Flow records strongest quarter yet with DeFi growth: Messari report

Flow’s DeFi ecosystem is growing fast, with DeFi TVL up 46% quarterly to $68 million.

- Flow’s DeFi TVL rose 46% to $68 million in the last quarter, best performance yet

- The chain is shifting its strategy to stablecoins, liquid staking, and DeFi.

- PayPal’s PYUSD supply on Flow rose 212% QoQ to $26.2 million

Once dismissed as an NFT chain whose time had passed, Flow (FLOW) is slowly making a comeback. On Thursday, August 21, Messari released a report on the state of the Flow ecosystem in the second quarter of 2025. The report reveals a 46% jump in TVL to $68 million, making it the best-performing quarter to date.

The growth is coming less from collectibles and more from stablecoins, liquid staking, and DeFi. Notably, Flow has seen significant interest in stablecoins, with PayPal’s PYUSD supply rising 211.9% QoQ to $26.2 million. This made PYUSD the biggest stablecoin on the network.

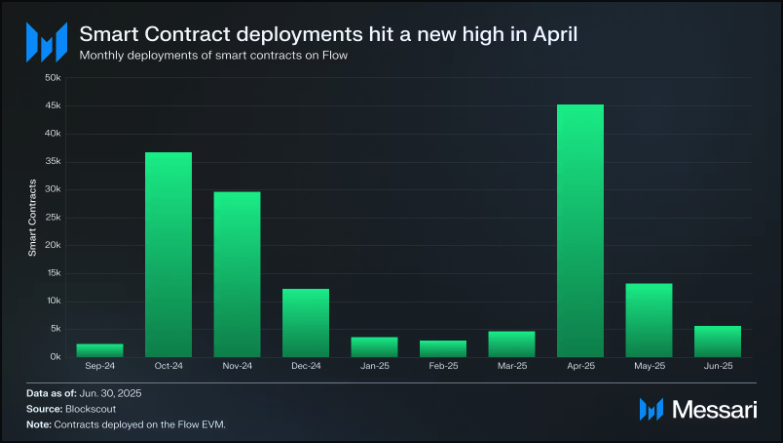

At the same time, developer activity saw a boom, with a 473% QoQ jump in smart contract deployments. April was the most active month for contract deployments, with deployments reaching 45,239. What’s more, user interest grew even further, with average daily transactions on Flow up 602% to 40.1k, following the LayerZero integration.

Flow pivots from early NFT strategy

Rising activity shows that Flow has successfully pivoted from its early NFT focus. Launched by Dapper Labs in 2020, the creators of Ethereum-based (ETH) CryptoKitties NFTs, Flow has seen a significant transformation. At its inception, it was a response to the congestion that CryptoKitties created on Ethereum. Flow was supposed to be a layer-1 chain that could handle mass consumer dApps.

At the time, it rode the early NFT wave, securing partnerships with giants such as Disney, the NFL, and the NBA. However, the decline in interest in digital collectibles led Flow to shift its strategy, with a greater focus on DeFi.