Here’s why crypto prices had a brief flash crash in South Korea

Crypto prices crashed hard in South Korea as the local currency plunged to a record low.

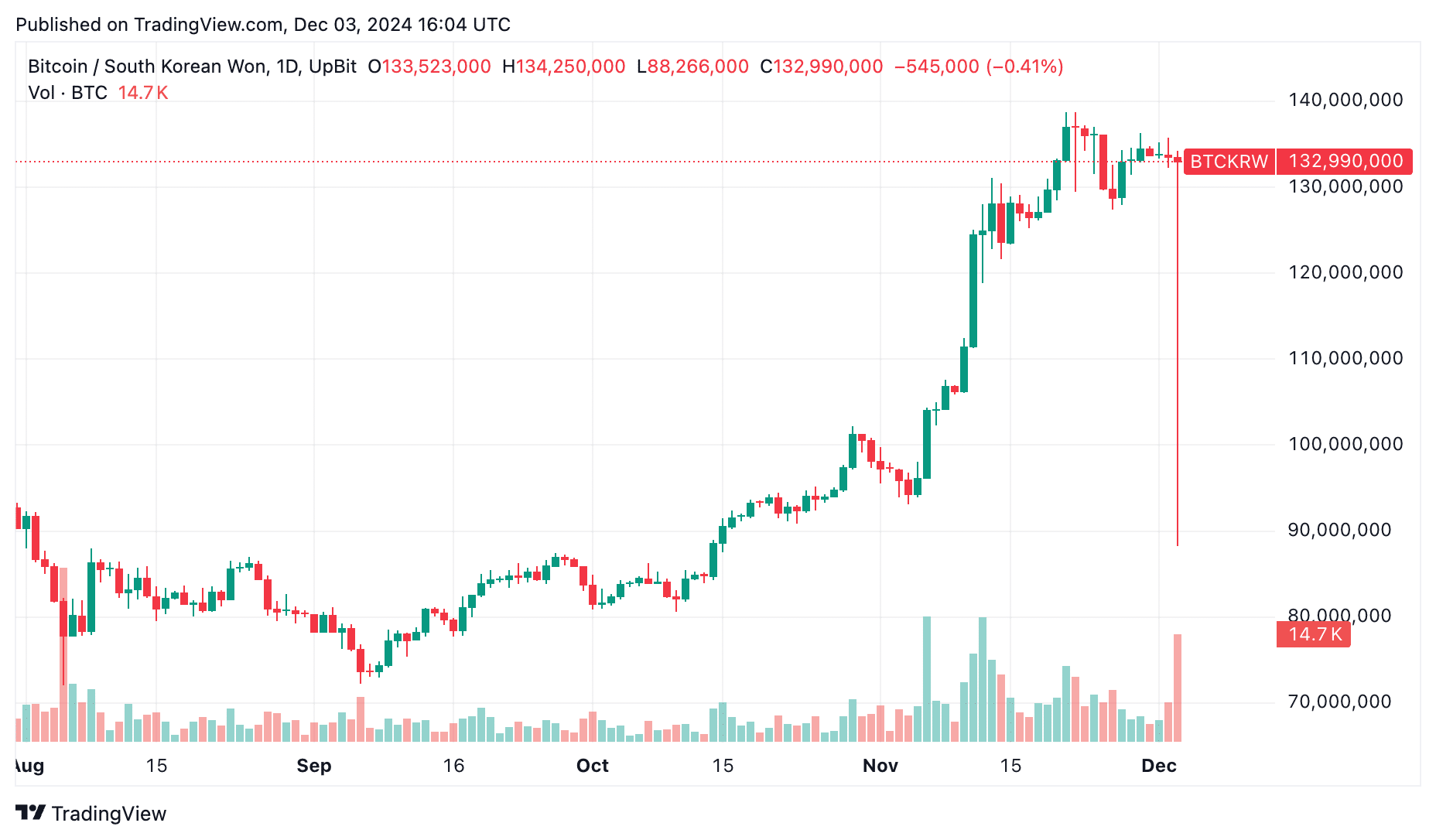

Bitcoin (BTC) price dropped to 88,197,000 KRW, its lowest level since October 5, before rebounding to 132,000,000 KRW. The cryptocurrency was down by almost 40% from its highest level this year.

Other altcoins had a similar price action. Ethereum (ETH) fell to 4,210,630 KRW, its lowest level since Nov. 9. Similarly, Ripple (XRP), Stellar Lumens, and Solana (SOL) were down by double digits.

The crash followed a political crisis in South Korea, which pushed the South Korean won to a record low. The won has become one of the worst-performing Asian currencies, dropping over 13% this year.

The turmoil was triggered by President Yoon Suk Yeol’s decision to declare emergency martial law. He attributed the move to the opposition party, accusing it of ties to North Korea. Yoon said:

“I declare martial law to protect the free Republic of Korea from the threat of North Korean communist forces, to eradicate the despicable pro-North Korean anti-state forces that are plundering the freedom and happiness of our people, and to protect the free constitutional order.”

Therefore, Bitcoin and other altcoins plunged as many investors rushed to liquidate their assets as the political crisis escalated. In most periods, investors are often driven in fear when a major event happens.

For instance, similar sell-offs occurred at the onset of the war in Ukraine and the COVID-19 pandemic, followed by rebounds as investors adjusted to the new circumstances. This pattern likely explains the recovery seen in BTC and altcoins after their initial plunge.

Additionally, cryptocurrencies maintain strong fundamentals, with regulatory developments expected to improve in the United States.