Gemini: Global crypto ownership steady as sell-off slows down

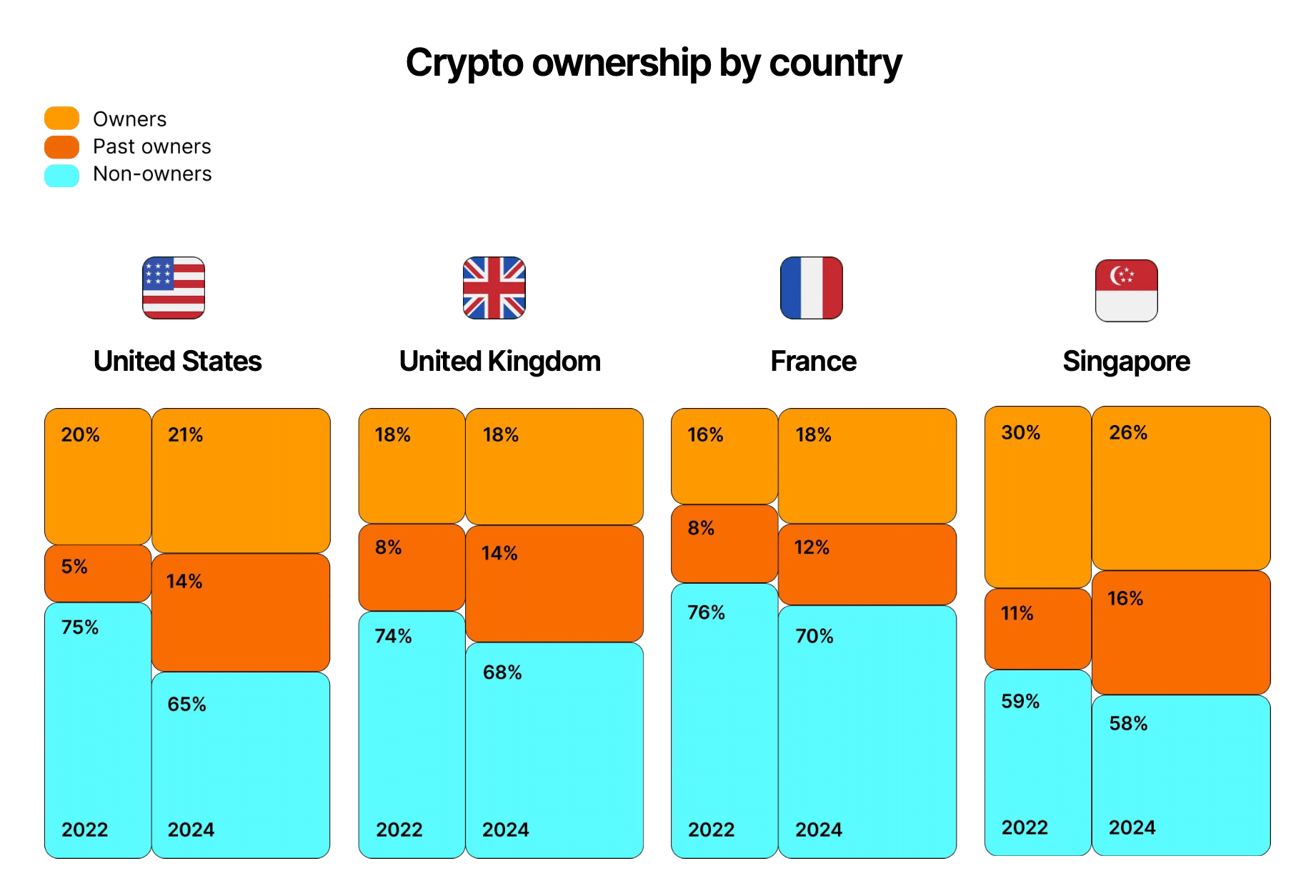

Gemini’s 2024 Global State of Crypto, released on Sept. 10, reveals that despite recent market challenges, crypto ownership has remained consistent in key regions like the U.S., U.K., France, and Singapore.

In the report shared with crypto.news, Gemini researchers highlighted the consistency of global crypto owners despite the turbulence that has rocked the industry in recent years – specifically from 2022 to 2024.

During these years, the U.S. and U.K. maintained stable ownership rates of 21% and 18%, respectively. France saw a modest increase in crypto ownership from 16% to 18%, while Singapore experienced a slight decline from 30% to 26%, according to the report.

This resilience is largely attributed to the long-term investment mindset of crypto holders, with 65% of owners in these regions reporting that they buy and hold cryptocurrency for its potential to appreciate over time.

Additionally, 38% of these investors view crypto as a hedge against inflation, reflecting its role as a strategic asset in portfolios.

Crypto selling has slowed in recent months

The report highlighted a significant slowdown in selling activity among crypto investors over the past six months. While the number of past crypto owners has increased in recent years, the majority (75%) exited the market more than six months ago, primarily due to price volatility.

However, as the market has shown signs of recovery, fewer investors have sold their holdings in the last half-year compared to those who sold more than a year ago. Only 29% of investors who sold their crypto did so after experiencing losses.

