Grayscale CEO advocates for spot Bitcoin ETF options

Grayscale renewed pressure on the SEC to greenlight options on spot Bitcoin ETF as the investment manager seeks new rails to onboard capital into its crypto fund.

Grayscale CEO Michael Sonnenshein said approving options for spot Bitcoin (BTC) ETFs would benefit all GBTC investors and participants in other spot BTC-backed products looking to generate income and hedge financial positions.

Sonnenshein previously advocated for the speedy acceptance of spot BTC ETF options as an additional tool for market regulations, as it would bring more stakeholders like broker-dealers into the fold.

Options allow investors to set buy and sell orders for assets at a specific price and date. The investment vehicle would also effectively expose spot Bitcoin ETFs to a new investor class and extra capital.

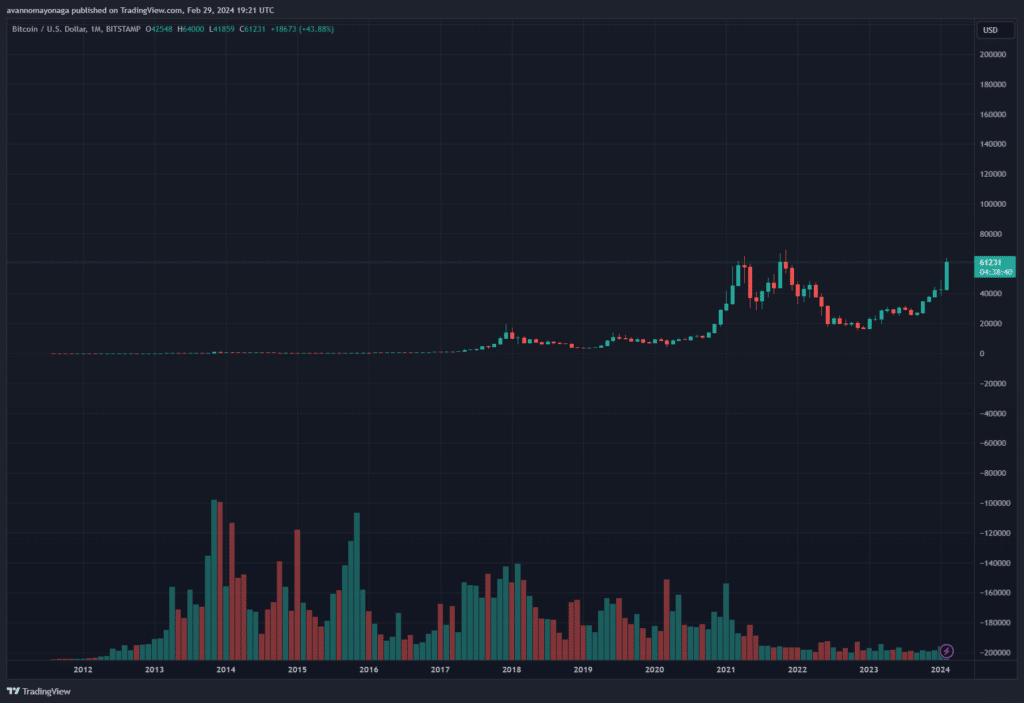

Spot BTC ETFs have already exceeded expectations in the opening two months of trading. Nine new issuers have accumulated over $7 billion in trading volume and inflows since Jan. 11. Analysts believe demand has contributed to Bitcoin‘s price uptick. The crypto is up over 40% in the last 29 days per CoinMarketCap and looks likely to close its most significant monthly increase in over four years.

Sonnenshein wrote in his Feb. 28 letter to the SEC that it would be unfair to deny GBTC shareholders and other spot Bitcoin ETF investors access to options, which would afford greater possibilities to providers and customers alike.

The U.S. SEC has acknowledged a request for spot BTC ETF options filed by Nasdaq in January. However, experts predict it could take months before it is approved and publicly available.