Fed inflation doubts leave crypto markets flat

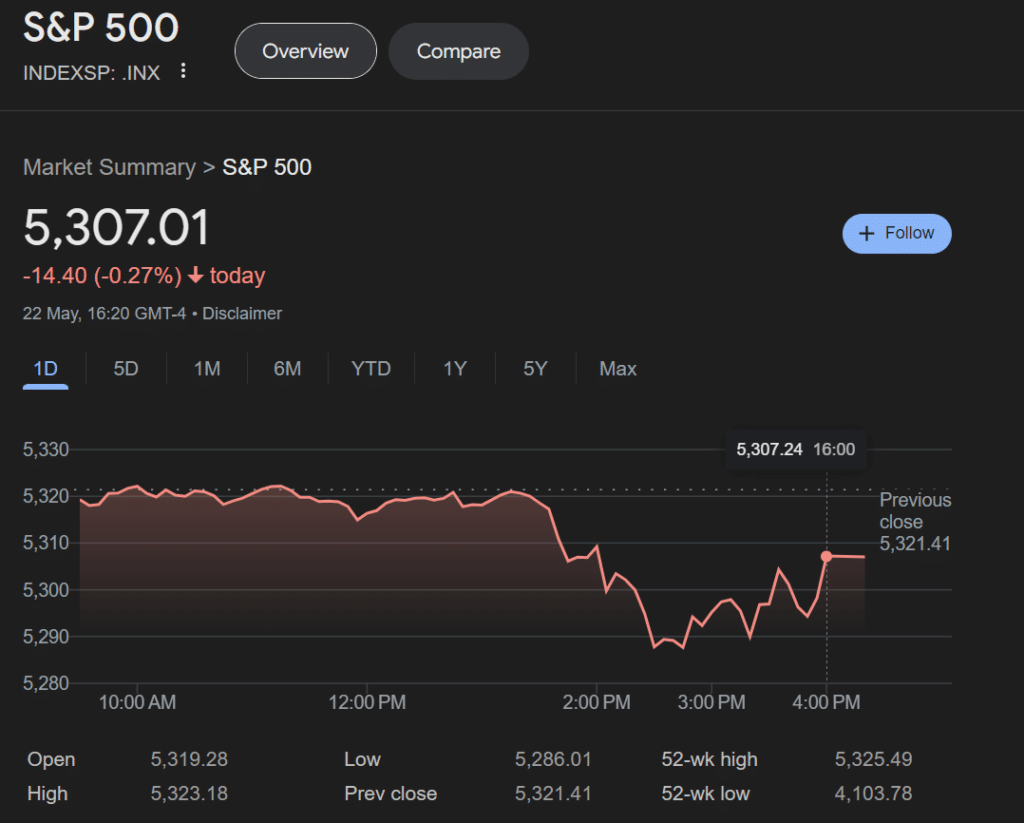

While crypto prices stayed relatively flat after the FOMC minutes, U.S. stocks traded downwards on the slim likelihood of hawkish decisions due to inflation concerns.

Despite positive consumer price index (CPI) reports from April, Federal Reserve officials remain skeptical that progress in beating inflation justifies cutting interest rates.

According to the latest Federal Open Market Committee (FOMC) Minutes, price levels have allowed this year’s inflation rates to remain substantially above the Fed’s 2% target.

Although some stakeholders at the policy meeting indicated consideration for rate hikes, officials like Chair Jerome Powell hinted against tightening economic policies. Federal Reserve Governor Christopher Waller previously said the central bank would require consecutive months of positive inflation data to adopt a dovish approach and ease interest rates.

Following the FOMC’s decision to maintain a 5.25%-5.5% short-term lending rate, U.S. stocks declined slightly. The S&P 500 traded around 0.27% down per Google Finance.

However, deVere Group CEO Nigel Green expects the Fed’s outlook to have less impact on investor sentiment in the coming months. “We expect the markets’ bull run which has taken Wall Street’s major indexes to fresh highs in recent weeks to continue”, Green said in a note obtained by crypto.news that a strong earnings season, recovery in China and Europe, as well as expected rate cuts should the U.S. economy achieve a soft-landing.

Flat crypto market not indicative of Bitcoin hedge status

Bitcoin (BTC) as a hedge against inflation has long since served as a rallying cry for the broader cryptocurrency community. The analytics back an argument for the so-called digital gold too.

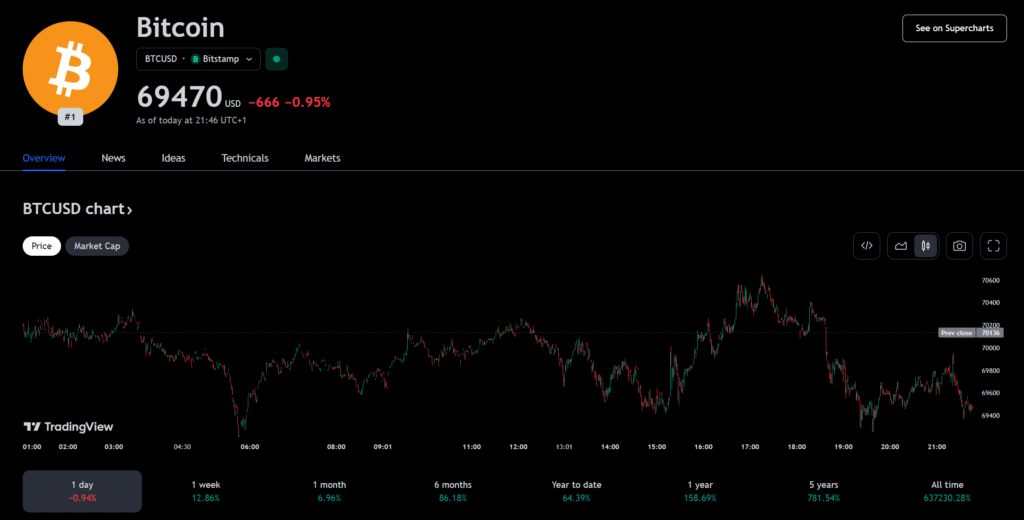

Year-to-date, crypto’s biggest token is up around 65%. The asset has witnessed increased demand with the introduction of spot Bitcoin ETFs, and analysts posit that the halving has initiated a supply shock.

In comparison, the S&P 500 is up 11.9% in a bull cycle for U.S. equities. Stretch the timeframe back five years and observers will note an even larger growth gap. Where Bitcoin has increased 781.3 percent since 2019, the S&P 500 has only managed 87.7% in that time.

Bitcoin may have spent its first 15 years largely outside the U.S. financial market, but the cryptocurrency has established its inflation hedge status for years on the bounce. So much so that Wall Street titans like MicroStrategy and BlackRock have forayed into the scene.