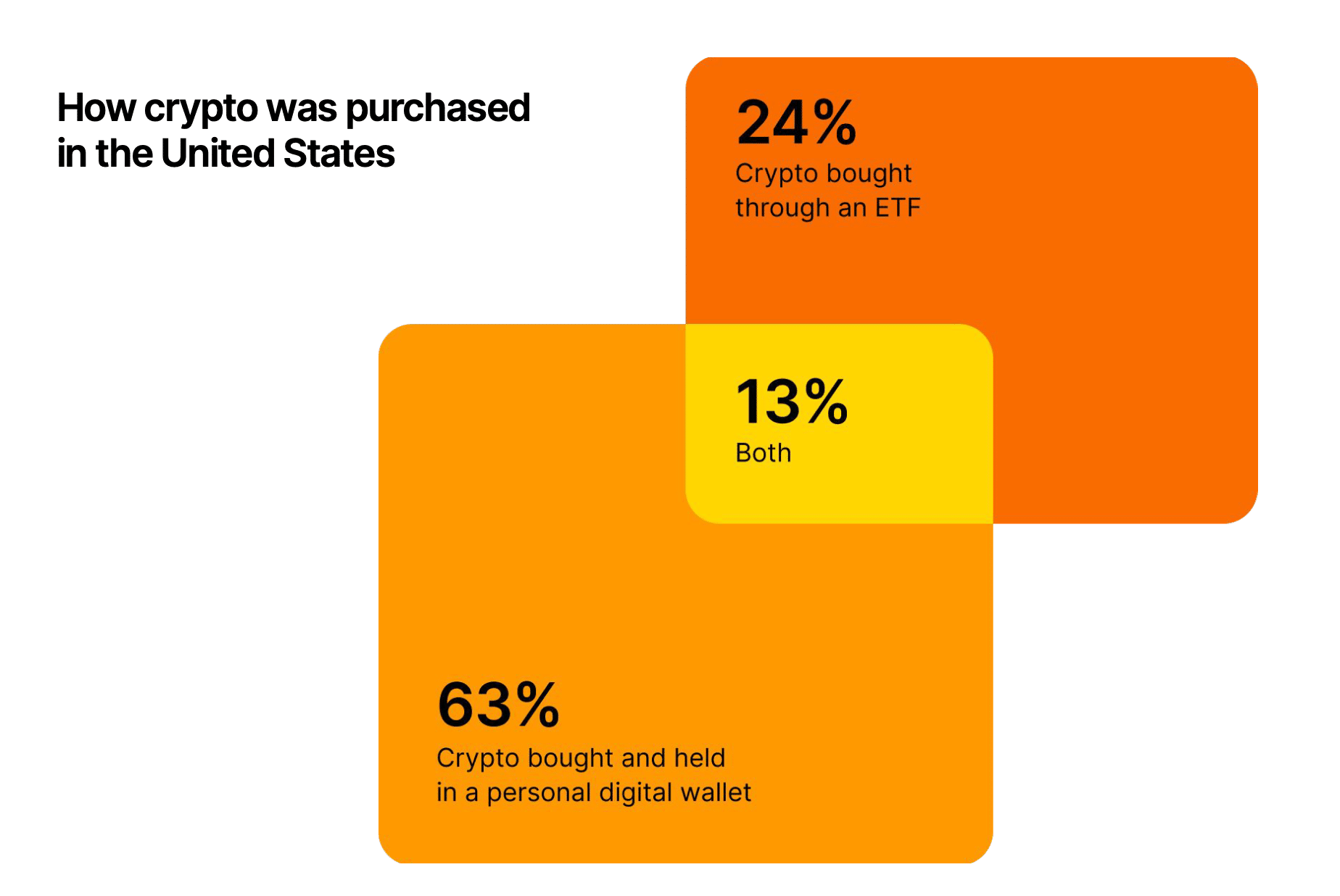

Spot crypto ETFs are bringing new owners to crypto in the United States

Gemini’s report found that nearly 37% of U.S. crypto owners now hold some assets through ETFs, and 13% entered the market exclusively through these financial products.

In early July, spot Ethereum (ETH) ETFs began trading, bringing mainstream acceptance of other cryptos beyond Bitcoin (BTC).

Regulatory concerns and gender disparities

In the U.S. and U.K., nearly 38% of non-owners cited regulatory concerns as a reason for not investing in crypto. This sentiment was even stronger in Singapore, where 49% of respondents expressed similar reservations.

The report also shed light on the persistent gender gap in crypto ownership. While men continue to dominate the space — with 69% of crypto owners identifying as male compared to 31% female — women who do invest are just as likely to HODL or hold onto their assets long-term as their male counterparts.

This statistic suggests that once women enter the market, their investment behaviors align with the overall trend of long-term holding.

Past crypto owners are likely to return to crypto

After exiting the crypto market during the decline, former crypto holders remain optimistic about digital assets and are indicating their readiness to re-enter the market.

Over 70% of previous owners have expressed their intention to purchase cryptocurrency within the upcoming year. Specifically, 77% of previous crypto owners in the United States said they are at least somewhat likely to buy crypto in the next year, according to the report.

Crypto is booming in Turkey

.The 2024 State of Crypto study included Turkey for the first time this year. The majority of respondents (58%) in Turkey reported owning crypto, and an even larger majority (65%) said they were likely to purchase crypto in the next year, per the report.

Additionally, Turkish crypto owners were significantly more likely to actively trade crypto (62%) compared to owners in other surveyed countries (43%).