Analysts reveal bullish case for Bitcoin as global liquidity rises

The stage looks set for Bitcoin to surpass its previous all-time high, fueled by a surge in global liquidity, several macroeconomic analysts argue.

In recent weeks, the global macro financial outlook has been showing signs of a shift. Over the weekend, Goldman Sachs economists announced that they had lowered their estimations of the probability of a U.S. recession in 2025 from 25% to 20%.

This change came after the latest U.S. retail sales and jobless claims data were released, which suggested that the U.S. economy might be in better shape than many had feared.

The Goldman Sachs analysts added that if the upcoming August jobs report — set for release on Sept. 6 — continues this trend, the likelihood of a recession could drop back to their previously held marker of 15%.

The possibility of such a development has sparked confidence that the U.S. Federal Reserve might soon cut interest rates in September, possibly by 25 basis points.

The potential rate cuts have already begun to impact the markets, with U.S. stock indices, including the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average, recording their largest weekly percentage gains of the year for the week ending on Aug. 16.

Alongside this relatively positive news for the U.S. economy, global liquidity has begun to rise. Historically, increasing liquidity and easing recession fears have often been catalysts for bullish trends in the crypto space.

So, let’s take a closer look at what’s happening globally and how these macroeconomic shifts could impact Bitcoin (BTC) and the entire crypto market in the coming weeks and months ahead.

Liquidity surge across global markets

To understand where BTC might be headed, we need to delve into the mechanisms behind the current liquidity surge and how it could impact the broader markets.

The U.S. liquidity flood

In the U.S., the Treasury appears poised to inject a massive amount of liquidity into the financial system. BitMEX cofounder and well-known crypto industry figure Arthur Hayes stated in a recent Medium post that this liquidity boost could push Bitcoin past its previous all-time high of $73,700. But why now?

One possible explanation is the upcoming presidential elections. Maintaining a strong economy is crucial, and this liquidity injection could be a way to ensure favorable conditions as the election approaches.

But how exactly is this liquidity going to be injected? The U.S. Treasury and the Fed have several powerful tools at their disposal, as Hayes lays out in his analysis.

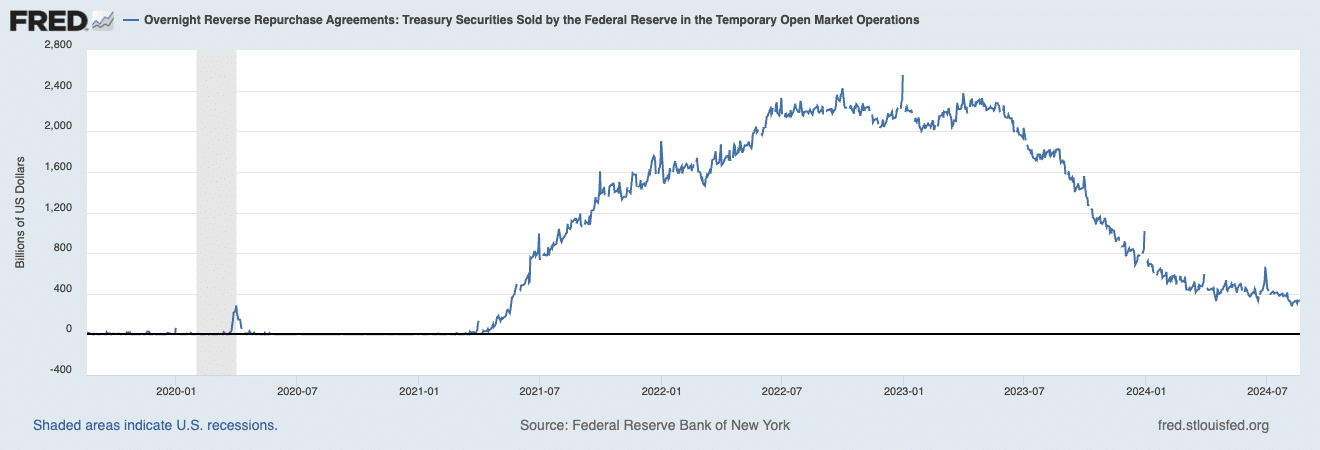

First, there’s the overnight reverse repurchase agreement mechanism, or RRP, the balance of which currently stands at $333 billion as of Aug. 19, down significantly from a peak of over $2.5 trillion in December 2022.

Hayes explains that the RRP should be looked at as a major pool of “sterilized money” on the Fed’s balance sheet that the Treasury is evidently looking to get “into the real economy” — aka add liquidity. The RRP represents the amount of Treasury securities that the Fed has sold with an agreement to repurchase them in the future. In this process, the buying institutions — namely money market funds — earn interest on their cash overnight.

As Hayes points out, the drop in overnight RRP over the past year indicates that money market funds are moving their cash into short-term T-bills instead of the RRP, as T-bills earn slightly more interest. As Hayes notes, T-bills “can be leveraged in the wild and will generate credit and asset price growth.” In other words, money is leaving the Fed’s balance sheet, adding liquidity to the markets.

