Grayscale launches Maker fund, whales start accumulating

Whales have started accumulating Maker tokens after Grayscale announced the launch of its MakerDAO Trust.

On Aug. 13, leading crypto asset manager Grayscale launched its MakerDAO (MKR) investment fund. Unlike its spot Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds which are available to the public, only “accredited investors” can invest in the MakerDAO Trust.

MakerDAO is already one of the big names in the decentralized finance sector and the decentralized autonomous organization behind the third-largest stablecoin, Dai (DAI).

Thanks to the bullish announcement from Grayscale, MKR is up by 7.9% in the past 24 hours and is trading at $2,150 at the time of writing. The asset’s market cap surpassed the $2 billion mark, making it the 39th-largest cryptocurrency.

Maker’s daily trading volume also increased by 64%, reaching $144 million.

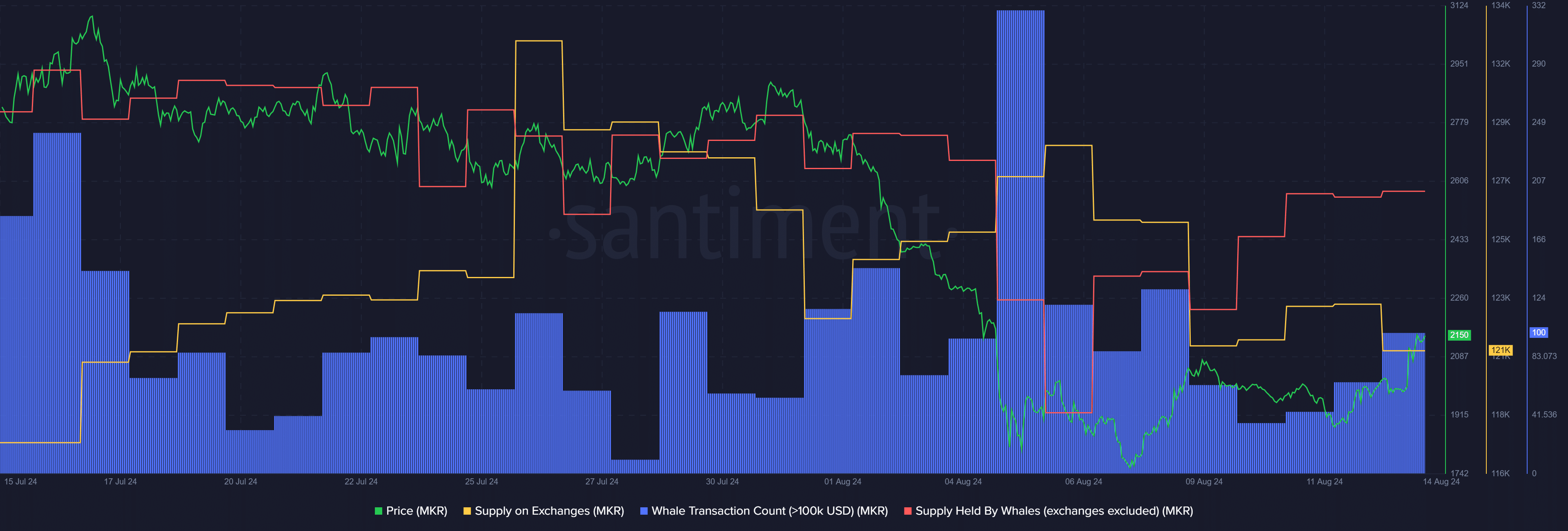

According to data provided by Santiment, the number of whale transactions consisting of at least $100,000 worth of MKR surged from 65 to 100 unique transactions over the past day.

On the other hand, the MKR supply on exchanges decreased from 123,100 to 121,340 tokens, per data from Santiment. This movement shows that whales have already started accumulating MKR as the Grayscale announcement triggered increased demand.

Data from the market intelligence platform shows that roughly 78.4% of the Maker circulating supply, around 729,330 MKR tokens, is held by whales.

At this point, increased price fluctuations could be normal for the MKR price considering the high whale activity around the asset.