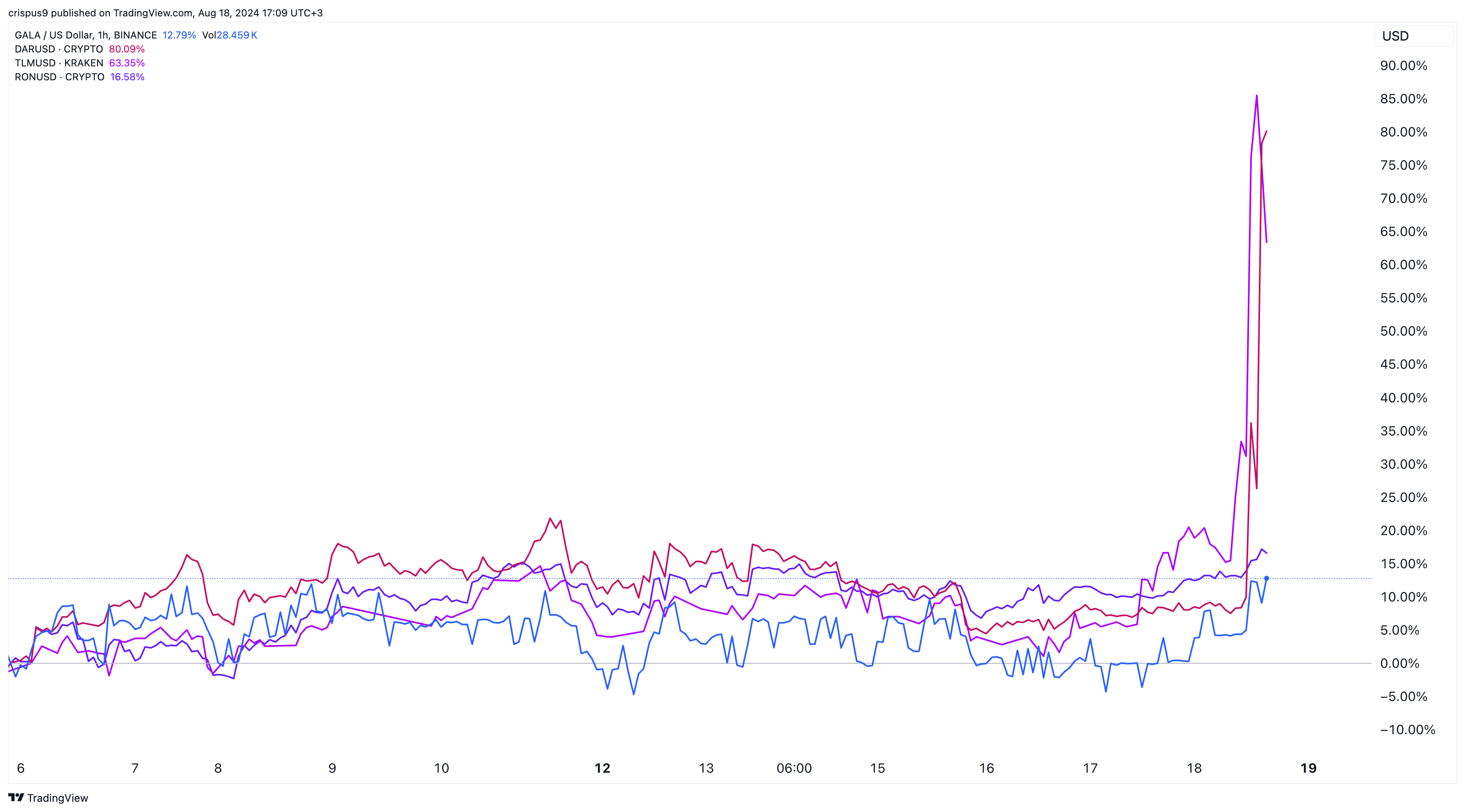

GameFi tokens surge: Alien Worlds, Mines of Dalarnia, Gala lead

GameFi tokens were the best performers on Sunday as Bitcoin recaptured the important resistance point at $60,000 for the first time since Aug. 14.

Bitcoin (BTC) recovery triggered gains in the crypto industry, with the total market capitalization of all coins rising by 0.8% to $2.2 trillion.

A closer look at the top gainers showed that gaming tokens were the best-performing coins on Aug. 18. Mines of Dalarnia (DAR) token formed a god candle as it jumped to a high of $0.218 — 115% above its lowest level this month. Its surge brought its market cap to over $120 million.

Its rally happened in a high-volume environment. Data by CoinMarketCap shows that the 24-hour volume rose by over 3,740% to over $398 million. Most of its volume was from Bitrue followed by Binance. Mines of Dalarnia was also one of the most trending tokens in StockTwits.

Meanwhile, Alien Worlds (TLM), another gaming token rose by 70% to $0.014, giving it a valuation of over $62 million. It has risen by over 120% from this month’s low.

Gala (GALA) token also rose for the second consecutive day and reached its highest level since Aug. 4. Ronin (RON) rose by over 5% to $1.63.

According to CoinGecko, the total 24-hour volume of all GameFi tokens rose to over $2 billion while the market capitalization jumped to $13 billion.

GameFi challenges remain

Despite the weekend surge, most gaming tokens have dropped sharply from their all-time high as demand for the sector wanes.

Axie Infinity, once touting a market cap of over $9 billion, has dropped to a valuation of just $715 million. Other tokens like Decentraland, Sandbox, and Gala have shed billions in valuation in the past few years.

A key concern among users is the volatility of the reward tokens. For example, Smooth Love Potion (SLP), which is used to reward Axie Infinity players, has dropped from $0.3335 in 2021 to $0.029, a 99% drop.

Tap-to-earn Telegram mini applications — Hamster Kombat, Notcoin, and TapSwap — are accumulating millions of users, further disrupting the industry.