Hong Kong firm mulls tokenizing 3-ton gold vault amid local ETF boon

Value Partners, a Hong Kong-listed company, is set on issuing blockchain tokens backed by physical gold and filing applications for crypto-related ETFs.

According to local media Hong Kong Commercial Daily, the firm plans to tokenize its three tons of gold bars worth an estimated $201 million at current prices.

Value Partners already offers the only Hong Kong gold ETF backed by physical gold and believes digitizing its precious metal with blockchain technology will only improve accessibility for investors.

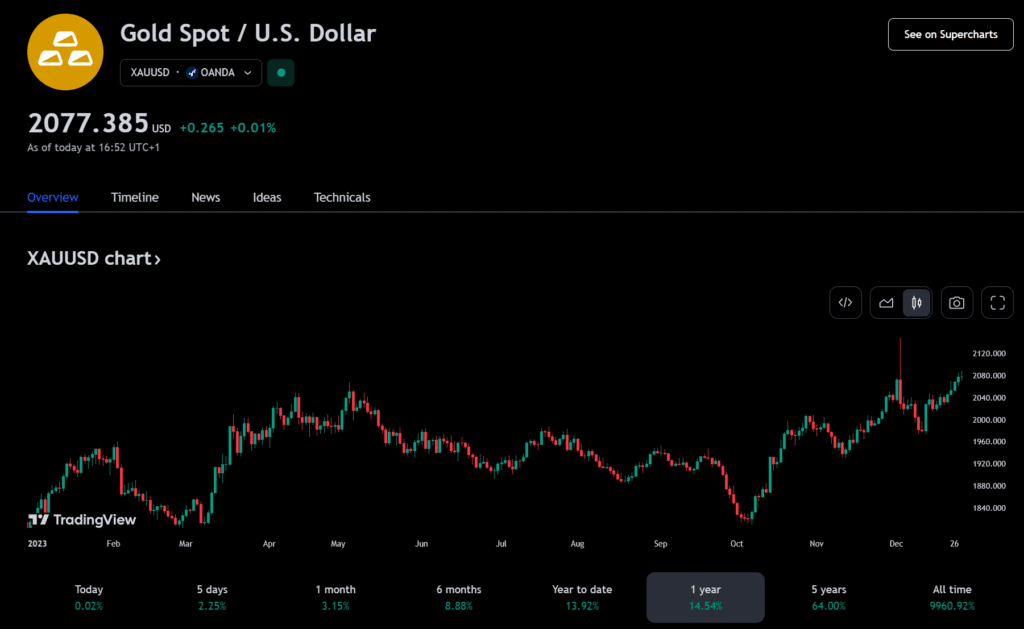

The move comes after gold hit its all-time high and traded at $2,150 on some venues in December 2023. Gold gained over 14% per data from TradingView.

Additionally, Value Partners disclosed its strategy to foray into cryptocurrencies. The Hong Kong asset manager is considering bringing several virtual currency exchange-traded funds to market.

Zhao Shande, senior strategist of ETF business at Value Partners, said Hong Kong’s regulatory structure for cryptos and recent acceptance of digital asset ETFs would incentivize market participants and attract billions in retail capital.

As crypto.news reported, Hong Kong’s Securities and Futures Commission (SFC) with its Monetary Authority (HKMA) signaled readiness to review crypto ETFs due to the increased interest in these investment products.

Unlike the United States Securities and Exchange Commission (SEC), which reportedly favors only in-cash models, Hong Kong financial watchdogs approved both in-cash and in-kind subscriptions.

The regulators published guidelines to oversee companies’ operations to list spot Bitcoin ETFs and other digital asset funds.

Hong Kong authorities also announced stablecoin regulations to allow retail investments. The policy requires issuers to obtain a special license, but provisions for algorithmic stablecoins were not disclosed.