Here’s What You Need To Know About The Fei Protocol Bug

Built to maintain a 1:1 peg with the US dollar, the Fei protocol stablecoin, FEI, failed to do so over the first week or so of its existence. The Fei Protocol is backed by major VCs with the goal of creating a stablecoin that would buy assets with its token, rather than holding them as collateral for loans.

An algorithmic stablecoin, FEI has not only traded below parity with the US dollar since its $1.2 billion launch, but, also, suffered a bug resulting in some users not being able to sell their coins. For the first couple of days, FEI fluctuated between a nickel to a dime off its target of $1. It declined precipitously on Tuesday to $0.75.

Fei Protocol founder Joey Santoro has stated that the team is focused on re-pegging the stablecoin to the US dollar. In order to do so, it will work to fix the incentive system, which had been disabled due to the bug, and will work on a proposal to return FEI to parity with the dollar.

The Fei Protocol was designed to use incentives so as to keep the coin pegged to the value of the US Dollar. The protocol penalizes anyone trying to sell it below its peg and rewards those who buy it below the peg. The design is intended to incentivize people to buy it back to parity with the dollar. When a sale beneath parity is made, a greater amount of FEI is burned and taken from circulation to boost the price.

This design hasn’t worked.The coin has fallen below parity since its launch on Sunday. It hasn’t moved back towards the dollar mark, either. As the incentive mechanism failed, the coin’s price only fell. Ultimately, when users could not sell the coin on the FEI/ETH pair. Had the transactions gone through, they faced a stiff penalty of 100%.

In essence, the token had become worthless. In fact, a Fei Protocol admin in its Discord channel said the burn could exceed 100%. The coin’s price is then effectively worth less than nothing. The Fei Protocol made some changes to allow selling in an attempt to reweight a few times. They also removed the penalty, at which point there were huge outflows. Band-aids were applied. Traders began trading FEI for TRIBE in order to bypass penalties, which they could then sell on the TRIBE.

The Fei Protocol team disclosed that it had been alerted to a vulnerability through the bug bounty program. After identifying the bug, the team moved to “suspend mint rewards” on the protocol. Mint rewards are the incentives for anyone buying FEI, and are designed to return the value towards dollar parity. The token’s price then fell further.

“Due to a bug, the team disabled the “buy” incentives, leaving only “sell” disincentives. So the FEI/ETH pool is looking very scary,” tweeted Robert Leshner, founder of DeFi lending platform Compound.

The Fei Protocol team states the protocol remains overcollateralized. Therefore, there is more cryptocurrency collateral backing the set of FEI tokens than they are worth. Furthermore, the team stated that there are still ways the token’s value could return through “reweighting.”

$1.2 billion remains on the line.

In a time of consistent DeFi successes, FEI’s struggles show that this is still a young and nascent industry. Will investors become more conservative in their approach to DeFi investing? For now, the industry is keeping an eye on the Fei Protocol. Will it ever recover?

How The Fei Protocol Works

The Fei Protocol innovates on the model of a decentralized stablecoin by creating a system where users directly purchase the stablecoin from a protocol that is capable of owning the assets used to purchase it.

The Fei Protocol smart contract stipulates that, in the event of an input of $100 worth of ether, the contract will issue 100 FEI. There’s no maximum on the amount of FEI that can be issued other than the fact that the smart contract that mints it does so only when it gets purchased. FEI is made on-demand, not in anticipation of it, in other words. The Fei protocol’s big innovation is that funds put into the Fei Protocol belongs to the Fei Protocol. FEI is not created with debt, but trade.

The Fei protocol enforces its peg to the dollar in a few ways. For one, through a pool on Uniswap, the decentralized trading protocol used to support the first peg. The Fei Protocol smart contract creates incentives for buying from and selling to that pool.

The price has thus far traded below the peg. FEI incentivizes users to hold FEI by burning FEI any time they sell to the Uniswap pool and giving them a little any time they buy from it.