The Treasury also recently announced plans to issue another $271 billion worth of T-bills before the end of December, Hayes noted.

But that’s not all. The Treasury could also tap into its general account, the TGA, which is essentially the government’s checking account. This account holds a staggering $750 billion, which could be unleashed into the market under the guise of avoiding a government shutdown or other fiscal needs. The TGA can be used to fund the purchase of non-T-bill debt. As Hayes explains: “If the Treasury increases the supply of T-bills and reduces the supply of other types of debt, it net adds liquidity.”

If both of these strategies are employed, as Hayes argues, we could see anywhere between $301 billion (the RRP funds) to $1 trillion pumped into the financial system before the end of the year.

Now, why is this important for Bitcoin? Historically, Bitcoin has shown a strong correlation with periods of increasing liquidity.

When more money is sloshing around in the economy, investors tend to take on more risk. Given Bitcoin’s status as a risk asset — as well as its finite supply — Hayes argues that the increased liquidity means a bull market could be expected by the end of the year.

If the U.S. follows through with these liquidity injections, we could see a strong uptick in Bitcoin’s price as investors flock to the crypto market in search of higher returns.

China’s liquidity moves

While the U.S. is ramping up its liquidity efforts, China is also making moves — though for different reasons.

According to a recent X thread from macroeconomic analyst TomasOnMarkets, the Chinese economy has been showing signs of strain, with recent data reportedly revealing the first contraction in bank loans in 19 years. This is a big deal because it indicates that the economic engine of China, which has been one of the world’s main growth drivers, is sputtering.

To counteract this pressure, the People’s Bank of China has been quietly increasing its liquidity injections. Over the past month alone, the PBoC has injected $97 billion into the economy, primarily through the very same reverse repo operations.

While these injections are still relatively small compared to what we’ve seen in the past, they’re crucial in a time when the Chinese economy is at a crossroads.

But there’s more at play here. According to the analyst, the Chinese Communist Party’s senior leadership has pledged to roll out additional policy measures to support the economy.

These measures could include more aggressive liquidity injections, which would further boost the money supply and potentially stabilize the Chinese economy.

Over the past few weeks, the yuan has strengthened against the U.S. dollar, which could provide the PBoC with more space to maneuver and implement additional stimulus without triggering inflationary pressures.

The big picture on global liquidity

What’s particularly interesting about these liquidity moves is that they don’t seem to be happening in isolation.

Jamie Coutts, chief crypto analyst at Real Vision, noted that in the past month, central banks, including the Bank of Japan, have injected substantial amounts into the global money base, with the BoJ alone adding $400 billion.

When combined with the $97 billion from the PBoC and a broader global money supply expansion of $1.2 trillion, it appears that there is a coordinated effort to infuse the global economy with liquidity.

One factor that supports this idea of coordination is the recent decline in the U.S. dollar. The dollar’s weakness suggests that the Federal Reserve might be in tacit agreement with these liquidity measures, allowing for a more synchronized approach to boosting the global economy.

Jamie added that if we draw comparisons to previous cycles, the potential for Bitcoin to rally is very high. In 2017, during a similar period of liquidity expansion, Bitcoin rallied 19x. In 2020, it surged 6x.

While it’s unlikely that history will repeat itself exactly, the analyst argues that there’s a strong case to be made for a 2-3x increase in Bitcoin’s value during this cycle — provided the global money supply continues to expand, and the U.S. dollar index (DXY) drops below 101.

Where could the BTC price go?

