Ethereum’s staked supply could increase while a price drop is expected

The Shanghai upgrade will allow the network’s validators to withdraw their staked funds by executing the Ethereum improvement proposal (EIP) 4895.

The Shanghai Ethereum upgrade, also known as the Shapella fork, is expected to be implemented on April 12. With the upgrade coming, a drop in the ethereum (ETH) price is expected.

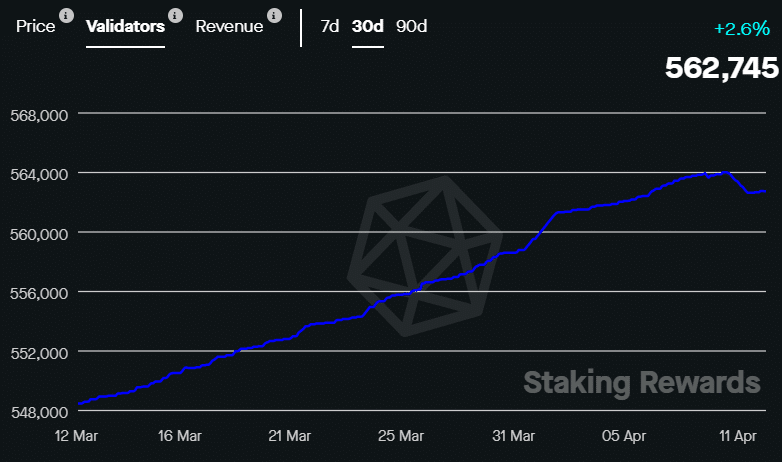

At the time of writing, 15.56% of the total ETH supply — roughly 18.839 million coins — is staked on the blockchain, according to data provided by Staking Rewards. Per the data, the ethereum staking market cap stands at $36.7 billion, leading the proof-of-stake (PoS) networks.

According to Staking Rewards, the total validator revenue on the Ethereum network has risen by 21% over the past month — currently stands at $2.34 billion. On the other hand, the number of Ethereum validators dropped from 564,018 on April 9 to 562,745 at the time of writing.

The market intelligence platform, IntoTheBlock expects a drop in the ETH price as the validators will be allowed to withdraw their funds from the network with the Shanghai upgrade. The amount of staked ethereum, however, is “highly probable” to increase after the EIP-4895.

Per the market analysis platform, the Ethereum network could witness a “25%-30%” rise in staking “within a year, making the Ethereum network more secure and decreasing the amount of ETH supply available to be sold.”

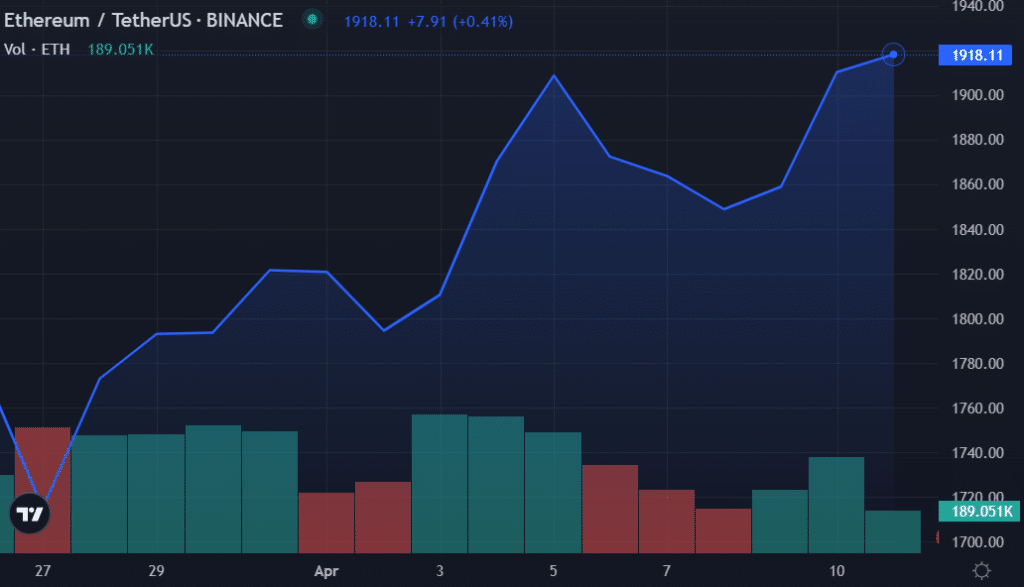

Ethereum is up by 3.2% in the past 24 hours and trading at $1,920 at the time of writing.