Ethereum price to cross $3k after Bitcoin ETF approval?

Ethereum price briefly broke past the $2,400 mark on Jan. 10, up 10% within the weekly time frame, ahead of the much-anticipated Bitcoin ETF Approval.

The crypto market experienced widespread volatility on Jan 9 after the U.S. Securities and Exchange Commission (SEC) announced false Bitcoin (BTC) ETF approval in a now-denounced post on X.

Despite the raging controversy, Ethereum’s (ETH) price has maintained a steady uptrend, trading as high as $2,440 on Jan. 10.

Ethereum vs Bitcoin: Crypto derivatives traders are betting bigger on ETH

Between Jan. 7 and Jan. 10, Ethereum’s 11% price growth performance has dwarfed Bitcoin’s 4%. Interestingly, vital derivative market metrics now suggest that ETH price could further outperform BTC if the SEC issues a timely positive verdict on Bitcoin Spot ETFs.

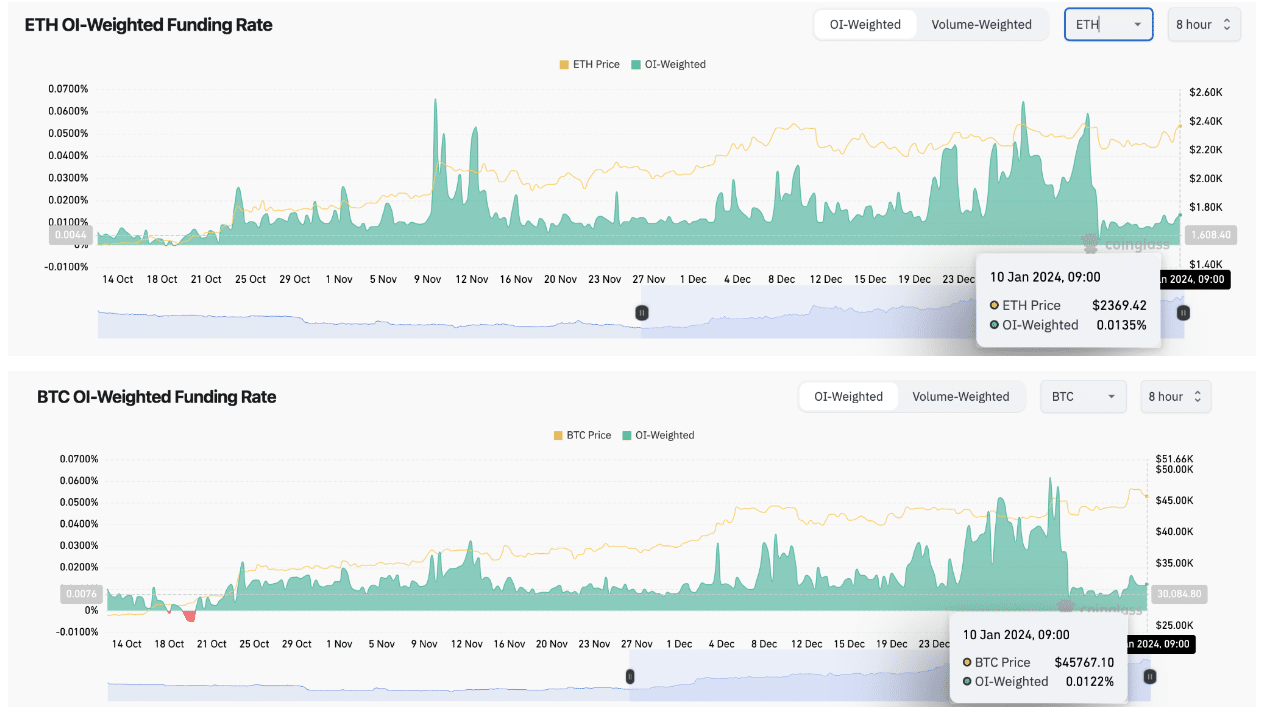

Firstly, the funding rate represents the interest paid by bullish traders to inverse traders to keep their LONG futures contract positions open. As of morning trading hours Eastern time on Jan. 10, ETH currently has a Funding rate of 0.014%, which marginally exceeds currently exceeds BTC’s 0.12%

Put concisely, a higher positive funding rate in Ethereum than in Bitcoin implies increased demand for long positions in the ETH derivatives market, potentially reflecting a more optimistic sentiment.

