Ethereum price prediction: Can Fusaka upgrade spark a breakout?

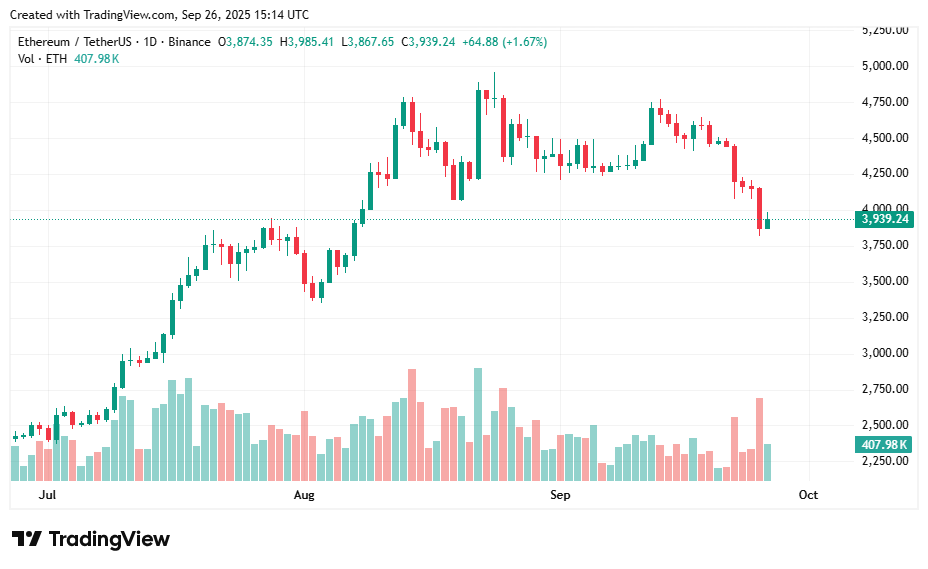

- Ethereum trades around $3,900–$3,950, consolidating as traders eye the December Fusaka upgrade with PeerDAS to boost scaling.

- A breakout above $4,500 could fuel an Ethereum price prediction toward $4,800–$5,000, while failure risks a pullback to $3,600–$3,800.

- Fusaka is a strong medium-term bullish catalyst, but near-term moves still hinge on macro sentiment and BTC stability.

ETH sits near $3.9K after a choppy week.

With developers targeting a December Fusaka hard fork that introduces PeerDAS and other scaling tweaks, and a testnet activation slated for early October, traders are asking whether fundamentals can overpower near-term risk-off flows and trigger a breakout above $4.5K.

Table of Contents

What is Fusaka?

Fusaka, Ethereum’s next major upgrade after Pectra, focuses on scalability, data availability, and node efficiency. Its key feature, PeerDAS, lets nodes verify block data without full downloads, cutting costs and boosting rollup throughput.

Developers target December 2025 for mainnet activation, with testnet rollout set for early October, alongside smaller tweaks like gas-limit changes and infra hardening.

Ethereum price prediction market data

ETH is moving between $3,800 support and $4,200 resistance, with volatility muted as markets await a clearer signal.

Fusaka’s headline feature, PeerDAS (Peer Data Availability Sampling), is designed to lower costs and increase throughput for rollups and L2s, potentially boosting demand for ETH as on-chain activity scales.

Markets typically respond positively to dated upgrade roadmaps, and with Pectra already behind and Fusaka lined up, confidence in Ethereum’s development cycle remains high. Still, near-term trading is dominated by macro sentiment and BTC’s direction.

Positive factors for Ethereum price

If Ethereum (ETH) can reclaim $4,200 and close above $4,500, traders see scope for a rally toward $4,800–$5,000 into Q4. The October testnet and December hard-fork timeline provide clear catalysts, while improved scaling could attract new inflows into DeFi and Ethereum’s ecosystem.

The bullish case rests on expectations that PeerDAS will deliver cheaper and faster rollups, that the presence of a concrete roadmap will reassure markets, and that capital rotation could move back into ETH if macro conditions improve.

Negative factors for ETH price

Despite the upgrade narrative, ETH faces several risks. A “buy the rumor, sell the news” reaction is possible if macro weakness persists, such as renewed ETF outflows or higher U.S. inflation. Execution delays remain a threat, since developers are treating December as a target rather than a fixed deadline.

There is also the issue of event magnitude, as Fusaka focuses on infrastructure improvements rather than headline-grabbing features. Failure to defend $3,800–$3,900 support could expose ETH to deeper losses, revisiting early-September levels in the low $3Ks.

Ethereum price prediction based on current levels

The base case over the next two to four weeks is for ETH to continue ranging between $3,800 and $4,500, with macro flows and BTC dictating direction. The catalyst case points to a stronger move, as successful testnet progress in October and the December hard fork could trigger a sustained breakout toward $4,800–$5,000.

On the other hand, weak sentiment or delays could cap ETH under $4,500 and drag it back toward $3,600–$3,800. The Ethereum outlook remains medium-term bullish thanks to Fusaka, but short-term price action is still tied closely to overall market conditions.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.