For the first time, Uniswap is showing a certain stated FEI price, but delivering less than it stated on the trade. FEI gets burned on a sale when FEI is underpriced. Users haven’t wrapped their heads around it, but it’s causing something of a panic to exit. The Fei Protocol exercises its other mechanic, the reweight.

What Is A FEI Reweight?

As an automated market maker or decentralized exchange (DEX), Uniswap doesn’t own any assets. Instead, it gives people a way to deposit pairs of assets into it and earn a little bit on trades users make with the protocol. In an ETH/DAI pool, a user could put in 100 DAI and $100 worth of ETH and, as people trade ETH for DAI and DAI for ETH, the depositor earns a bit on each trade.

The Fei Protocol supplies the ETH/FEI pool on Uniswap. When FEI is trading below its target of $1, the protocol reweights the whole pool by withdrawing the ETH and FEI from the DEX.

With some funds placed by others in the ETH/FEI pool, Fei deposits the right amount so that the funds remain in the pool equal 1 FEI for $1 worth of ETH. The Fei protocol then deposits as much of its remaining ETH and FEI sufficient to maintain that ratio back into the Uniswap pool.

FEI will be left over after the reweight, because the market needs to reduce supply. Therefore, the price is below the peg. That leftover FEI gets burnt.

With so many people trying to get out of FEI, upon reweight users try to exit their position, because at that moment they receive the best price for FEI. This rush to trade leads to another plunge in value and, once again, FEI falls off its peg. So, the reweight, which is meant to make things better, is making the situation worse.

The only reason users might presently hold FEI currently is to have a stake in its governance. They can hold FEI and its governance token, TRIBE, and stake them in the FEI/TRIBE Uniswap pool to earn more distributions of TRIBE.

Collateralization

One topic that hasn’t received a ton of attention is how collateralized FEI is. In the debate, one Fei protocol supporter on the forum argued that FEI is overcollateralized. But look at it another way, it’s undercollateralized.

The ETH that the Fei Protocol owns now came from a launch event whereby early supporters put in ETH and got FEI at a discount. That is how Fei acquired more than $1 billion worth of ETH. Once those wallets got FEI, the protocol started the Uniswap pool, which would launch at 1 FEI equaling $1 of ETH.

“The FEI for this deposit comes from minting, and therefore this PCV [Protocol Controlled Value] Deposit must be appointed as a Minter by Fei Core. The amount of FEI minted is equivalent to the amount of ETH times the spot price of FEI/ETH in the pool,” reads the Fei white paper.

The Fei Protocol minted more FEI to match the value of ETH that went into the pool. In other words, a billion FEI were minted to buyers with the $1 billion worth of ETH that had been spent during the launch event. Another billion FEI were then minted to pair with that same ETH to go in the Uniswap pool.

Fei went into full capitulation mode after the second reweight. People in discord report the UI doesn't allow selling when the penalty is over 50% (price is lower than 0.93). A good move would be to return the captive ETH and get back to the drawing board. pic.twitter.com/XblhvpKbZd

— banteg (@bantg) April 6, 2021

Santoro wrote in the FEI Discord forum on Tuesday: “@Everyone the PCV is safe and the protocol is still overcollateralized, we will move forward with a solution to help allow FEI to exchange for the fair market price.”

According to analyst Sébastien Derivaux, Tribe holders eventually grew greedy, tweeting: “$TRIBE holder are basically saying they want to make a stablecoin that is not redeemable for $1.

They are greedy and short-termist.

You make the big buck by making a good product not by screwing your customers.”

$TRIBE holder are basically saying they want to make a stablecoin that is not redeemable for $1.

They are greedy and short-termist.

You make the big buck by making a good product not by screwing your customers.