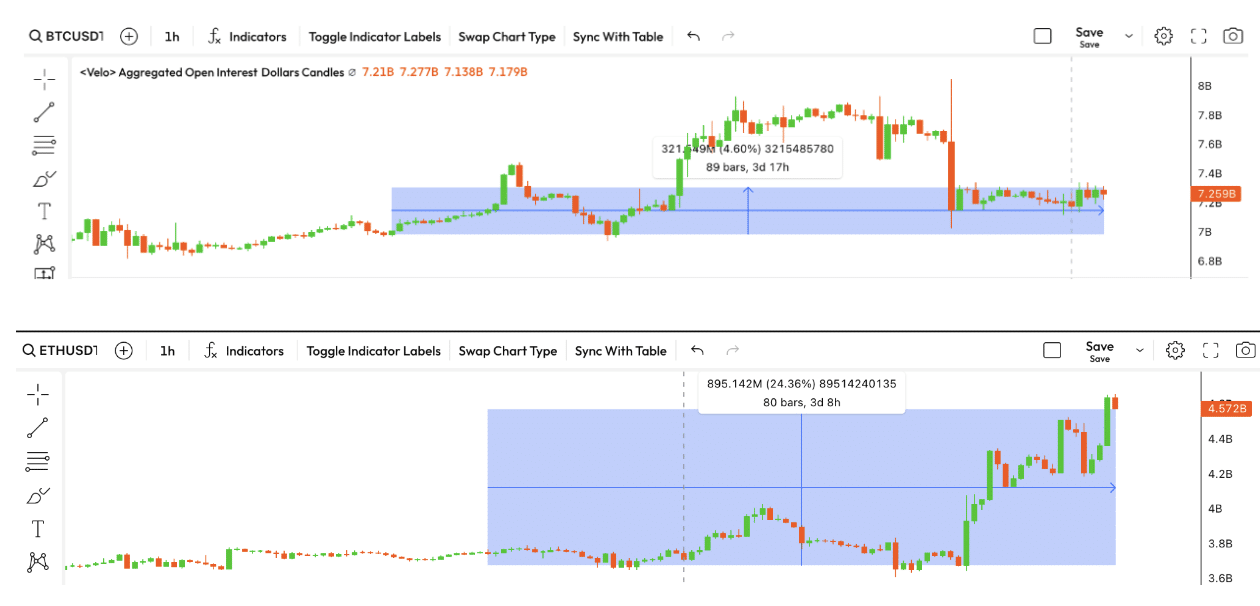

In further confirmation that Ethereum price could outperform Bitcoin, the open interest dynamics have also flashed similar signals since the week’s turn.

ETH open interest growth has outpaced BTC

ETH Open Interest has increased by 14.6% from $3.71 billion at close on Jan. 7 to $4.57 billion at the time of writing on Jan 10. Meanwhile, BTC open interest has witnessed only a 5% boost, from $6.4 billion to $7.3 billion during this period.

Open interest represents the dollar value of all active futures contracts for a specific cryptocurrency. An increase in open interest implies more new entrants are bringing fresh capital than those closing out their positions.

The chart above clearly illustrates that the percentage increase in ETH has outpaced Bitcoin’s open interest amid intense speculation on the spot BTC ETF verdict. This affirms that crypto traders are betting on Ethereum to deliver larger price gains in the days ahead.

Will ETH reach $3,000 after BTC ETF approval?

Despite Bitcoin pulling more media traction, the current ETH Funding rate and Open Interest trends imply that crypto traders anticipate higher price gains in Ethereum after a positive ETF verdict. If this scenario continues, ETH’s price will likely reclaim the $2,500 territory.

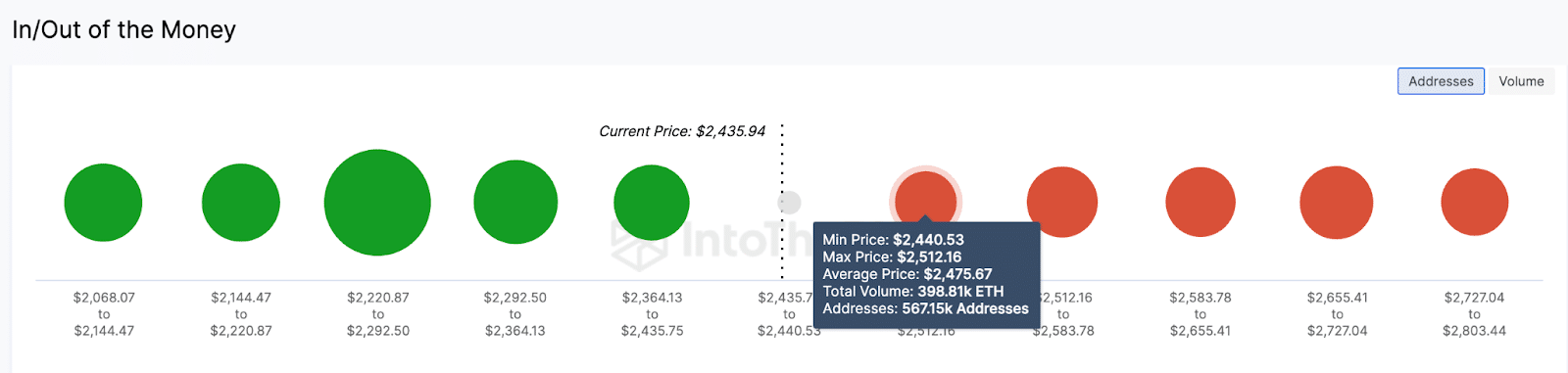

However, IntoTheBlock’s in/out of the money around price (IOMAP) data, which groups the current ETH holders by their historical entry points, shows a major resistance sell-wall around the $2,475 range.

The IOMAP depicts that 567,150 addresses have acquired 398,810 ETH at the average price of $2,475.

Given that this cluster of holders has been holding at a loss for nearly two years, they could rapidly book profits as ETH price approaches their break-even point again.

But if the derivative traders continue doubling their bullish positions as depicted by the elevated ETH funding rates, Ethereum’s price could break above $2,500 for the first time since May 2022.

Conversely, if a material market even sends ETH price into a down trend, the $2,200 support level could be crucial.

As seen above, the 2.85 million addresses that had acquired 7.7 million ETH coins at the minimum price of $2,220 could mount a formidable buy-wall to avert a prolonged Ethereum price downswing.