Here’s why Aptos price is on the verge of a big breakout

Aptos, a top layer-1 network, is showing resilience even as its token hovers near its lowest level since 2023.

The Aptos (APT) token was trading at $5.90 on Tuesday, slightly above the year-to-date low of $4.60. This price is about 62% below the highest point in December last year.

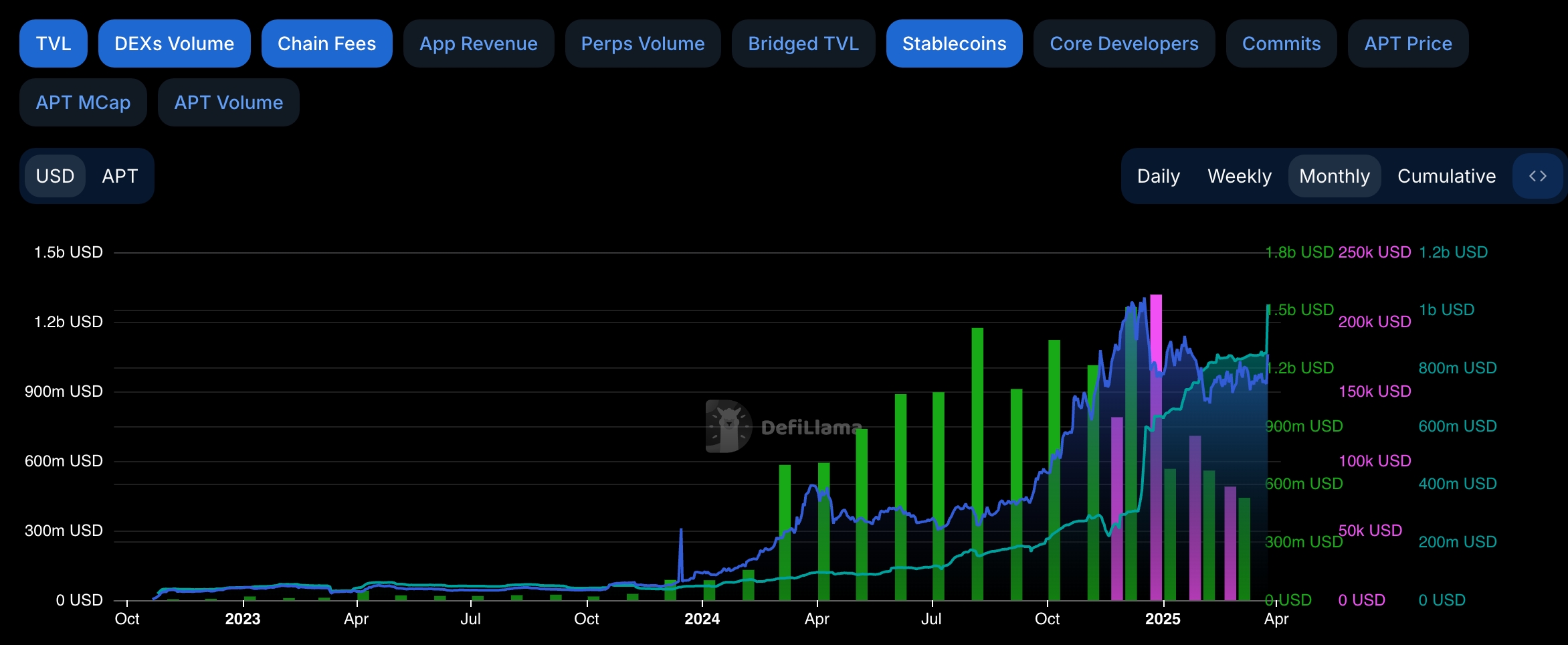

The recent decline in Aptos price comes even as its ecosystem continues to grow. According to DeFi Llama, the total value locked in the Aptos network has jumped to $1.06 billion. Most of these assets are in Aries Markets, a lending protocol with over $391 million in assets. Echelon Market, another top platform in the network, holds over $178 million, while Cellana Finance has $26.7 million.

Other leading liquid staking platforms in the Aptos ecosystem include Amnis Finance, Echo Protocol, and Thala.

Data also shows that the stablecoin market cap on Aptos has crossed the $1 billion milestone for the first time. This increase signals rising user engagement with decentralized applications within the ecosystem.

Aptos revenue has also continued to rise this year. Its application revenue climbed to a record high of $205,000 in February and stands at $201,000 this month. These revenue figures are smaller than those of other chains because Aptos users are drawn to the network’s lower fees.

Aptos price technical analysis

The daily chart shows that APT has been in a strong downtrend over the past few months, dropping from a high of $15.3 in November to a low of $4.93 this month.

Aptos remains below the 50-day Exponential Moving Average, indicating that bears are currently in control. On the positive side, the coin has formed a large double-bottom pattern with a neckline at $15.3. This pattern is considered one of the most bullish reversal signals in the market.

Therefore, APT could bounce back in the coming days, with the next key target being at $12.13, the 50% retracement point, which would represent a gain of about 105% from the current level.