Goldfinch (GFI) token surges 50% in the last 24 hours

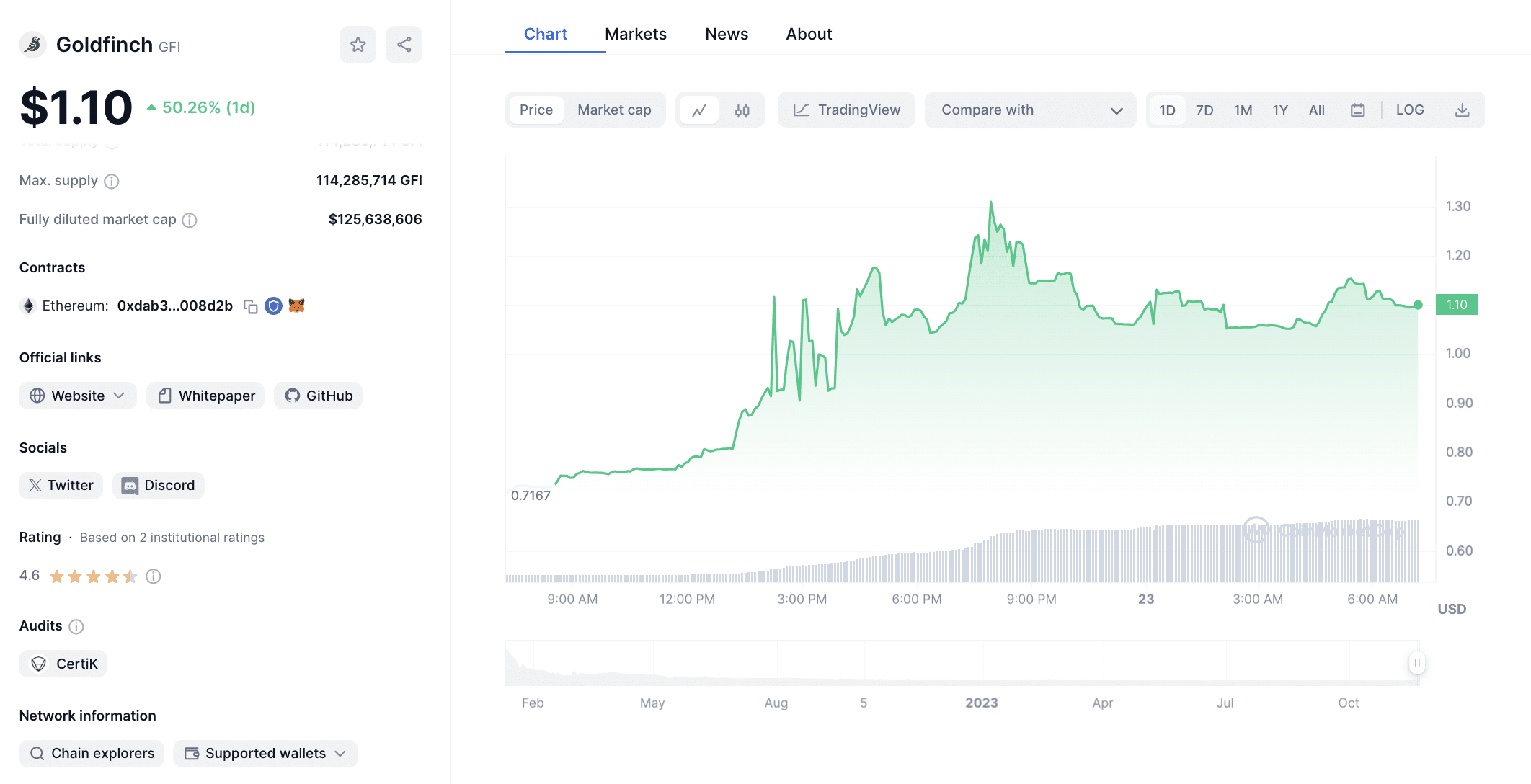

Goldfinch, a global credit protocol, has seen a 50.26% surge in the last 24 hours, currently trading at $1.10.

In the last seven days, Goldfinch (GFI) grew to 68.46%.

According to a Sept. 20 post from a tokenomics researcher, the project generated over $700,000 in fees monthly and had over $100 million worth of active loans.

By design, the platform is said to facilitate loans between real-world businesses and crypto investors and has introduced an original approach that doesn’t necessitate any crypto collateral. In this system, loans are allocated through collective consensus involving multiple participants.

The initial token supply of 114,285,714 GFI tokens is presently capped for the project, with around 25.49% of the supply currently in circulation. Most of the tokens were assigned to the team and investors, and this allocated supply is anticipated to be entirely unlocked by early 2026.

Despite recent growth news, earlier headlines about Goldfinch that circulated in August came down to its arguably first bad loan from a Kenyan taxi financer.

The financer defaulted on the $5 million loan, triggering a 20% decline in the token’s price.