Fed’s rate hike causes ripples, but crypto market stands firm

Despite the Federal Reserve’s decision to raise interest rates, the crypto market remains resilient, showing signs of decoupling from traditional financial markets.

The Federal Reserve announced a 25 basis points hike on May 3 in response to rising inflation, sending shockwaves across various financial markets.

However, the crypto market has remained resilient, registering a 1.73% increase in the last 24 hours and reaching a market cap of $1.20 trillion.

This resilience has raised questions about the future direction of the crypto market and its potential to further decouple from traditional financial markets.

Decoupling from traditional markets

In a stunning move during its May meeting, the Fed opted for a quarter percentage point increase in the federal funds rate, settling within the 5%-5.25% range.

This decision marks the tenth such hike, catapulting borrowing costs to their peak since September 2007.

Interestingly, the cryptocurrency market has shown signs of progressive decoupling from traditional equities. On May 3, US indices closed in the red, with the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all recording losses.

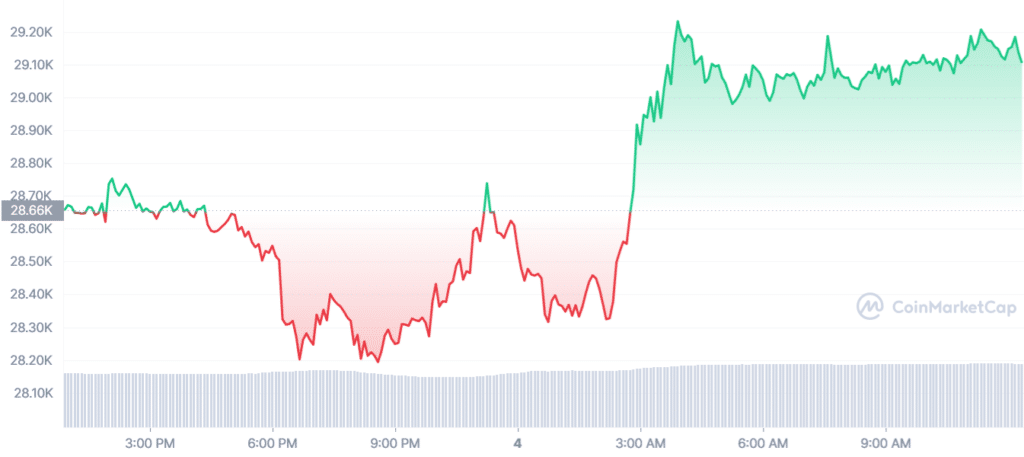

In stark contrast, the cryptocurrency sector remained unyielding. Bitcoin (BTC) gained over 1.5%, reaching a trading value of $29,085 on May 4.

Throughout the week, bitcoin has reclaimed significant territory as investors keep a close watch on the potential for a breakthrough beyond the crucial $30,000 resistance level.

Furthermore, BTC and the broader cryptocurrency market have demonstrated increased immunity to the ongoing US banking crisis, raising questions about their ability to maintain price performance amid looming macroeconomic uncertainties.

In related news, on-chain analytics firm Santiment has reported a notable increase in trading volume activity following the rate hike announcement, suggesting a positive market reaction to this development.

What to expect next?

The Federal Open Market Committee (FOMC) recognized that tightening credit conditions would likely exert pressure on economic activity, employment, and inflation.

In light of these factors, Fed Chair Jerome Powell emphasized the necessity to continually assess further policy tightening. He cautioned that uncertainties surrounding credit conditions might result in a mild recession.

Following Powell’s statement asserting the strength of the American financial system, several US stocks plummeted, exposing significant inadequacies in the current economic milieu of the United States.

Meanwhile, in an ever-changing financial landscape, crypto investors continue to display confidence in the long-term potential of digital assets, even as they navigate the uncertainties of a shifting macroeconomic environment.

Market participants should closely monitor the Fed’s regulatory announcements and other central banks’ policies.

Understanding the interplay between global economic trends amid these turbulent times can help investors make informed decisions and capitalize on the opportunities a decoupling financial landscape presents.