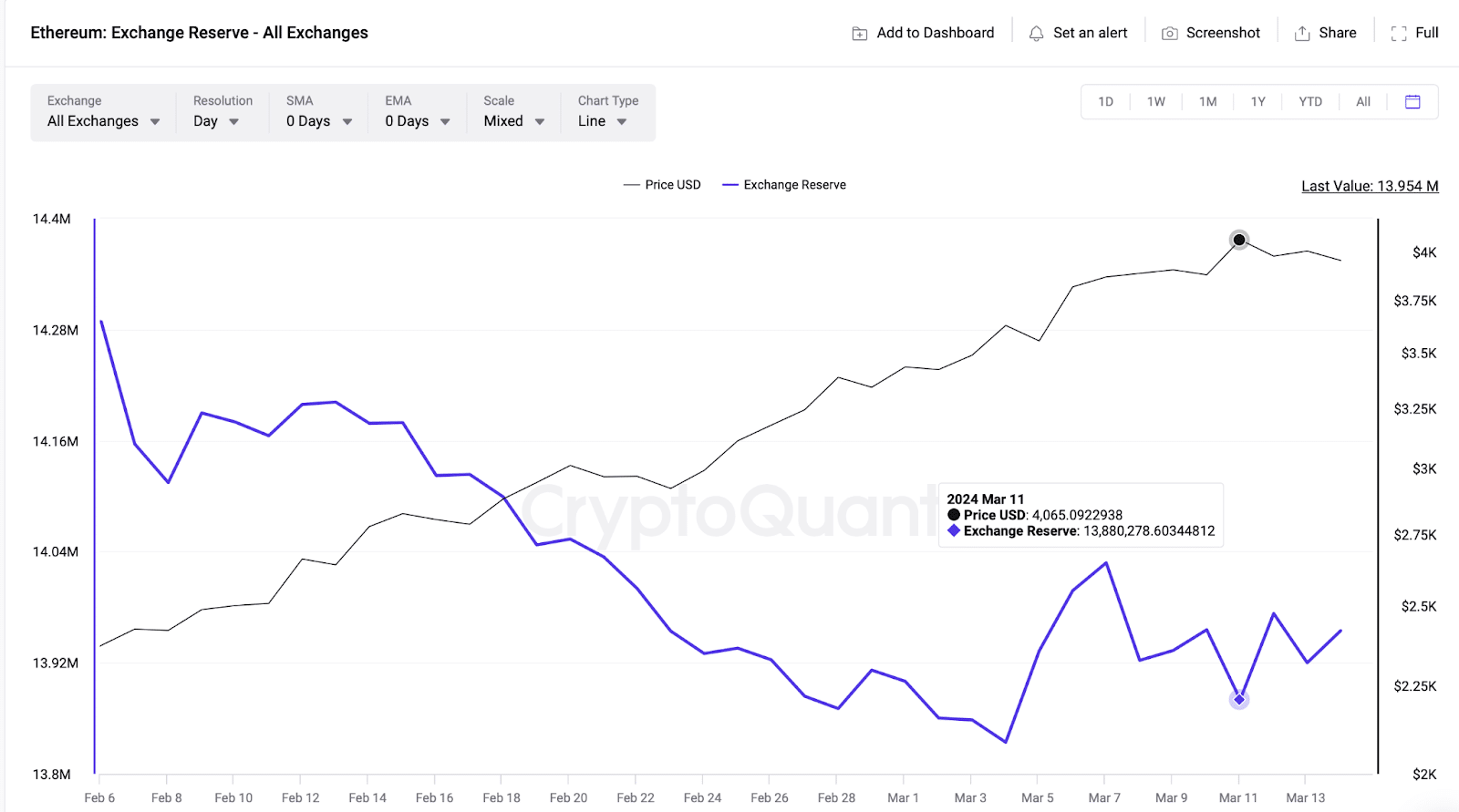

CryptoQuant exchange reserves chart below monitors real-time changes in the number of tokens that investors have deposited in exchange-hosted crypto wallets.

As seen in the chart above, Ethereum investors held over 13.8 million ETH in exchange wallets at the start of the week on March 10. When writing on March 14, that figure jumped to 13.9 million.

Effectively, existing Ethereum holders have shifted 74,000 ETH coins into exchange wallets this week, potentially to seek out short-term opportunities to sell.

Valued at the current prices, those 74,000 ETH are worth approximately $290 million. Such a large inflow of coins into exchange reserves is poised to dilute market supply. If a commensurate demand surge does not meet it, the ETH price risks sliding further below $3,900 in the days ahead.

How will the Dencun upgrade impact Ethereum’s price?

Drawing inferences from the ETH market data trends analyzed above, it is unlikely that the Dencun upgrade fanfare will drive the Ethereum price to $5,000, as initially anticipated by optimist bull traders.

Instead, in the near term, ETH price will likely slide further below $3,900 as the traders selling the news continue to move new coins into the spot market supply.

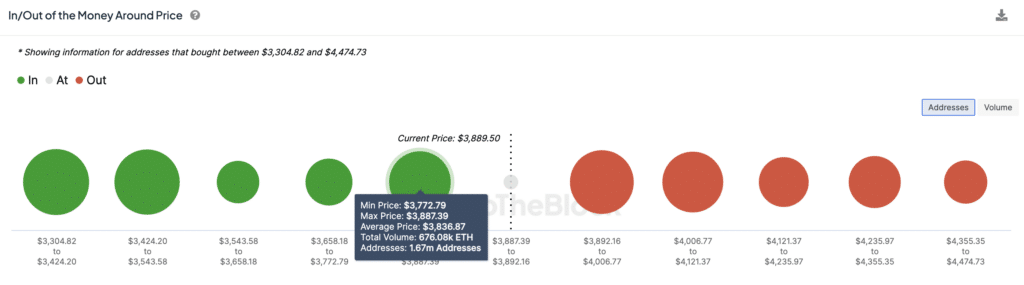

The $3,840 territory remains a key support level, as IntoTheBlock’s in/out of the money data shows that a cluster of 1.7 million addresses had bought 676,500 ETH at the average price of $3,836. If those holders make covering purchases to avoid slipping into losses, they could inadvertently trigger an early price rebound.

But if Ethereum’s price slides below $3,830, it could trigger a wave of margin calls and stop-loss orders, considering the larger number of investors who bought ETH at that price range.

Conversely, on the upside, the bulls must reclaim and establish a steady support base above $4,050 to regain control of the short-term market momentum.