Here’s why Ethereum price reclaimed key $4k support

Ethereum price has reclaimed the critical $4,000 support after briefly losing the level earlier this week. Rising daily on-chain transactions, combined with a bullish market structure, suggest further upside potential toward $4,800 and beyond.

- Ethereum defended and reclaimed the $4,000 high timeframe support after a short deviation.

- Market structure remains bullish with consistent higher lows and higher highs since $2,400.

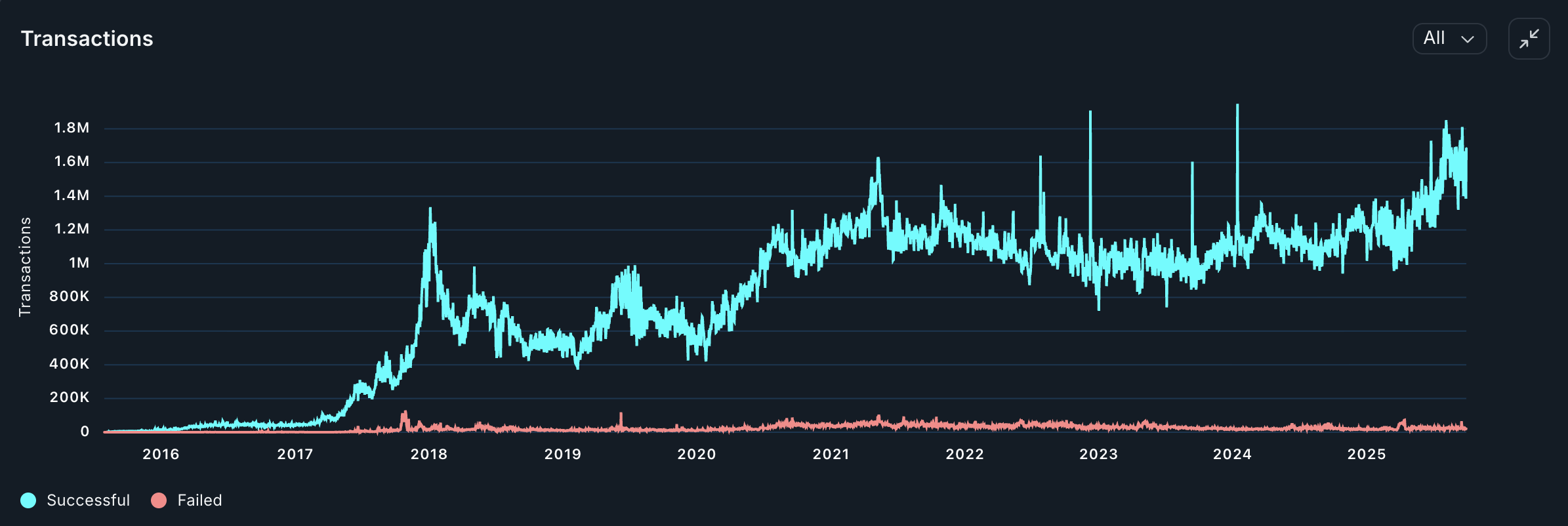

- On-chain transactions have surpassed 1.6 million, reinforcing long-term bullish momentum.

Ethereum (ETH) price action has demonstrated resilience as bulls reclaimed the psychologically significant $4,000 support level. This comes after a temporary breakdown that pushed price briefly below the threshold. The recovery was fueled by both technical confluence and strengthening on-chain fundamentals, giving traders confidence that the bullish trend remains intact.

Adding to this, Bitcoin and Ethereum ETFs have attracted more than $1 billion in inflows as the market strengthens, fueling optimism for a bullish October. With Ethereum continuing to form higher lows and higher highs since $2,400, momentum is building for another rotation toward higher levels.

Ethereum price key technical points

- Key Support Reclaimed: $4,000 has been reestablished as a high timeframe support level after a brief deviation.

- Bullish Market Structure: Consecutive higher lows and higher highs continue to define Ethereum’s price action.

- On-Chain Strength: Transactions have surpassed 1.6 million in recent months, highlighting strong network activity.

The reclaim of $4,000 is a significant technical development. This level not only represents a major psychological barrier but also aligns with the value area low of Ethereum’s current trading range. The confluence at this region allowed price action to engulf back above on the daily chart and close convincingly above $4,000. This confirms buyer demand and reaffirms the level as a high-timeframe support zone.

From a structural perspective, Ethereum has been carving a bullish path since its swing low at $2,400. The market has consistently respected a pattern of higher lows and higher highs, a hallmark of bullish momentum. This characteristic strengthens the case for continued upside as long as the $4,000 support remains intact. Should buyers continue to defend this region, price action opens the probability for a rotation toward the next major resistance at $4,800, with potential to push even higher if momentum accelerates.

Another reinforcing element is the status of Ethereum’s moving averages, which remain in bullish alignment. These averages are providing dynamic support and signaling sustained demand for ETH at current levels. The technical environment is broadly supportive of a continuation of the bullish structure.

In parallel, Ethereum’s on-chain fundamentals are adding weight to the bullish outlook. Recent months have seen network transactions consistently rising, with total daily successful transactions surpassing 1.6 million. This increase in network activity highlights active demand for Ethereum’s ecosystem, supporting the argument that on-chain health and price action are aligned.

When fundamentals and technicals converge, the case for continuation in the prevailing trend grows stronger.

What to expect in the coming price action

If Ethereum continues to hold above $4,000, the bullish trend is likely to extend toward $4,800 as the next major resistance. Sustained growth in on-chain transactions will further reinforce momentum, while failure to maintain $4,000 could weaken the bullish case.