Global volatility slows Bitcoin, but Ethereum could surge: report

Per a recent Copper Research report, Bitcoin’s price movement has been stagnated by global events, and Ethereum’s limiting supply could lead to a price surge.

The latest issue of Copper Research’s “Opening Bell” report highlights that despite Bitcoin’s (BTC) resilience against the German government’s sale of 40,000 coins, overall market conditions have been challenging, erasing gains made since Bitcoin’s all-time high in March.

The report suggests that Bitcoin has little buying activity due to heightened market volatility driven by a series of global events. These events include the U.S. election, UK riots, Middle East tensions, and shifts in Japanese central bank policy.

Initially, market participants bought the dip during the German sell-off, but the report contends that recent market volatility has reduced interest in risk assets, resulting in minimal buying activity for Bitcoin.

Considering the unexpected supply from Germany, the markets effectively show no net additions. Since Bitcoin’s peak in March, ETFs have only added 40,000 coins, and prices are currently trading within the same range observed during the German sell-off, according to the report.

Ethereum’s surge at the end of the year

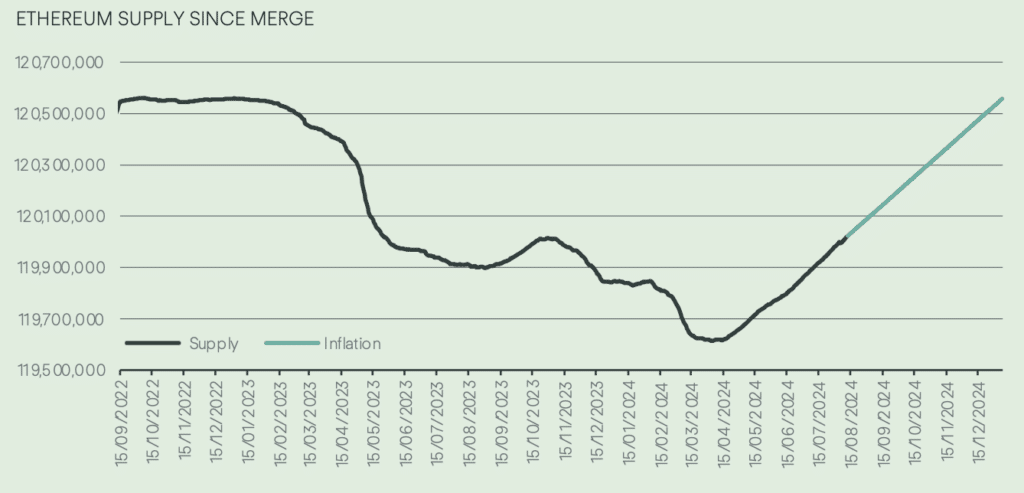

Ethereum’s (ETH) supply dynamics are also under scrutiny, as Layer-2 adoption has returned the asset to an inflationary state since mid-April. However, a significant portion of ETH is being locked into smart contracts.

This limited supply could potentially reduce the circulating supply and create upward price pressure by the year-end.

As of Aug. 12, 66% of Ethereum addresses are in profit, with ETH trading just above $2,600. This is an increase from last week when only 63% were profitable.

However, this is still lower than the 75% in profit when ETH was above $3,159 earlier in the month, with 3.59 million addresses needing a price rise to between $2,679 and $2,755 to turn profitable.

Surge in tokenized assets

The report also noted that tokenized assets are experiencing remarkable growth, with blockchains adding over $1 billion in tokenized government products this year.

McKinsey recently projected the market value of tokenized real-world assets could reach up to $4 trillion by 2030, driven by factors like mutual funds and bonds.

BlackRock’s BUIDL product has contributed to over half of this increase, signaling strong market momentum. Other products, including Franklin Templeton’s BENJI 0.6 and Ondo Finance’s USDY and USDG, are also gaining significant traction.