GBTC ETF outflows hit record low as market anticipates BTC halving

The Grayscale Bitcoin Trust (GBTC), an exchange-traded fund, has experienced a significant drop in outflows, reaching a record low that was nearly 90% lower than the previous day.

The latest shift occurred simultaneously with Bitcoin’s price rebound after the latest United States inflation data was released, which introduced volatility into the market.

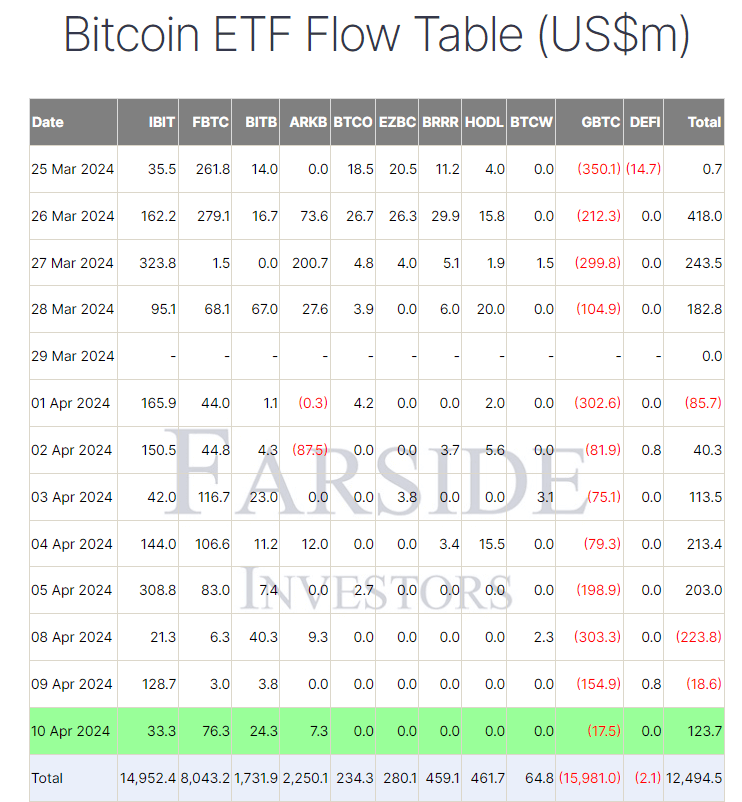

On April 10, GBTC experienced outflows amounting to $17.5 million, a stark contrast to the $154.9 million recorded on April 9, based on data from Farside.

The price of Bitcoin has seen a 2.08% increase over the last 24 hours, now valued at $70,542, according to CoinMarketCap. This rise followed a dip to local lows of $67,482 after the March U.S. Consumer Price Index (CPI) report indicated a higher-than-anticipated 3.5% year-on-year increase. This development raised concerns that the U.S. Federal Reserve might postpone interest rate cuts further.

Crypto industry observers have expressed optimism that the slowdown in GBTC outflows, which have totaled $16 billion since the fund transitioned to a spot Bitcoin ETF in January, may be beginning.

Thomas Fahrer, CEO of the crypto-focused reviews portal Apollo, queried his 41,500 X followers on April 11 if “GBTC selling [is] over?” He noted that the outflows on April 10 were about equivalent to 250 Bitcoin, nearly a 95% drop from the beginning of the week.

On April 8, just days prior, Grayscale saw outflows of 4,288 Bitcoin, totaling $303 million.

The lowest previous outflow was on Feb. 26, amounting to $22.4 million, with the average daily outflow over four months being $257.8 million.|

Among BTC ETFs, which include BlackRock IBIT, Fidelity FBTC, ARK’s ARKB, and Bitwise BITB, only these registered positive inflows on April 10, according to Farside data.

FBTC led with an inflow of $76.3 million, its largest since April 5, bringing its total inflows to $8,043.2 billion. The collective net inflows into Bitcoin ETFs now stand at $12,494.5 billion.

The upcoming Bitcoin halving, expected around April 20, is another focal point for the market. The event will halve the Bitcoin block issuance rate from 6.25 coins per block to 3.125.

Halvings, which occur every four years, have historically led to a surge in Bitcoin’s price due to the reduced supply growth.

With the current enthusiasm around spot Bitcoin ETFs, the market anticipates even greater demand, potentially intensifying the rally.

In a Bloomberg interview on April 9, Fred Thiel, CEO of Bitcoin mining firm Marathon Digital, suggested that recent spot Bitcoin ETF approvals have brought substantial capital into the market, thereby accelerating the market’s appreciation, which was typically anticipated after the halving of Bitcoin.

Bitcoin’s price has seen a more than 60% increase in the months leading to the halving, with experts indicating a continued bullish market driven mainly by growing demand rather than the halving’s supply cut.

“The past halvings have brought remarkable supply shock, but this year’s event will be different. This is because we’ve never had both a supply shock and a demand shock at the same time. And the catalyst is undoubtedly ETFs – single-day inflows into spot BTC ETFs have already topped $1 billion, “Andras Kristof, CEO and co-founder of Galaxis, told Crypto.news.

He went on to suggest that if demand for the new ETFs is as great as it is now, it will just add to the daily buying pressure. Against the backdrop of reducing supply, this could result in a significant spike in bitcoin price and volatility.

“While the price of Bitcoin has more than doubled over the past year, there is steam left in the rally. The halving effect will very likely pull institutional investors in from the sidelines as they succumb to the fear of missing out.”