Exploring the early CBDC adoption results beyond the hype

Preliminary outcomes from countries where central bank digital currencies (CBDCs) have been introduced show mixed results. Despite widespread exploration and a handful of launched projects, CBDCs are yet to achieve global adoption.

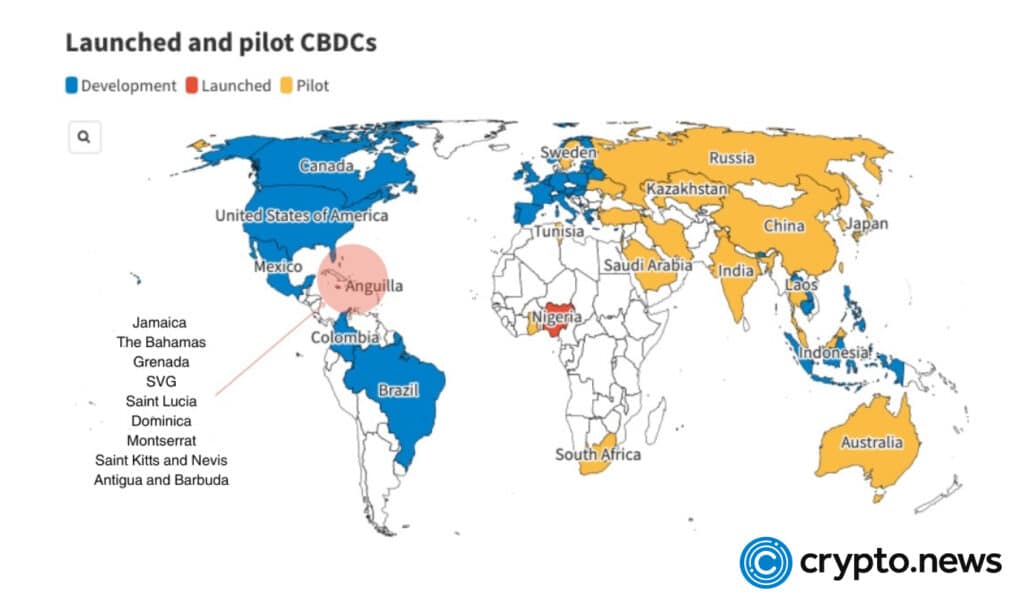

According to an Atlantic Council report, 130 countries and currency unions are exploring CBDCs, with 11 nations having launched their digital currencies.

This rapid pace of exploration is a significant increase from May 2020, when only 35 countries were considering a CBDC. Now, 64 countries are in an advanced exploration phase, including development, pilot, or launch.

The European Central Bank (ECB) is on track to pilot its digital euro, while Australia, Thailand, Russia, and several other nations are continuing their pilot testing. In contrast, the United States’ progress on retail CBDC has somewhat stalled, but it’s forging ahead with wholesale CBDC development.

Yet, the journey has just begun, and there is a broad global consensus on the potential benefits of CBDCs. The International Monetary Fund (IMF) is working on a global CBDC platform to avoid fragmented national propositions and promote financial inclusion and cheaper remittances. The IMF warns that failure to agree on a common platform could lead to a vacuum that cryptocurrencies could fill.

On that note, let’s delve deeper into the world of digital currencies and examine the initial results of how CBDC projects have fared so far.

The Jamaican journey: Jam-Dex and financial inclusion

In the realm of CBDCs, the Caribbean island nation of Jamaica is pioneering a path with its digital currency system, the Jam-Dex.

Launched in July 2022, Jam-Dex has become one of only four retail Central Bank Digital Currencies (CBDCs) worldwide that are fully operational. The primary driving force behind Jamaica’s leap into the CBDC arena was the Bank of Jamaica’s zealous pursuit of financial inclusion.

In the local context, it’s common for Jamaicans – even those with bank accounts – to keep their earnings at home. This behavior can be attributed to the high fees of digital transactions and the stringent requirements for opening an account.

With these issues in mind, Jam-Dex was designed to meet the needs of its users. It simplifies the Know Your Customer (KYC) process and provides features such as conversions at ATMs and fee-free transactions, aiming to attract those without access to traditional banking services.

By promoting financial inclusivity, Jam-Dex can potentially incorporate more Jamaicans into the formal financial ecosystem.

