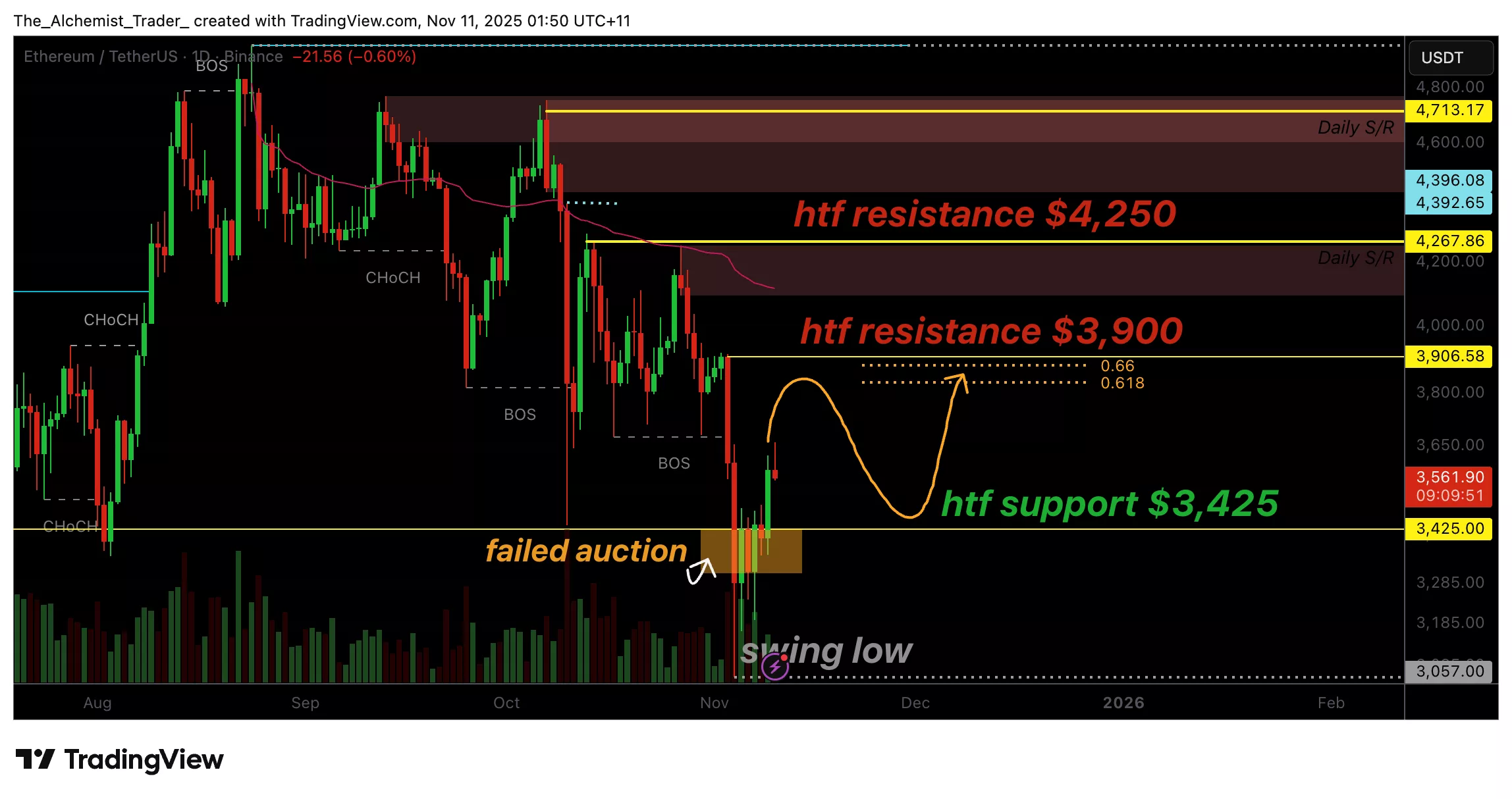

Ethereum price rejects lower after failed auction, bullish reversal to $4,000 possible?

Ethereum price reclaims the $3,425 failed auction level, signaling strong demand. Bulls aim to confirm a reversal with a potential rally toward the $3,900–$4,000 resistance zone.

- Failed Auction: $3,425 level reclaimed, confirming strong demand.

- Bullish Setup: Holding support favors rotation toward $3,900–$4,000.

- Downside Risk: Losing $3,425 reopens bearish continuation potential.

Ethereum (ETH) price has shown renewed strength after reclaiming a key technical level at $3,425, a zone previously lost during the latest correction. The swift recovery above this level suggests that buyers have stepped back in, defending the market from deeper downside continuation. This price behavior now raises the probability of a bullish reversal forming from the current trade location.

Ethereum price key technical points:

- Failed Auction Reclaim: $3,425 level reclaimed, confirming demand absorption.

- Bullish Retest Zone: Holding above $3,425 opens the path toward $3,900 resistance.

- Downtrend Invalidated: Failure to close below $3,425 could mark a structural reversal.

From a technical perspective, the reclaim of the $3,425 level represents a classic failed auction scenario, where a breakdown below support was quickly reversed by intense buying pressure. This recovery often signals sellers’ exhaustion, with demand overpowering supply and shifting the short-term market bias to bullish.

If Ethereum maintains this reclaimed support, the next primary objective lies near the $3,900–$4,000 zone — a region that previously acted as a distribution range before the correction began. Sustaining higher candle closes above $3,425 will confirm that buyers have regained control and could propel the price toward that upper boundary in the short- to medium-term.

However, a loss of this level would reintroduce bearish pressure, invalidating the failed auction thesis and potentially exposing Ethereum to further declines toward the $3,200–$3,000 region. Volume influxes will play a crucial role here; continued buyer presence is necessary to sustain the rally and avoid another breakdown.

The broader market also shows signs of stabilization, with Bitcoin consolidating near key support and altcoins starting to exhibit localized recoveries. Ethereum’s resilience around the $3,425 mark positions it favorably if overall sentiment improves, possibly leading the next sector-wide rebound.

What to expect in the coming price action:

If Ethereum continues to hold above $3,425, the setup favors a gradual rally toward $3,900–$4,000. Reclaiming $4,000 on a daily closing basis would confirm a full bullish reversal, signaling a structural shift toward higher highs. Conversely, a breakdown below support would suggest that the downtrend remains intact, delaying any recovery.