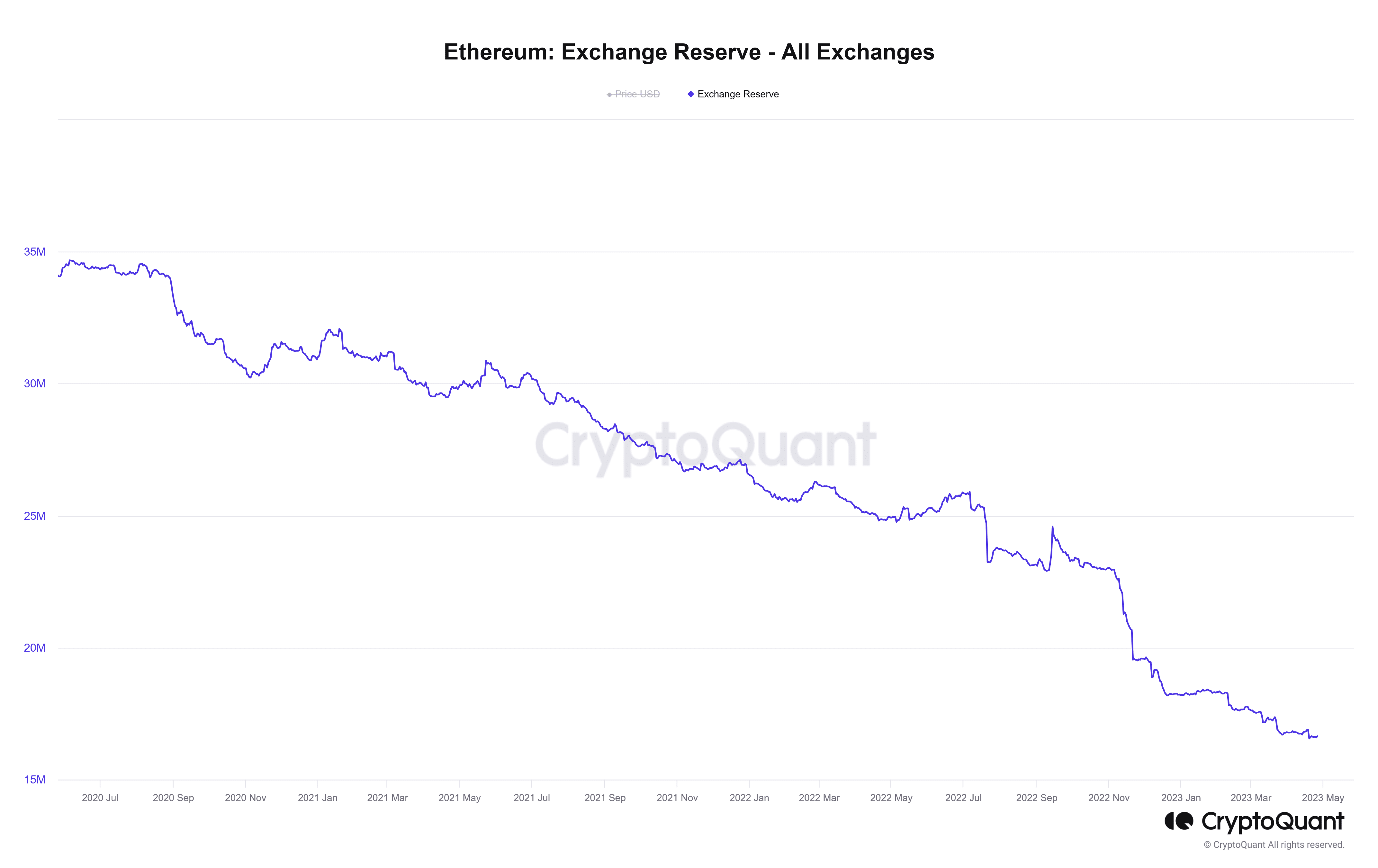

Ethereum’s exchange holdings plunge to 5-year low

Ethereum (ETH) balances on crypto exchanges have plunged to a five-year low, triggering speculation on its future price action.

Intriguing developments have always marked the ebb and flow of the crypto market, and this week is no exception.

The show’s star is ether, the world’s second-largest cryptocurrency, quietly making headlines due to an intriguing phenomenon – its balance on exchanges is nearing an all-time low.

The question on everyone’s mind is: what could this mean for the future of ETH?

Data from Glassnode paints a compelling picture. As of May 26, out of the total ETH supply of 120.26 million, a mere 16.64 million is present on centralized exchanges, suggesting that 86% of the ETH supply is lying dormant.

This marks a drastic decrease from 2021’s bull market, during which the exchange balance was around 25-26%. This trend seems to suggest a bullish sentiment, as a limited supply drives prices upwards.

Staking craze: the power of passive income

One of the significant contributors to this phenomenon is the growing popularity of ether staking. Millions of additional coins have been staked thanks to the recent Shapella upgrade to the Ethereum network.

This move has resulted in a significant chunk of the ether supply being absorbed from the market, creating a supply crunch. This increasing interest in staking is primarily due to large ether holders’ preference for generating passive income rather than liquidating their assets.

Ethereum’s recent upgrades fuel the exodus

Another crucial factor is Ethereum’s recent upgrades. Following the introduction of the Merge upgrade, which transitioned Ethereum to a proof-of-stake (PoS) consensus mechanism in September 2022, the rate of decline in ETH exchange reserves has accelerated.

Further fuelling the exodus is the Shanghai upgrade implemented on April 12, which has boosted ethereum staking even more. Staking rewards data reveals that approximately 18.91 million ETH worth $34 billion is currently staked on various platforms.

Impact on ETH price: will it soar or plunge?

Historically, low exchange reserves suggest less selling pressure and a bullish momentum, potentially driving ETH prices higher. The recent stats support this speculation; the ETH price has increased by 2% in the past 24 hours, trading above the $1800 level.

Moreover, ether’s decreased volatility and declining trading volumes since the upgrade have brought stability to ETH prices. However, the question remains, will this stability persist, or are we on the brink of a price explosion?

Only time will tell whether this all-time low balance on exchanges leads to a bullish run or introduces an unexpected twist. As always, stay tuned for more exciting developments.