Ethereum strategic reserves hit 1% of supply as corporate adoption accelerates

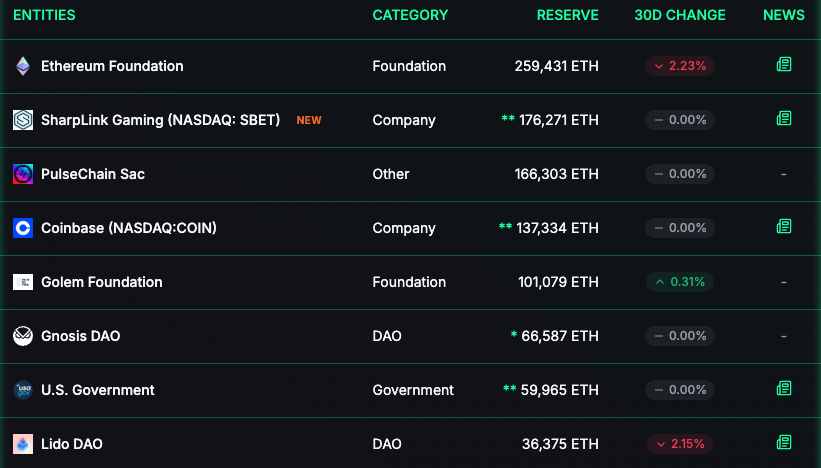

Top institutional holders dominate Ethereum’s strategic reserves, with the Ethereum Foundation leading the pack.

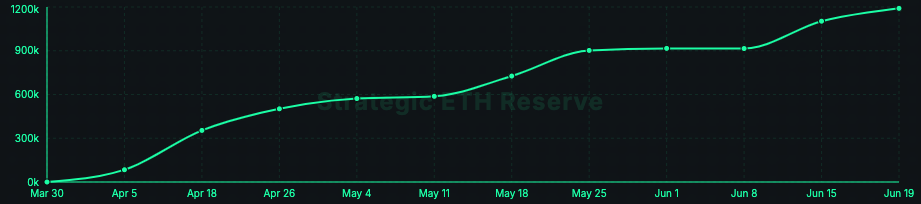

Corporate Bitcoin (BTC) strategic reserves have been a major trend in the past few months. However, Ethereum (ETH) is slowly catching up. On June 19, strategic reserves among institutions rose to 1.190 million ETH, according to the Strategic ETH Reserve website. These reserves, worth almost $3 billion, amount to more than 1% of the total supply of ETH.

Top holders dominate these reserves, with the five largest entities controlling over 70% of all institutional ETH holdings. The Ethereum Foundation is the single largest holder, with 269,431 ETH. It’s followed by SharpLink, a Nasdaq-listed gaming company that acquired 176,271 ETH on June 13 and has staked 95% of it.

The Nasdaq-listed firm acquired its reserves on June 13 and is staking 95% of the ETH. The most recent entrant is Status, an Ethereum messenger and Wallet, which acquired 23,066 ETH on June 19, worth $2.9 million.

Other significant holders include layer-1 network PulseChain, crypto exchange Coinbase, and the Ethereum-focused Golem Foundation. Notably, the U.S. government also holds close to 60,000 ETH, largely originating from asset seizures.

More firms consider ETH reserves

While Bitcoin remains the leading asset for strategic reserves, Ethereum is attracting growing interest from corporations and government entities. As the most established altcoin, it is emerging as the top choice beyond Bitcoin.

Among them, Michigan’s state pension plan made a $10 million allocation in Ethereum. Publicly traded companies that hold Ethereum include Bit Digital, BTCS, Intchains Group, and KR1, firms that are mostly focused on crypto assets.

The figures come from the Strategic ETH Reserve initiative, which tracks major institutional holders through publicly visible wallets. The initiative aims to promote transparency and drive broader adoption of Ethereum in institutional portfolios.