Helium token forms rare patterns; could rise by 46%

Helium, the biggest Decentralized Public Infrastructure Network in Solana, continued its strong comeback this week.

HNT price rally continues

Helium (HNT) rose by over 8% on Aug. 29, outperforming all top 100 altcoins. It jumped to an intraday high of $7.5, bringing its 30-day gains to 50%. It has also soared by over 100% from its lowest point this month.

The rally followed the community’s overwhelming vote in favor of the HIP130 and HIP131 proposals. This means that all compatible Wi-Fi access points can be configured to support service providers like Helium Mobile.

Proposal HIP 131, conversely, allows service providers to begin affecting Hex boosting areas only within the highest earning areas. These proposals will start going into effect seven days after the announcement.

Helium also gained momentum after revealing its work with major US telecom companies to handle carrier offloading tasks, a process that reduces network congestion during significant activity, such as large events.

In these situations, such as concerts or sporting events, carriers can offload some users to the Helium Network, increasing HNT token burns and creating value for investors. The carrier offload test has over 500,000 users.

Helium forms a golden cross pattern

HNT’s rally has occurred in a high-volume environment, indicating substantial demand. Data shows that open interest in the futures market has surged to $7.42 million, its highest point since April and much higher than this month’s low of $2.7 million.

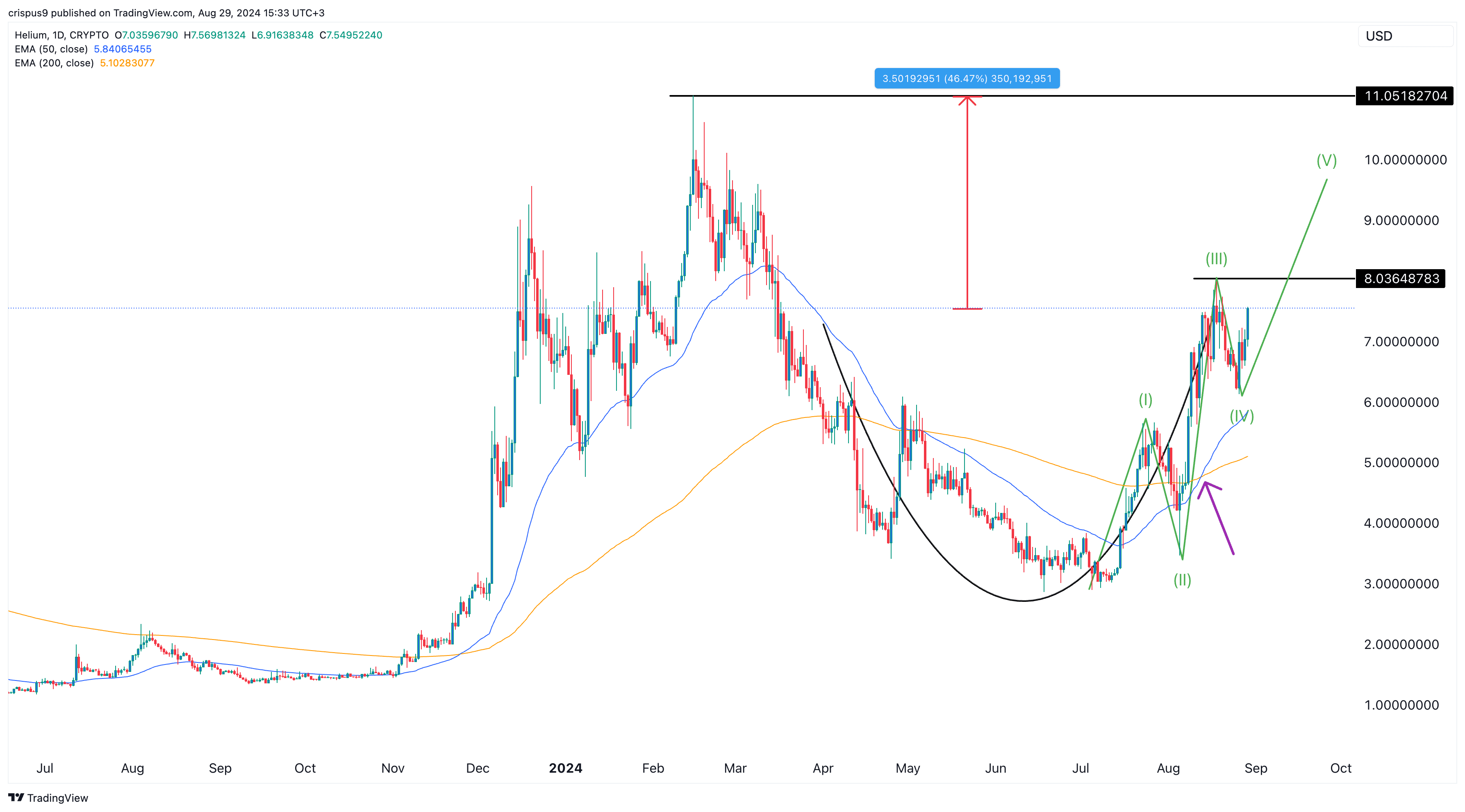

HNT’s technical indicators suggest that the ongoing gains may continue. The token formed a golden cross pattern as the 50-day and 200-day Exponential Moving Averages (EMA) crossed, a widely recognized bullish sign.

Helium has also formed a cup and handle pattern, with the recent consolidation forming the handle section. It has moved to the fifth section of the impulse Elliot Wave chart pattern, which is typically bullish.

Further upside will be confirmed if the price breaks above the key resistance point at $8.036, its highest point on Aug. 18. If this occurs, the token may jump to $11.05, its highest point on Feb. 15, representing a potential 46% gain from the current level.