Fidelity’s FBTC lead $71.73m Bitcoin ETF outflows, Ether ETFs also slide

Spot Bitcoin exchange-traded funds in the United States experienced their third consecutive day of net outflows, while spot Ethereum ETFs also saw a return to negative flows.

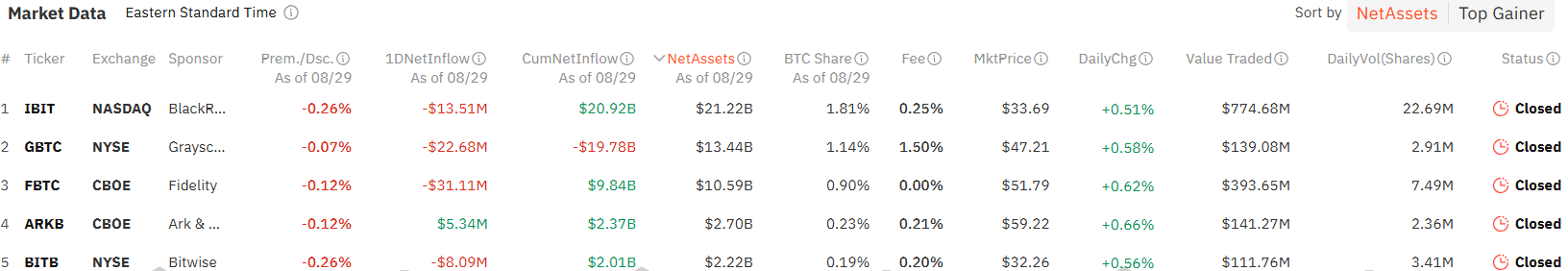

According to data from SoSoValue, the 12 spot bitcoin exchange-traded funds recorded $71.73 million in net outflows on Aug. 29, marking the third consecutive day of outflows.

FIdelity’s FBTC led the lot, logging $31.1 million in outflows on the day — its highest recorded outflows since Aug. 6. Grayscale’s GBTC continued its outflow streak, with $22.7 million leaving the fund, pushing its total outflows to date to $19.78 billion.

BlackRock’s IBIT, the largest spot Bitcoin ETF by net assets, recorded its first net outflows since May 1, amounting to $13.5 million. Despite this, the fund’s total net inflows remain at $20.91 billion.

Other funds, such as Bitwise’s BITB and Valkyrie’s BRRR, saw outflows of $8.1 million and $1.7 million, respectively. Ark and 21Shares’ ARKB was the only spot Bitcoin ETF to report net inflows, bringing in $5.3 million.

The total daily trading volume for the 12 spot Bitcoin ETFs dropped to $1.64 billion on Aug. 29, down from $2.18 billion the previous day. At the time of writing, Bitcoin (BTC) was down 0.4% over the past day, trading at $59,342 per data from crypto.news.

Meanwhile, the spot Ethereum ETFs in the U.S. returned to negative flows, recording $1.77 million in net outflows on Aug. 29, following modest inflows of $5.84 million the day before.

Grayscale’s ETHE was the only spot Ethereum ETF to report outflows, losing $5.3 million, which was partially offset by $3.6 million in net inflows into the Grayscale Ethereum Mini Trust. The remaining seven spot Ether ETFs saw no activity on that day.

The total trading volume for the nine ETH ETFs fell to $95.91 million on Aug. 29 from $151.57 million on Aug. 28. At the time of publication, Ethereum (ETH) was also up 0.9%, exchanging hands at $2,529.