Good way to kill @feiprotocolhttps://t.co/FrsnoS82Sd— Sébastien Derivaux @Permissionless (@SebVentures) April 11, 2021

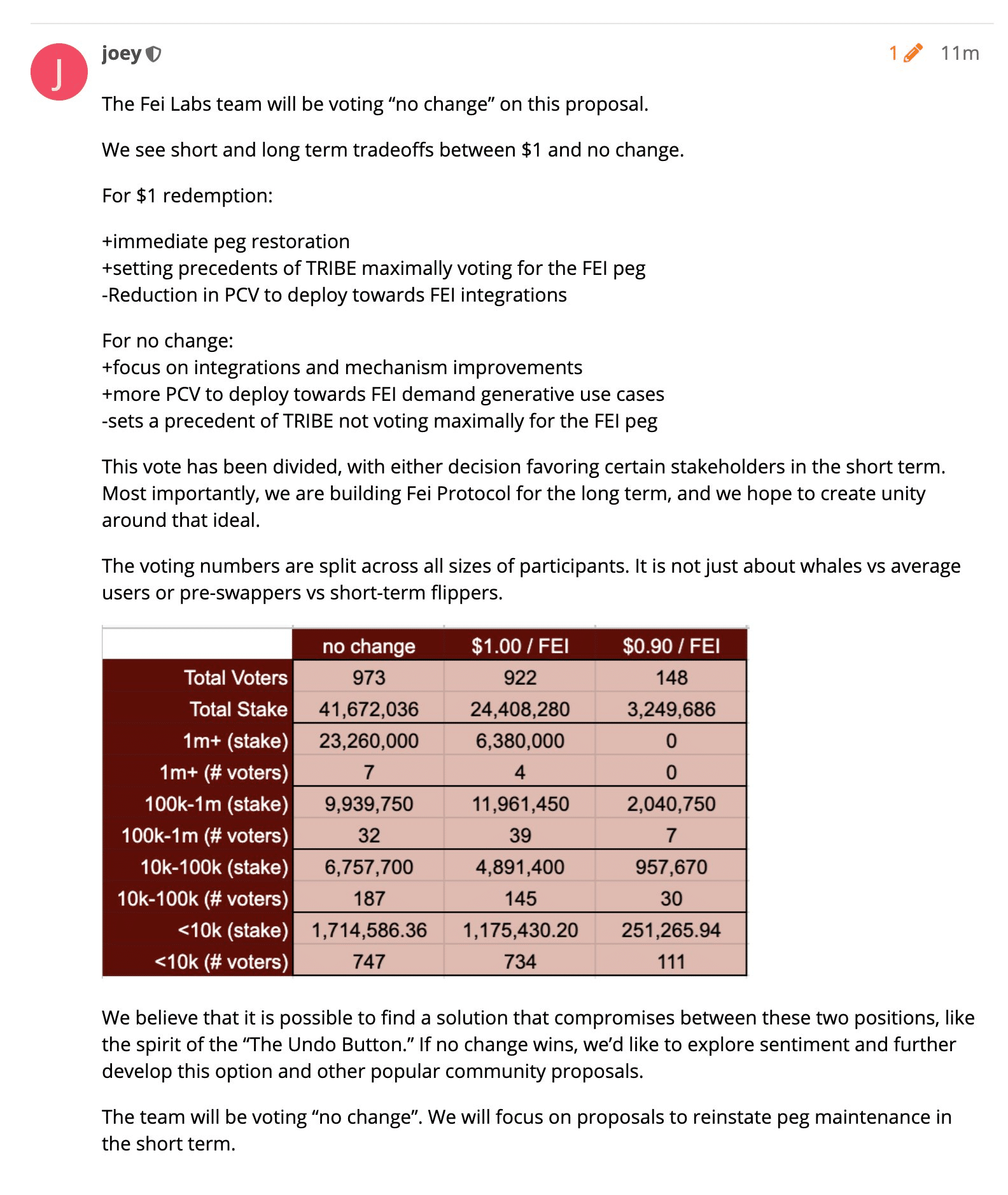

Fei ultimately made a statement outlining their path forward, diverging with a vocal majority of TRIBE holders.

For now, the DeFi community watches with bated breath to see how the Fei protocol decides to move forward and rectify what’s gone wrong.