GoPlus: Web3 incidents in October saw over $45.8M loss

GoPlus Security’s on-chain monitoring concluded that October saw a series of incidents in the crypto community which led to losses exceeding $45.84 million within the month alone.

- Web3 users suffered over $45.84 million in losses throughout October due to major exploits, phishing scams, and hacks. These include incidents linked to North Korean groups and exploits of firms like SBI Crypto, Garden Finance and Astra Nova.

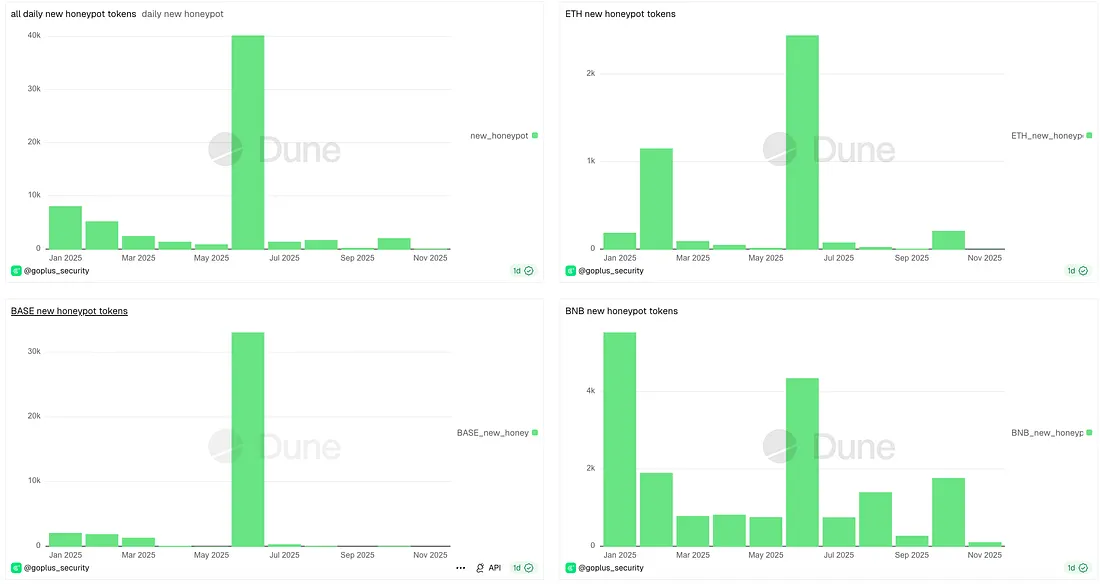

- GoPlus reported a 600% surge in honeypot tokens across Ethereum, Base, and BSC networks, identifying 2,189 malicious tokens. Honeypot tokens trap investors by blocking them from selling or withdrawing funds.

According to a report published by the on-chain security firm GoPlus, the community saw significant losses due to incidents in web3 that reached more than $45.84 million. These incidents included hacks, exploits, social engineering attacks, honeypot tokens, phishing attacks, Ponzi schemes, token rugpulls and more.

The platform noted in its translated blog post that there were 16 high-profile incidents that led to losses ranging from thousands to millions of dollars in just the span of a month.

One of the largest contributors was the SBI Crypto hack that occurred at the very start of the month. The crypto exchange suffered a hack that drained the platform of $21 million in multiple assets including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Dogecoin (DOGE) and Bitcoin Cash (BCH).

According to crypto sleuth ZachXBT’s investigation with blockchain security firm Cyvers, the exploit was suspected to have links to North Korean hacking groups. This is because the method used to launder the funds, such as funneling the stolen crypto through mixer platform Tornado Cash, is similar to workflows used by the Lazarus Group and other DPRK-affiliated hacking syndicates.

Though, this theory was never confirmed nor denied by SBI Crypto.

Another notable crypto exploit noted by GoPlus is the Garden Finance hack, which resulted in a loss of about $10.8 million according to ZachXBT. The official social media account Astra Nova also suffered a hack, which led to a large-scale sell off of its native token, RVV. This incident resulted in a loss of about $10.3 million.

Based on the report, phishing scams have been on the rise in the past month, contributing to a total of $3.5 million in combined thefts that affected an estimated 11,000 victims. One of the biggest phishing scams involved the trading platform GMGN, where around 107 users fell victim to an external phishing attack due to a fake third-party website that tricked users into green-lighting unauthorized transactions.

Due to the fake platform, user losses reached more than $700,000.

In a separate case, GoPlus noted that a crypto trader lost $325,000 worth of Coinbase Wrapped BTC after approving a malicious “increaseAllowance” authorization. Meanwhile another user suffered a $440,000 loss in multiple crypto assets after signing away a malicious authorization order labeled “permit.”

“Attackers used ‘Phishing-as-a-Service’ platforms and AI technology to greatly reduce the cost of creating phishing sites, launching widespread phishing campaigns across various crypto ecosystems,” said GoPlus Security in its blog post.

GoPlus: Honeypot tokens on the rise

GoPlus also noted a massive rise in what it deems as honeypot tokens across ecosystems like Ethereum, Base (BASE), and Binance Smart Chain.

Honeypot token is a term used to describe a type of scam involving tokens laden with malicious smart contracts that allow users to buy tokens but a hidden feature prohibits them from selling those tokens or withdrawing their funds.

The security firm found that the number of honeypot tokens has seen a 600% increase compared to the amount recorded in the previous month, reaching 2,189 tokens. However, it was still far below the number recorded back in June 2025, when the crypto community saw an influx of honeypot tokens that amounted to at least 40,000 tokens.

The largest number of honeypot tokens was found on BSC, specifically 1,780. Meanwhile, Ethereum was home to around 216 honeypot tokens and Base only had 131 tokens.