However, as with any new technology, Jam-Dex’s journey was not without obstacles. By February 2023, it could only boast 190,000 customers, and the total transactions for 2022 stood at a meager $357 million—a mere fraction of Jamaica’s $4.7 trillion in electronic retail transactions for that year.

One significant hurdle was the limited merchant adoption, resulting in early Jam-Dex users finding few avenues to spend their digital cash, leading to a somewhat digital dead-end.

Despite the initial teething issues, the Jamaican finance ministry shows no signs of backing down. Instead, they are doubling their commitment to making Jam-Dex a success. They have announced two ambitious incentive programs—the “Small/Micro Merchant Incentive Program” and the “Wallet-holder Individual Loyalty Program.” Both are designed to entice merchants and everyday users onto the digital currency bandwagon.

But hurdles go beyond the technical realm. The historical distrust in government and financial institutions, deeply rooted in Jamaica’s colonial past, poses a significant challenge. To turn the tide, the government aims to address these concerns directly and offer compelling reasons for adoption.

The Bahamas’ sand dollar lessons

The Bahamas launched its “sand dollar” in October 2020. The move was impressive, with PwC even hailing it as the “world’s most mature CBDC.” The Bahamas seemed to be on to something special, leading the global pack in CBDC development.

The sand dollar was designed to tackle a genuine problem: financial exclusion. Quite a few people living in the remote corners of the Bahamian archipelago were cut off from traditional banking services and effectively excluded from the financial system.

The Central Bank knew of this issue and thought they could use this digital currency to bring more people into the financial fold.

According to the report published by The London School of Economics and Political Science (LSE), there was a sense of real optimism when the sand dollar started its initial pilot on Exuma, an island group in the Bahamas. But the actual results from the pilot raised a few eyebrows. Turns out, most people in Exuma already had some kind of bank account.

The problem of financial exclusion wasn’t as urgent as initially thought. Account ownership in Exuma was on par with global levels and only slightly below the Bahamian average. So, the sand dollar’s impact on financial inclusion wasn’t as significant as people had hoped.

Martin C W Walker, director of banking and finance at the Center for Evidence-Based Management and the author of the LSE report told crypto.news:

“The example of the sand dollar means central banks need to work harder to identify real-world problems that CBDCs solve before rolling them out.”

Despite these findings, the sand dollar continued its journey. Some people were still optimistic about it. The Central Bank published a paper claiming a positive correlation between the CBDC and financial inclusion, and the International Monetary Fund (IMF) saw potential in the sand dollar to improve financial inclusion and payment system resilience.

By July 2022, the adoption rate was approximately 7.9%, with over 32,000 wallets created.

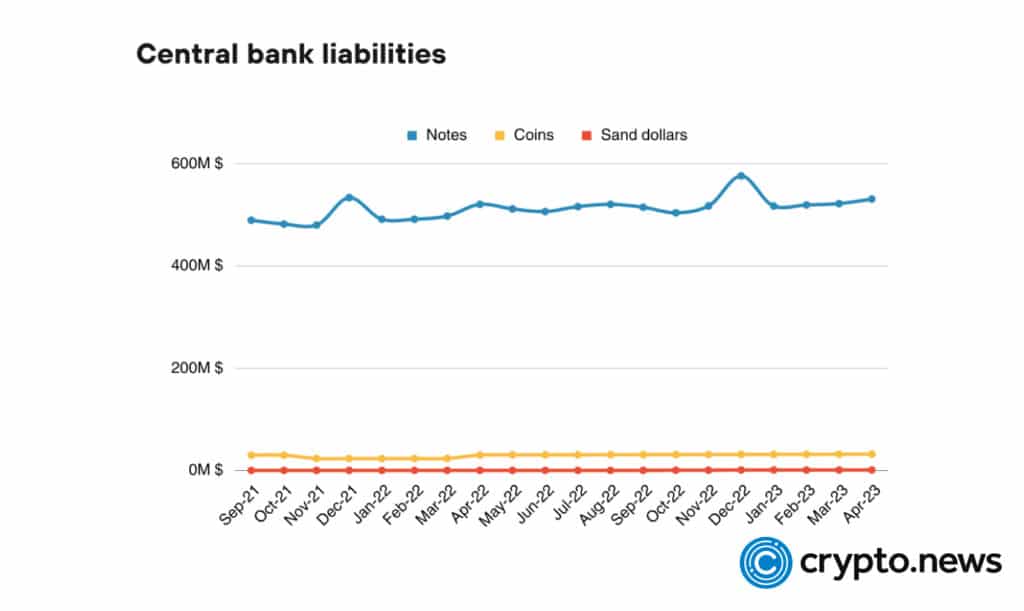

But there’s a catch. The IMF report also noted that the sand dollar accounted for less than 0.1% of currency in circulation and had limited use cases. Let’s take a look at the sand dollar’s circulation data.

