FOMC dot plot sparks $600m in crypto investment outflows

Crypto investment product AUM plunged late last week following a hawkish FOMC meeting and short-term macroeconomic outlook.

CoinShares highlighted a $600 million net outflow from crypto vehicles like U.S. Bitcoin (BTC) ETFs as the Federal Open Market Committee (FOMC) meeting shook investor confidence in risk assets.

Trading volumes declined from their weekly average of $22 billion to $11 billion last week. The drops culminated in the biggest outgoing capital stream in over three months, and broke a 20-day inflow streak for spot BTC ETFs on Wall Street.

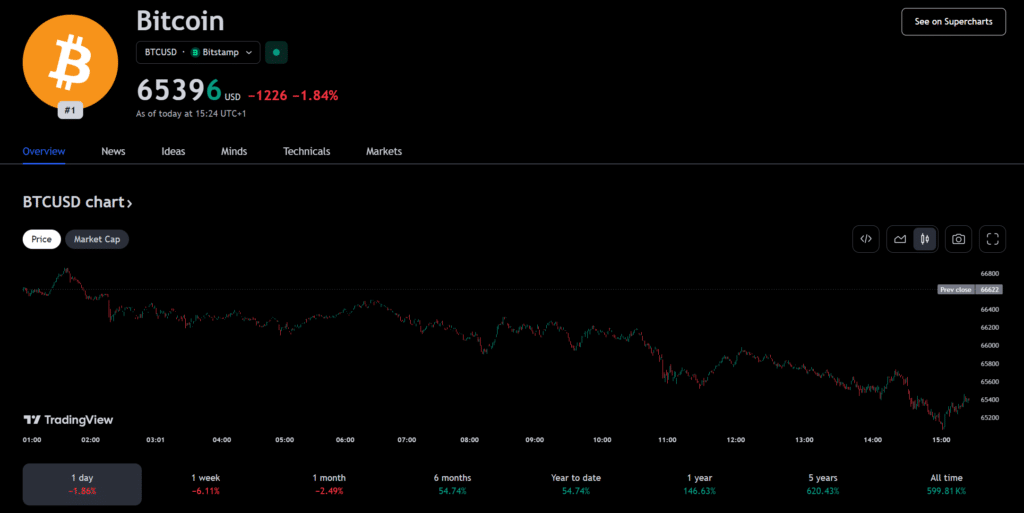

Bitcoin was especially rocked by macroeconomic factors and FOMC data. Digital investment products underpinned by the leading blockchain coin marked the largest outflows in the market, as Bitcoin itself lost over 6% over the weekly timeframe per TradingView.

At press time, BTC changed hands under $65,500. The token had previously rallied toward $70,000 early last week. Conversely, altcoins showed an opposite pattern to Bitcoin and BTC products, drawing in capital. Ethereum (ETH) reportedly led the charge with $13 million in inflows.

Crypto markets lull despite cooling inflation

Last week, the FOMC decided to sustain its funding rates within a 5.25% to 5.50% range. While the Fed’s dot plot suggests a single interest cut this year, monthly and annual inflation data indicated an improved market environment.

As crypto news reported, the U.S. Consumer Price Index (CPI) was flat last month, and year-on-year numbers fell to 3.4% from 3.6% in April. The levels remain shy of the Fed’s 2% target. Still, cooling inflation data could serve as a boon for risk assets like cryptocurrencies and incentive capital deployments leading up to a rate cut widely anticipated by September.