IDEX surges 33%, investors interest skyrockets

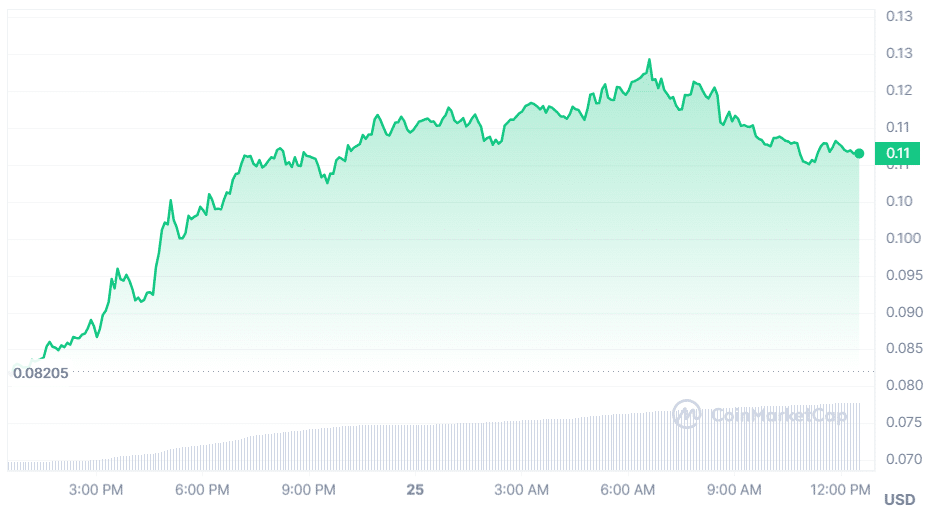

IDEX, the native token of the hybrid decentralized exchange (DEX) and market-making protocol of the same name, has increased 33% over the past 24 hours as it records a surge in investor interest.

The crypto asset, often leveraged for gas fees and liquidity provision on the Idex exchange, had witnessed a generally bearish trend over the past two weeks, dropping 30% from $0.0920 on March 13 to a low of $0.0642 on March 20 as the broader market fell.

However, this price slump immediately preceded a recovery push that has now seen the token reclaim a 10-month-high. IDEX saw the start of its good fortunes over the weekend, spiking to a high of $0.0904 on March 23 before retracing on the back of stern resistance.

The asset’s bullish momentum extended to the next day, allowing it to surge to $0.1191 on March 23, as it breached the $0.1 psychological price threshold for the first time since May 2023. IDEX closed March 23 with an impressive 48.24% gain, marking its largest intraday gain in 23 months.

Despite a subsequent 4.48% decline this morning, the asset has retained most of the gains recorded over the weekend. Market data indicates IDEX is up 33% in the last 24 hours, making it one of the top-performing crypto assets within this period.

Notably, details are scant on the possible trigger of the recent surge, but data suggests it may stem from growing demand following a rise in interest. IDEX’s volume has spiked 636% to $171.9 million over the past 24 hours, with Binance commanding 66% of the global volume.

Google Trends data also indicates that searches for IDEX have skyrocketed since March 23, with interest over time rising from 23 to 92 as of 14:00 UTC on March 24. Interest has dropped since then, but remains fairly higher compared to the seven-day average.

Significantly, IDEX’s derivatives volume has also increased by 1,364% in the last 24 hours to $784.53 million at the reporting time, with Open Interest (OI) rising 508% to $35.67 million, according to Coinglass data. The asset currently trades for $0.1111, looking to hold above the $0.11 territory despite the prevailing bearish action.