By June 2022, only $338,908 worth of sand dollars were circulated. Compare that to over $30 million in coins and almost $506 million in Bahamian-issued bank notes. The per capita usage of sand dollars was a mere 86 cents, way less than $78 in coins and $1,287 in Bahamian notes.

Fast forward to April 2023, the volume of sand dollars in circulation experienced an uptick, totaling $1.1 million. However, this figure was still considerably dwarfed by the $530.7 million in Bahamian notes circulating during the same period.

So, what can we take away from the sand dollar’s experience? Launching a flashy new project without thoroughly assessing alternatives and potential impact is not enough. Otherwise, the results might not live up to the hype.

Nigeria’s eNaira: forced remedy or public choice?

Nigeria has taken a bold step towards a new financial landscape in Africa with its CBDC, the eNaira. As the country is nearing the second anniversary of the eNaira’s launch, let’s see the progress they’ve made.

CBDC came at a critical time when Nigeria was grappling with a severe cash shortage due to the central bank’s decision to replace older banknotes with larger denominations amidst spiraling inflation.

In a country where around 90% of daily transactions were in cash, the value of eNaira transactions shot up 63% by March 2023, totaling 22 billion nairas, which is about $47.7 million.

According to a Bloomberg report, the growth was pretty spectacular, with the number of CBDC wallets booming twelvefold from October 2022 to reach a whopping 13 million.

This dramatic adoption can be linked to several things. One of them is Nigeria’s successful demonetization efforts, which reduced circulating cash from 3.2 trillion nairas to just 1 trillion.

Nigeria minted over 10 billion eNairas to fill this void. Plus, government-led initiatives and social schemes added to the eNaira’s success as it became a preferred method for financial inclusion and executing critical social interventions.

Still, this picture of progress should be viewed in the context of the ongoing challenges.

Nicholas Anthony, a policy analyst in the Cato Institute’s Center for Monetary and Financial Alternatives, told crypto.news:

“The experience in Nigeria should be considered a cautionary tale for other countries looking to create a CBDC. Adoption only increased after the Nigerian government created a cash shortage that led to protests in the streets, and even then adoption remains extremely low.”

He further said, “This experience shows that a CBDC is no panacea for the problems plaguing economies around the world.”

Indeed, Nigeria was facing a financial crisis, and many experts believe adopting eNaira was not entirely by choice. The government caused a cash shortage for its 200 million citizens, which resulted in protests, riots, and unrest. This situation led to an increase in the adoption of eNaira, from 0.5 percent to 6 percent of the population.

Nigeria’s Central Bank governor, Godwin Emefiele, has made it clear that his goal is a 100% cashless economy in Nigeria. But while this may be the government’s choice, it doesn’t necessarily reflect the will of the Nigerian people.

Despite the government’s aggressive push for the eNaira, many Nigerians have resisted. Citizens protested the cash shortage and demanded the restoration of paper money instead of adopting the CBDC. This could indicate that average citizens see CBDCs as potentially threatening their financial freedom without providing unique benefits.

The government tried various tricks to encourage adoption, such as removing access restrictions and offering discounts for using the CBDC for certain services. But these measures largely fell flat.

This is a potent reminder that while CBDCs may be popular among central bankers and policymakers, they must ultimately serve the people. Nicholas Anthony finalized his insight in his conversation with crypto.news saying,

“These examples <Nigeria, Jamaica and The Bahamas> show that so long as the risks outweigh the benefits, it’s unlikely a CBDC will gain traction in other countries as well.”

A key lesson from Nigeria’s experience is that you can’t legislate a change in behavior. Forced adoption can lead to backlash, and genuine change requires addressing the needs and preferences of the people.

CBDC pilots: “Still a long way to go”

China’s digital yuan: struggle and success

China’s venture into the sphere of CBDCs with the digital yuan, or e-CNY, has been marked with both rapid adoption and a series of challenges.

