How Trump’s proposed tariffs could affect crypto

Donald Trump wants to impose tariffs of 25% on all trade products coming from Canada and Mexico as well as an additional 10% on Chinese goods. How will Trump’s tariffs affect the crypto market?

In a Nov. 26 post on his social media site Truth Social, U.S President-elect Trump announced the international tariffs would remain in place “until such time as Drugs, in particular Fentanyl, and all Illegal Aliens stop this Invasion of our Country.”

Throughout his presidential campaign, Trump placed trade tariffs high on the list of priorities, specifically aiming the spotlight on Mexico. He told Mexico’s President Claudia Sheinbaum that he would levy tariffs of at least 25% if she did not take action against the “onslaught of criminals and drugs” crossing the border.

In a separate post, he also threatened to impose an additional 10% tariff on all imports from China, criticizing the nation for not enforcing the death penalty for fentanyl dealers. Trump’s tariffs would add to the already existing levies imposed by Biden during his term.

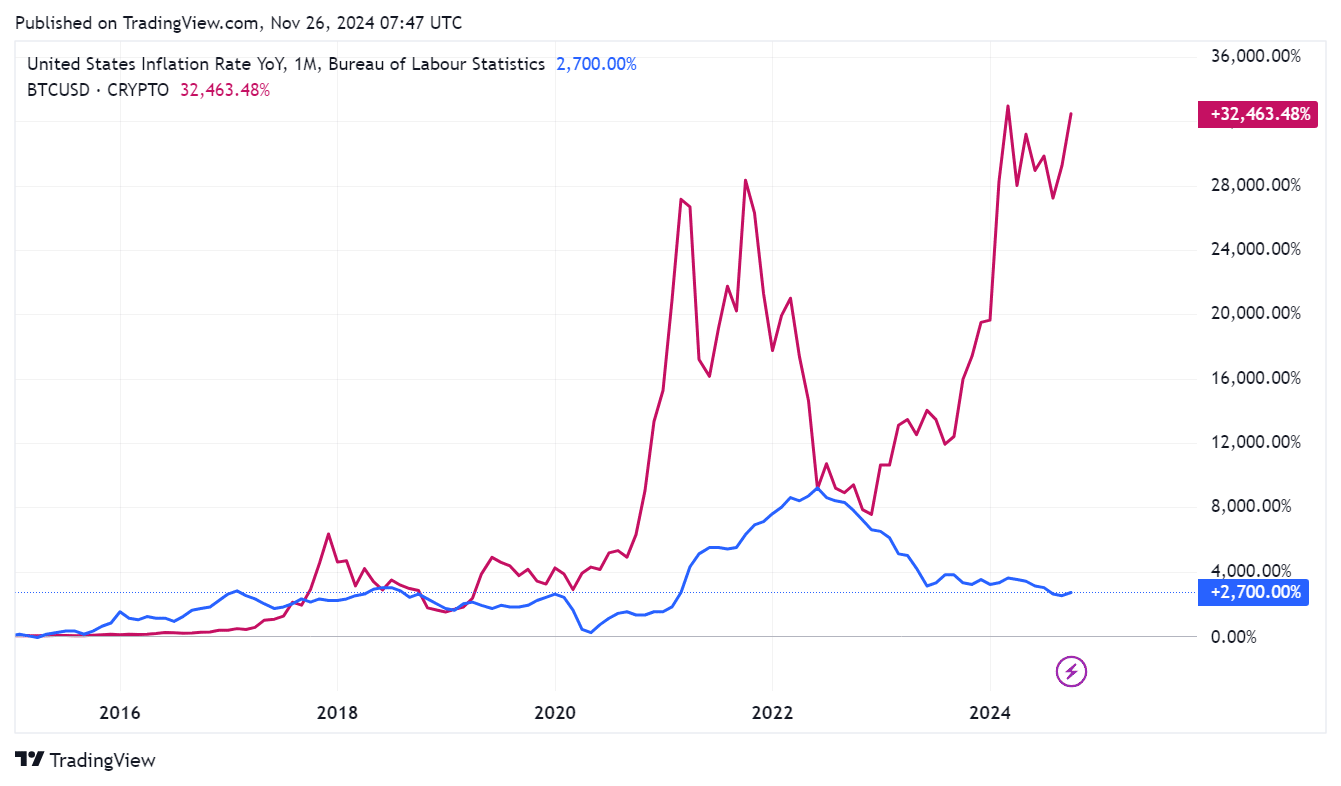

Analysts warn that Trump’s tariffs would increase the cost of goods and potentially disrupt business, leading to widespread inflation in economies across the globe.

How do tariffs affect the crypto market?

Tariffs are a fiscal tool used to protect local industries by making imported goods more expensive by raising import taxes. Though tariffs are known to have a more direct effect on the global trade landscape and fiat currencies as a whole, they also play a role in elevating the crypto market.

As tariffs make importing goods from other countries more expensive, the volume of imports would go down which would benefit domestic businesses. For consumers, this leads to an increase in their overall living expenses as the cost of goods will go up while demand goes down, indicating inflation.

Not only that, the trade tensions that comes with imposing tariffs may lead to economic uncertainty. This can be seen through how the U.S dollar went up by 0.4% following Trump’s tariff declaration, while the currencies of the affected countries like Canada, China and Mexico took a slight tumble.

Historically, inflation and the economic tension caused by trade wars between the U.S and China have rattled traditional financial markets. In the wake of such uncertainty, traders would seek alternative assets such as Bitcoin(BTC) to avoid the volatility of more traditional assets that are bound to be affected by trade. This is why Bitcoin has often been described as a “safe-haven” asset by investors.

Though inflation devastates the national economy, it is shown to have a positive relation to Bitcoin growth. Take the 2018-2020 U.S and China trade war for example, when the U.S raised costs for technology and electric vehicles coming from China. This led to an increased interest in Bitcoin as investors scramble to protect their funds against the volatile market, hiking up the Bitcoin price.