Florida joins Bitcoin reserve race with first committee approval of HB 487

Florida has taken its first legislative step toward embracing Bitcoin as a state-held asset, joining the race led by Arizona and closely followed by New Hampshire.

Florida is the latest U.S. state to make strides toward adopting Bitcoin (BTC) as a strategic reserve asset, as its House Bill 487 (HB 487) passed through the House Insurance and Banking Subcommittee with unanimous support on April 10 hearing.

The bill, titled “Investments of Public Funds in Bitcoin,” proposes allowing Florida’s Chief Financial Officer and State Board of Administration to invest up to 10% of key public funds — including the General Revenue Fund and Budget Stabilization Fund — into Bitcoin. It outlines strict custody, security, and compliance protocols, and also enables Bitcoin held by the state to be loaned out or used in exchange-traded products.

Having cleared the first of four committees, HB 487 must still pass through the Government Operations Subcommittee, the Ways & Means Committee, and the Commerce Committee before heading to the full House for a vote. If passed by the House, the bill will move to the Senate for consideration and, ultimately, the governor’s desk.

Florida’s push comes amid a wider trend across U.S. states exploring Bitcoin as a sovereign asset class.

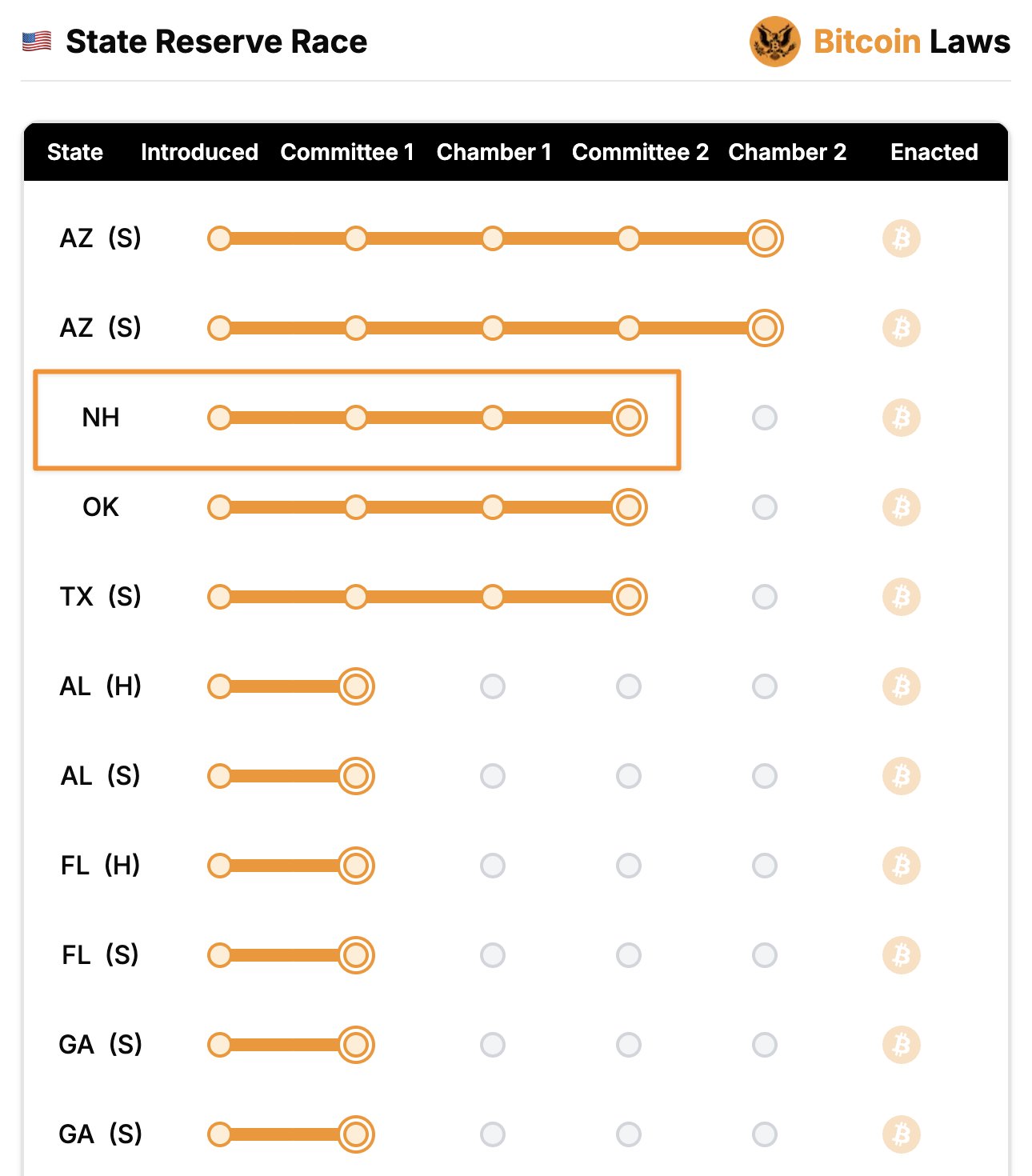

According to Bitcoin Laws, Arizona appears to be leading the legislative race. As of late March, its Senate Bills 1373 and 1025 — both related to digital asset reserves — have passed through the Senate and cleared the House Rules Committee. These bills are now headed for a full House vote. If successful, they would only require Governor Katie Hobbs’ signature to become law, making Arizona the first state to officially adopt a Bitcoin reserve policy.

Meanwhile, New Hampshire has also advanced its Bitcoin reserve bill (HB 302), which passed the full House in a 192-179 vote and is now under Senate review. The bill would allow the state treasurer to allocate up to 10% of authorized funds into Bitcoin and precious metals, but only assets with a market cap exceeding $500 billion — a threshold currently met only by Bitcoin — would qualify.