Ethereum still leads in gas fees despite 4-year low in transaction costs

Ethereum continues to lead in all-time gas fees, particularly in DeFi, despite a decline in on-chain activity and the lowest transaction costs in over four years.

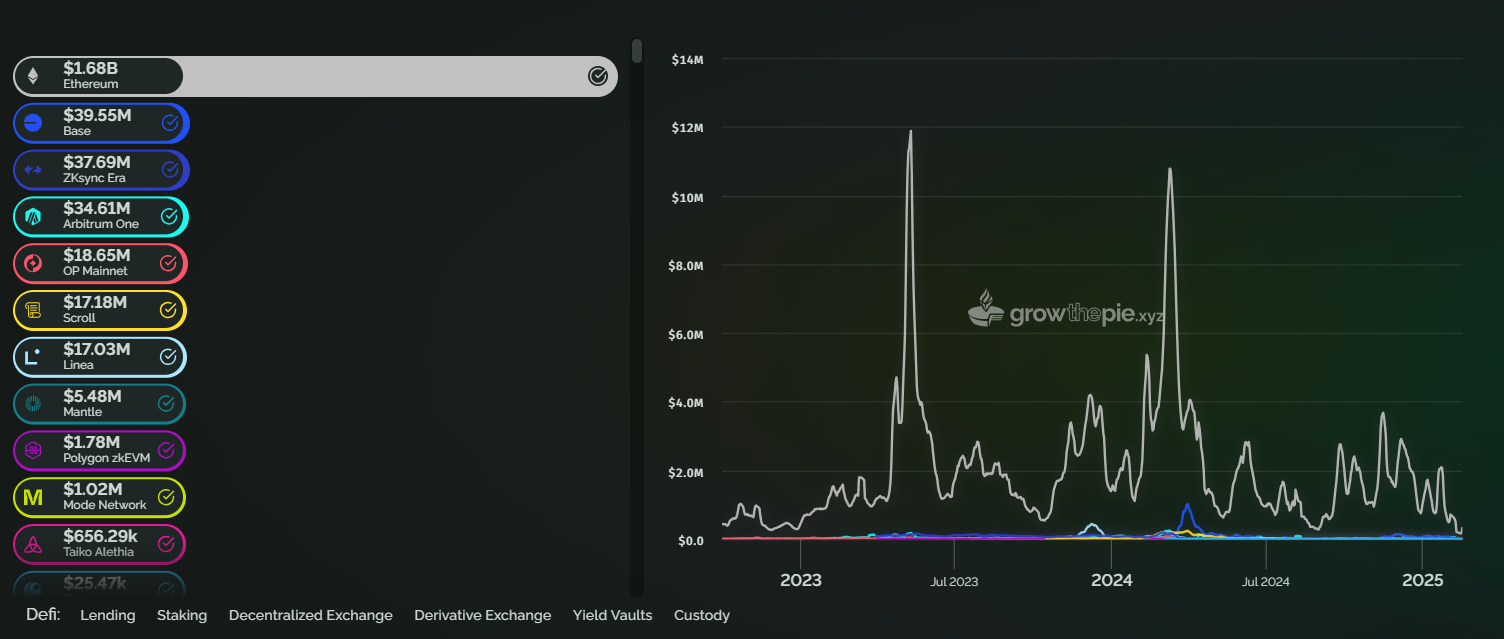

According to data analytics platform Growthepie, Ethereum’s Layer 1 blockchain still dominates in all-time gas fees generated across all sectors (finance, gaming, NFTs, etc.), except for social.

In DeFi alone, Ethereum (ETH) has accumulated over $1.68 billion in total gas fees. It leads other blockchains in DeFi gas fees on all timeframes (all-time, monthly, 3-month, and weekly). This shows that Ethereum is still the dominant platform in terms of DeFi usage, even though Layer 2 solutions typically offer cheaper fees.

