HumidiFi becomes Solana’s largest DEX with $1.1B volume

Dark pool HumidiFi has grown to become the largest DEX protocol on the Solana blockchain surpassing Meteora, Raydium, and Pump on all fronts.

- HumidiFi has overtaken major competitors like Meteora, Raydium, and Pump.fun to become Solana’s largest DEX, recording over $1.1 billion in 24-hour trading volume.

- Its rise highlights a broader shift in DeFi toward dark pool or proprietary AMM models that prioritize execution efficiency and privacy over transparency and open liquidity.

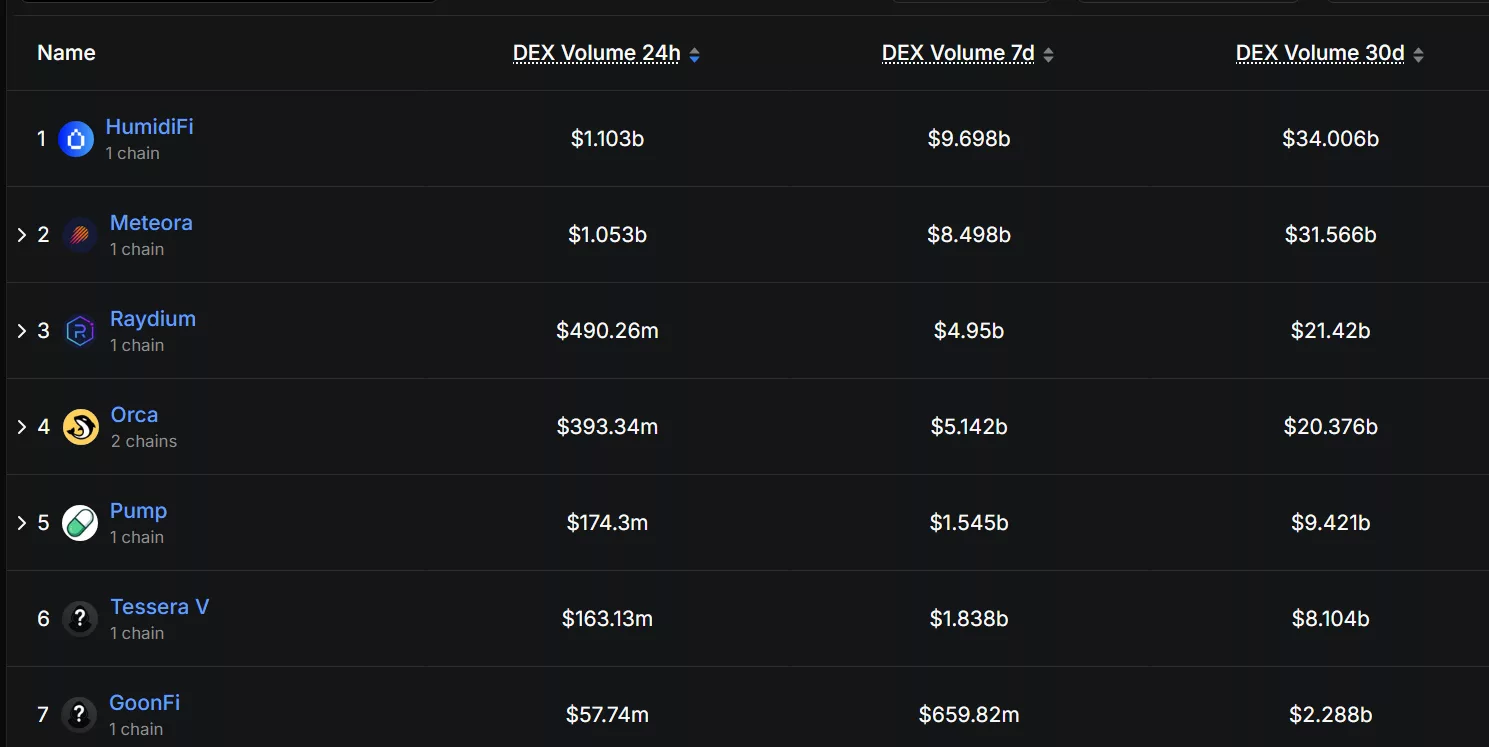

On Oct. 20, the dark pool decentralized exchange HumidiFi officially became the largest protocol on the Solana blockchain, having surpassed Meteora, Raydium and Pump.fun. According to data from DeFi Llama, the protocol contributes as much as $1.1 billion to the total 24 hour DEX trading volume on Solana.

At press time, the total daily DEX volume on Solana (SOL) has amounted to more than $3.68 billion. Compared to Meteora, the second largest DEX on Solana, the dark pool protocol only has a $100 million head start.

In terms of DEX trading volume within the past seven days, it is also in the lead with a trading volume that has nearly reached $10 billion. Meanwhile, Meteora’s seven-day trading volume is around $1.2 billion short of the other protocol.

On the other hand, Raydium’s (RAY) daily DEX volume is nearing $500 million. Its seven-day trading volume is still below $5 billion, indicating that it is still half-way behind the two largest DEX platforms on Solana.

Meanwhile, Solana’s meme coin launcpad Pump.fun (PUMP) has fallen far from grace. The protocol’s DEX trading volume sits at $174.3 million. Despite this, Pump.fun’s DEX trading volume has amounted to $1.5 billion while its 30-day volume has reached $9.4 billion.

HumidiFi is a decentralized-exchange platform built on the Solana blockchain that operates using a “proprietary” automated market maker or prop AMM, rather than the traditional open-liquidity-pool AMM model. This means that the protocol does not rely on external liquidity providers contributing to open pools the way many standard AMMs do. Hence, why it is known as a “dark pool.”

Dark pools keep trades completely invisible to other users, unlike on traditional exchanges. With protocols like HumidiFi, traders are able to execute private traders, which are particularly useful for carrying out high-value trades and large liquidations.

What does HumidiFi’s surge indicate?

The sudden surge of trading activity on HumidiFi could signal deeper changes within the decentralized finance sector. It indicates a shift in how liquidity is provided and consumed in DeFi.

Traditional DEX models, which are known for open AMMs and public liquidity pools, are being challenged by models where liquidity is centrally managed and trades are routed via aggregators like Jupiter to high‐efficiency venues. This may mean that the market is shifting from public pools to dark pools.

Traders may be prioritizing execution efficiency and institutional-grade trading mechanics rather than traditional metrics like visible total value locked or open-pool liquidity. HumidiFi claimed to have processed $8.55 billion in weekly trading volume while having a very low TVL, as it emphasizes tight spreads, low slippage and reduced exposure to front-running or sandwich attacks.

On the other hand, the increase in HumidiFi’s trading volume could mean that more traders are inclined to make their trades anonymous instead of public knowledge. The shift toward closed liquidity models could very well raise concerns about transparency, decentralization, and fairness on-chain.

Not only that, there is also the question of whether the model would be sustainable in the long-term. It may be possible that the surge in activity is only temporarily motivated by particular market conditions or pairs that are being executed on the platform at the moment.