By the end of June 2023, e-CNY transactions reportedly reached 1.8 trillion yuan ($249.33 billion), a notable increase from the 100 billion yuan reported in August 2022.

The e-CNY is still primarily used for domestic retail payments as part of a pilot program, which has led to 16.5 billion yuan in circulation and 120 million wallets opened.

Despite only making up 0.16% of China’s M0 money supply, the digital yuan has begun to play a part in trials for cross-border transactions to improve the efficiency and cost of global financial interactions.

However, the second phase of Hong Kong’s cross-border digital yuan tests has been met with mixed reviews. The rollout has faced several hurdles despite including major banks such as the Bank of China (Hong Kong), HSBC, Hang Seng Bank, and Standard Chartered. The trials have primarily focused on transactions common to restaurants and retail, and there have been instances where cashiers struggled to process transactions using the e-CNY. In some cases, it took significantly longer to process payments, and some customers reported difficulties finding merchants that accept the digital yuan.

While the numbers seem to indicate growth, a closer look reveals a complex reality. As Anthony points out,

“It’s important to recognize that China’s pilot program has been going on for three years now. Although it might sound significant at first glance when China reported that 261 million people set up a CBDC wallet (whether they use it is another question), this figure pales in comparison to the 903 million people that already use mobile payments in China.”

Anthony further cautions, “Many policymakers have cited fears over China “being ahead” with its CBDC, but these observations show that it still has a long way to go.”

In conclusion, while e-CNY’s growth metrics seem impressive, the ground reality reveals a complex mixture of success and struggle.

India’s digital rupee: first results

The Reserve Bank of India (RBI) has been working steadfastly on its CBDC, the digital rupee, garnering impressive milestones and stumbling blocks.

In less than a year since its launch in December 2022, the digital rupee’s retail CBDC reportedly saw user numbers grow to one million by June 2023. This growth, while indicative of a certain level of acceptance and adoption among Indian consumers, doesn’t give the full picture of the digital currency’s journey.

The RBI has ambitions to use the digital rupee for international trade payments, hoping to streamline cross-border transactions. However, the practical application of these goals remains in the exploratory phase.

A partnership with the United Arab Emirates (UAE) for cross-border CBDC transactions has been set in motion to enhance payment efficiencies and reduce costs. Yet, it’s still early to gauge such initiatives’ real-world effectiveness and user reception.

While there’s been notable progress in the wholesale trials of the digital rupee, with experiments extending beyond government bond transactions to include money market funds and short-term lending, these developments are still in the testing phase.

The expansion plans, which involve broadening the currency’s reach to ten more regions and five more banks, may face logistical and regulatory challenges that could slow progress.

On the retail side, despite the RBI’s satisfaction with the results from the trials, the digital rupee’s circulation remains modest, at less than $1 million.

Although the number of users has grown from 50,000 in February 2023 to one million by the end of June, these figures represent a fraction of India’s population of over 1.3 billion people, indicating that the digital rupee is yet to penetrate mainstream use significantly.

While the digital rupee has demonstrated considerable potential to revolutionize the financial landscape, these developments should be contextualized within the broader challenges of digital currency adoption.

Challenges and possibilities lying ahead

The road ahead for CBDCs remains paved with uncertainties, yet it’s clear that these digital currencies are making significant strides in shaping the future of global finance. However, each country’s experience is unique, shaped by specific national circumstances, economic contexts, and public sentiments.

In the coming days and months, we can expect a continued ramping up of pilot programs globally. CBDCs, like the digital euro and others, will likely move from their exploration phase into more tangible, trial-based stages. It will be vital to observe how these currencies navigate the transition and the lessons they learn in the process.

The push from the IMF for a global CBDC platform indicates an attempt to streamline the process and avoid potential pitfalls. Yet, the question remains whether global consensus can be reached or if we will see the rise of incompatible national digital currencies.

It is also important to remember that adoption and trust don’t automatically come with introducing CBDCs. As seen in Nigeria and Jamaica, cultural factors, trust issues, and resistance to change play a significant role in adopting such technologies.

The road ahead will likely be characterized by significant experimentation and evolution, with countries learning from one another’s successes and failures. The quest to successfully integrate CBDCs into our financial systems might continue, driven by their potential benefits. However, the journey might be marked by challenges testing the digital currencies’ robustness, security, and acceptance.