Ethereum price declines with June’s poor track record looming

Ethereum price pulled back in the past three days as traders adjust their positions for June, its historically worst month.

Ethereum (ETH) has declined for three consecutive days, hitting a low of $2,500. That’s a 9.8% drop from its monthly high. Despite the pullback, it has outperformed most altcoins, many of which have fallen more than 15% from their highs this month.

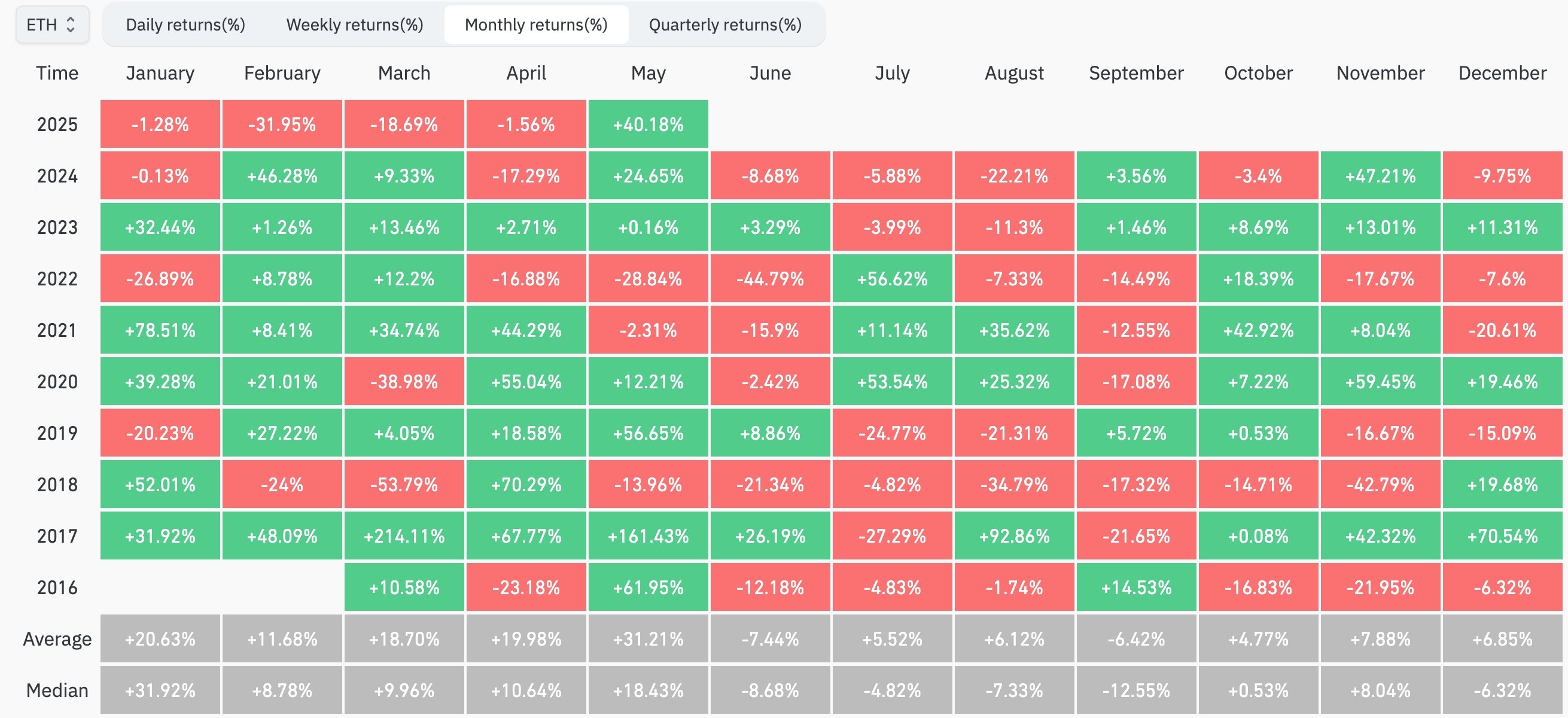

ETH retreated ahead of June, which is usually its worst month, because of the start of summer. CoinGlass data shows that the average monthly performance in June since 2016 is minus 7.4%. Its median monthly return in June is minus 8.68%.