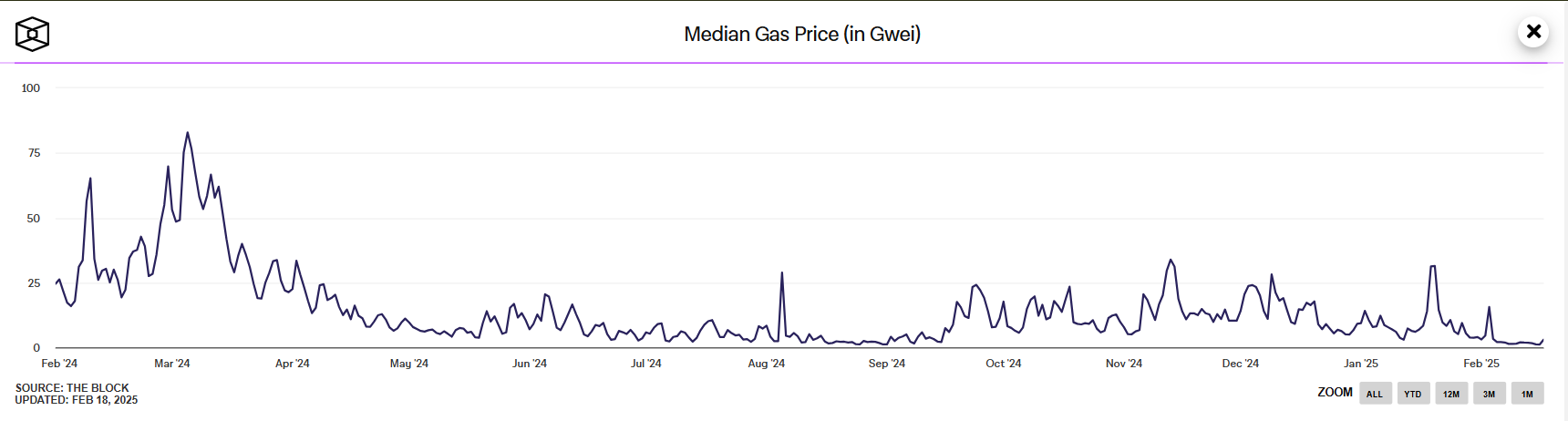

While Ethereum is generating all-time highest gas fees, the actual transaction costs (fees for sending individual transactions) are currently at their lowest levels in over four years (the last time it was this cheap to use Ethereum for transactions was in July 2020). This is mainly because the median gas price (the price users pay to process transactions) is very low right now, averaging 3 (a tiny fraction of an ETH). On Feb. 16, it was even lower at 1.19 Gwei, which was the lowest since Jan. 2020.

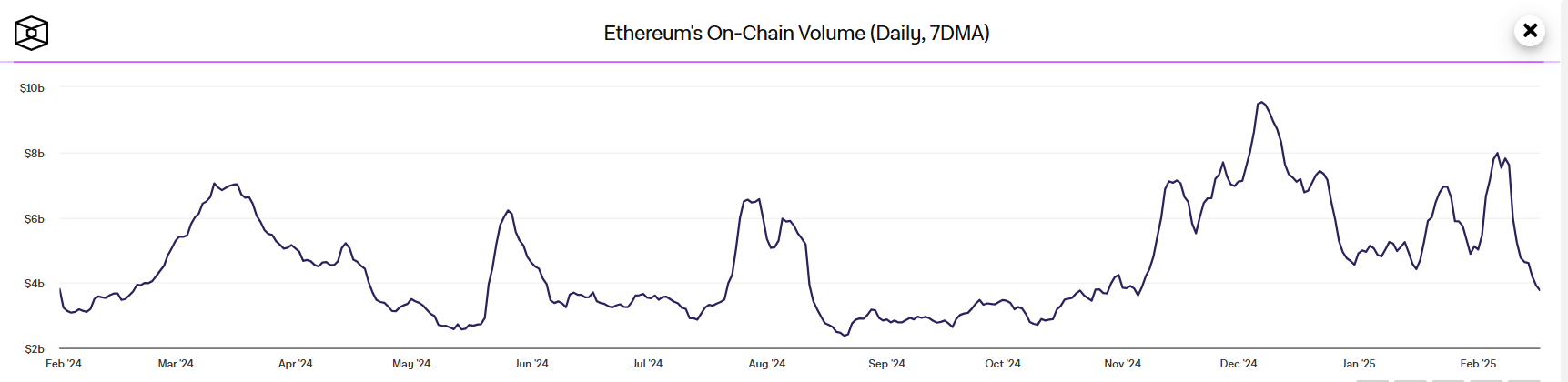

However, although Ethereum still leads in gas fees and transaction fees are low, the on-chain activity on Ethereum is actually slowing down, meaning that there is less demand for Ethereum transactions rather than increased network efficiency. The 7-day moving average (7DMA) of Ethereum’s on-chain volume dropped to approximately $3.77 billion on February 18, marking the lowest daily volume for Ethereum since Nov. 2024.