Flipping Uniswap, Flopping on Price: PancakeSwap Paradox

Despite a steep drop in the price of its native token, PancakeSwap is quietly dominating the decentralized exchange (DEX) landscape.

The Binance-backed platform has leapfrogged rivals like Uniswap (UNI) and Raydium (RAY), processing over $116 billion in monthly volume and racking up millions in fees and revenue. But even as the DEX sees explosive growth in usage, CAKE — its governance and utility token — has slipped from a late-May high of $2.95 to around $2.30, raising questions about whether market sentiment is out of sync with protocol fundamentals.

This retreat brought its market valuation to about $745 million.

Still, DeFi Llama data shows that PancakeSwap is now the biggest player in the decentralized exchange or DEX industry.

The platform handled over $4.16 billion worth of volume in the last 24 hours, higher than Uniswap’s $1.6 billion and Raydium’s $529 million. It handled $116 billion in the last 30 days, while the two processed transactions worth $95 billion and $27 billion, respectively.

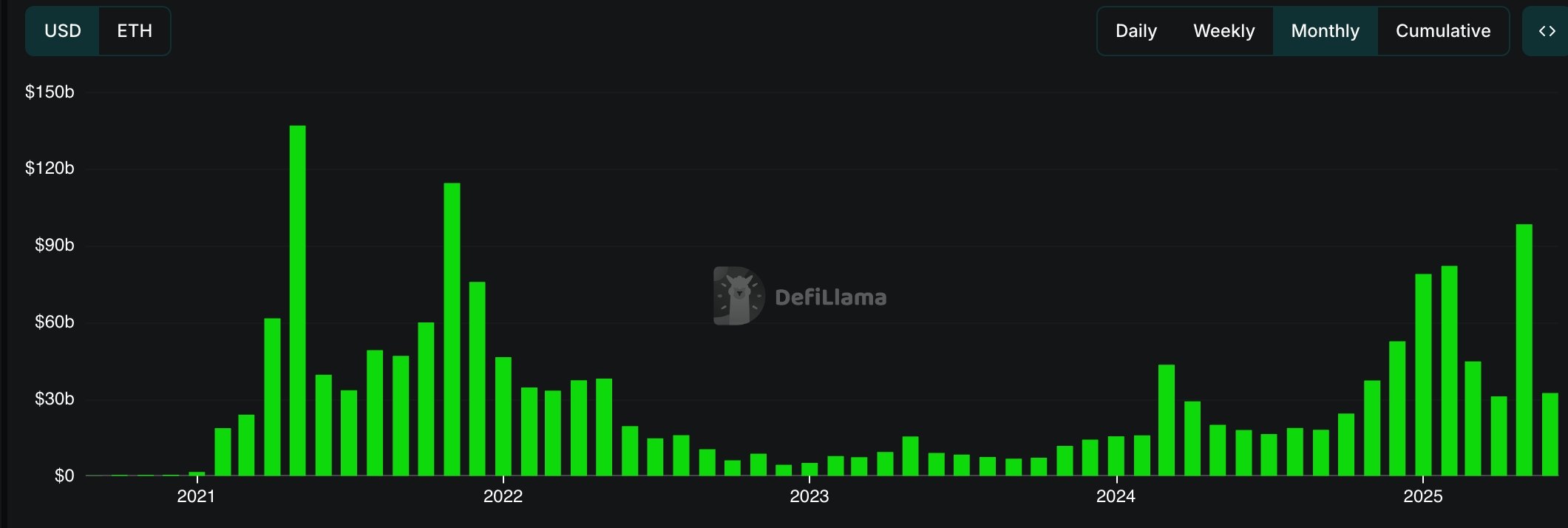

While PancakeSwap has always been a big player in the DEX industry, its growth surged in May. As the chart below shows, its monthly volume jumped to over $98 billion in May from $31 billion a month earlier.

This growth led to a big increase in fees and revenue. Its monthly fees rose to $131 million in May from $57 million a month earlier. Its revenue rose to $32 million from $14 million. More metrics on active CAKE addresses and staking have also jumped.

CAKE price analysis

CAKE has remained above the ascending trendline that connects the lowest levels since May 11. It also remains above the 50-day and 100-day moving averages.

The risk, however, is that the token has formed a small head and shoulders pattern. This pattern comprises a head, left and right shoulders, and a neckline, where it is today.

Therefore, a break below these support levels will point to more downside, with the next point to watch being at $2. That implies a 13% drop below the current level.