June is also Bitcoin’s (BTC) second-worst-performing month after September, with an average return of minus 0.35%.

Seasonality does not always work out. For example, ETH dropped by 18% in March, bucking a four-year trend of gains. It also dropped by 31% in February, after recording positive gains in the last six consecutive years.

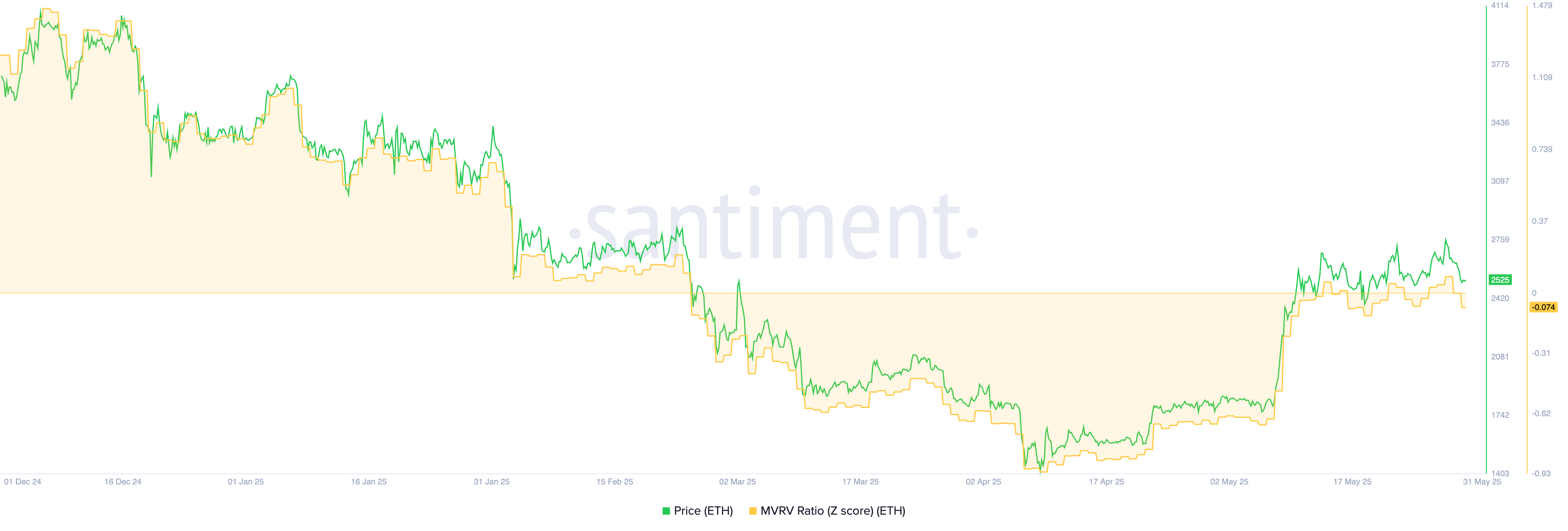

Ethereum has some strong fundamentals as June kicks off. First, there are signs that the coin is cheap, as the closely-watched MVRV ratio has moved to minus 0.074. The MVRV ratio compares the market value and the realized value, with a reading of less than 1 signaling that an asset is undervalued.

There are also signs that Ethereum whales are buying the dip. They hold 103.5 million ETH coins, up from this week’s low of 103.45 million. Whale purchases is a highly bullish sign.

Wall Street investors have also continued to buy ETH this month. Spot Ethereum ETFs have had inflows in the last 10 straight days, bringing the cumulative inflows to over $3 billion.

Ethereum price technical analysis

The daily chart below shows that Ethereum’s price bottomed at $1,385 on April 9 and then bounced back to the current $2,530. It has moved above the 50-day moving average and is slowly forming a bullish flag pattern.

This pattern comprises of a vertical line and a consolidation.

Ethereum is also forming a cup-and-handle pattern, a popular continuation sign. The cup has a depth of about 50%, giving it a price target of $4,185.