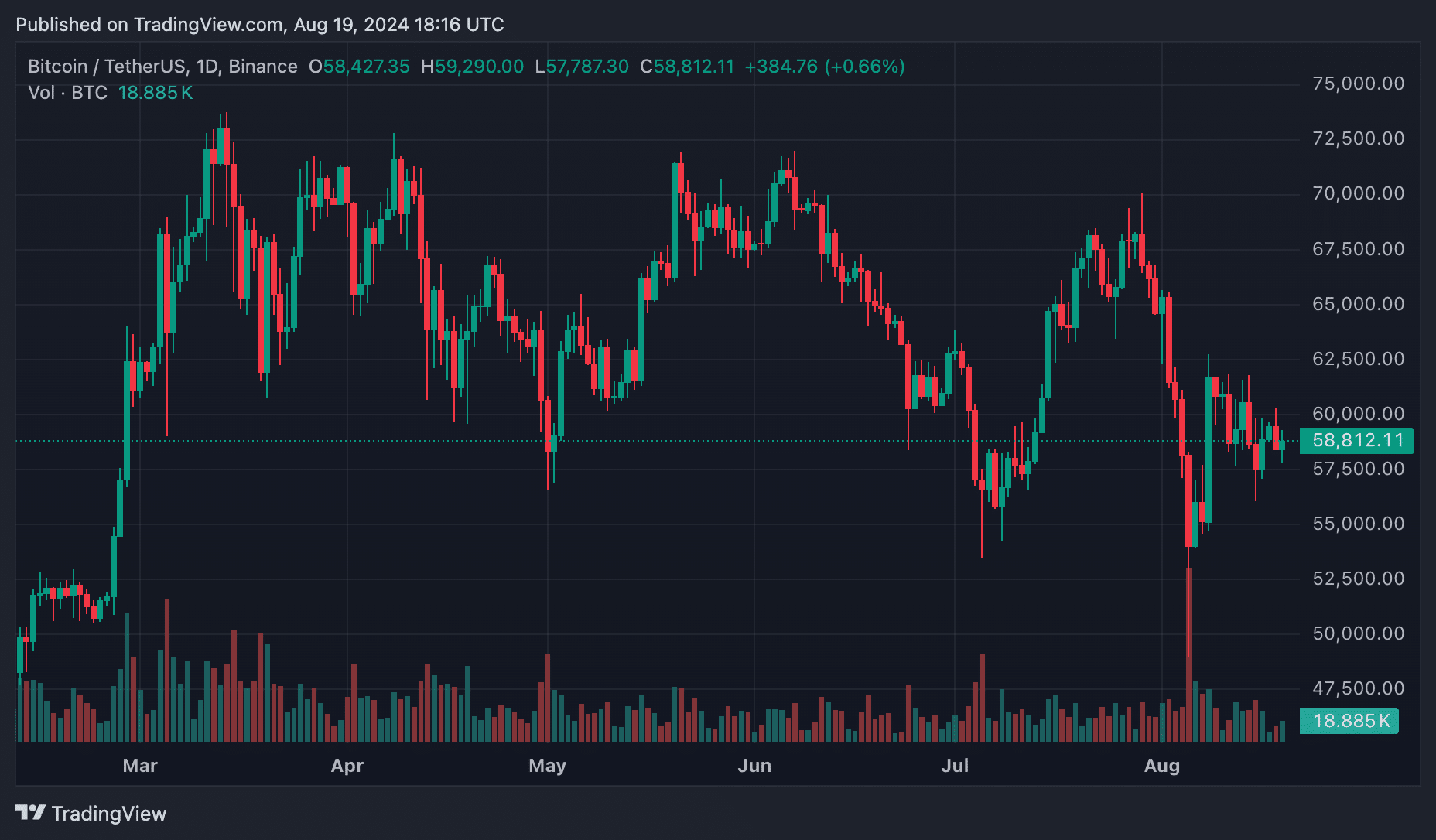

On Aug. 5, Bitcoin and other crypto assets suffered a sharp decline due to a market crash triggered by growing recession fears and the sudden unwinding of the yen carry trade. The impact was severe, with Bitcoin plummeting to as low as $49,000 and struggling to recover.

As of Aug. 19, Bitcoin is trading around the $59,000 mark, facing strong resistance between $60,000 and $62,000. The key question now is: where does Bitcoin go from here?

According to Hayes, for Bitcoin to truly enter its next bull phase, it needs to break above $70,000, with Ethereum (ETH) surpassing $4,000. Hayes remains optimistic, stating, “the next stop for Bitcoin is $100,000.”

He believes that as Bitcoin rises, other major crypto assets will follow suit. Hayes specifically mentioned Solana (SOL), predicting it could soar 75% to reach $250, just shy of its all-time high.

Supporting this view is Francesco Madonna, CEO of BitVaulty, who also sees the current market environment as a precursor to an extraordinary bullish phase.

Madonna highlighted a pattern he has observed over the past decade: during periods of uncertainty or immediate liquidity injections, gold typically moves first due to its safe-haven status.

Recently, gold reached its all-time high, which Madonna interprets as a leading indicator that the bull market for risk assets, including Bitcoin, is just beginning.

Madonna points out that after gold peaks, the Nasdaq and Bitcoin typically follow, especially as liquidity stabilizes and investors start seeking higher returns in growth assets.

Given that gold has already hit its all-time high, Madonna believes Bitcoin’s recent consolidation around $60,000 could be the calm before the storm, with $74,000 being just the “appetizer” and $250,000 potentially within reach.

As Coutts stated in a recent X post, the expansion of the money supply is a condition of a credit-based fractional reserve system like the one we have.

Without this expansion, the system risks collapse. The analyst argues that this “natural state” of perpetual growth in the money supply could be the catalyst that propels Bitcoin, alongside other growth and risk assets, into its next major bull market.

With the U.S., China, and other major economies all injecting liquidity into the system, we’re likely to see increased demand for Bitcoin as investors seek assets that can outperform traditional investments.

If these liquidity measures continue as expected, Bitcoin could be on the verge of another key rally, with the potential to break through its previous all-time high and set new records.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.